A new Square report reveals how much the Pandemic has accelerated the digital economy and highlights how the onset of COVID-19 has affected global commerce and payments behavior.

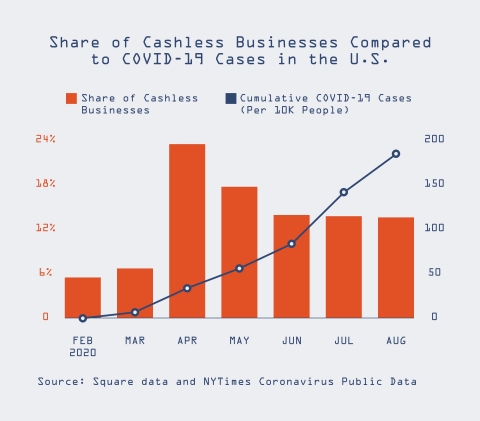

In February 2020, just 5.4% of Square sellers across the US were cashless*. By April 2020, amidst the height of shelter-in-place mandates, that number jumped up to 23.2%. By August 2020, as the world slowly began to reopen, the number of Square sellers with a cashless business model was showing signs of stabilizing at 13.4%.

That said, there has still been a remarkable increase in cashless adoption rates compared to pre-pandemic.

Square Economist, Felipe Chacon explains, “These new findings show a significant and stabilizing increase in cashless adoption rates compared to pre-pandemic, with business owners increasingly reliant upon contactless and online payments and consumers utilizing those alternatives. This signals that COVID-19 has already had what will likely be a lasting impact on consumer behavior.”

U.S. – Cash Usage Over Time

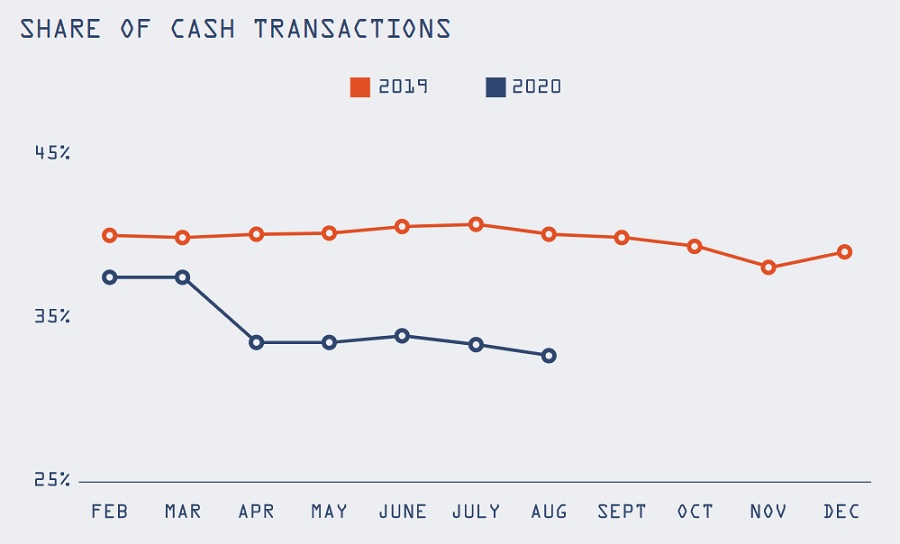

Among payments transacted at US Square sellers since February 2020, the share of cash transactions decreased from 37% in February to 33% in April, and held stable at 33% through the end of August. By comparison, during that same time period in 2019, the share of cash transactions increased slightly: from 39.9% in February to 40.0% in August.

When comparing the share of cash transactions via Square in 2019 to 2020, the year-over-year change shows a 7.3 percentage point drop from 40.6% in 2019 to 33.3% as of August 1, 2020.

„If we use 2019 as a baseline indicator, we estimate this one-year shift would have taken more than three years without the pandemic,” the company said in the press release.

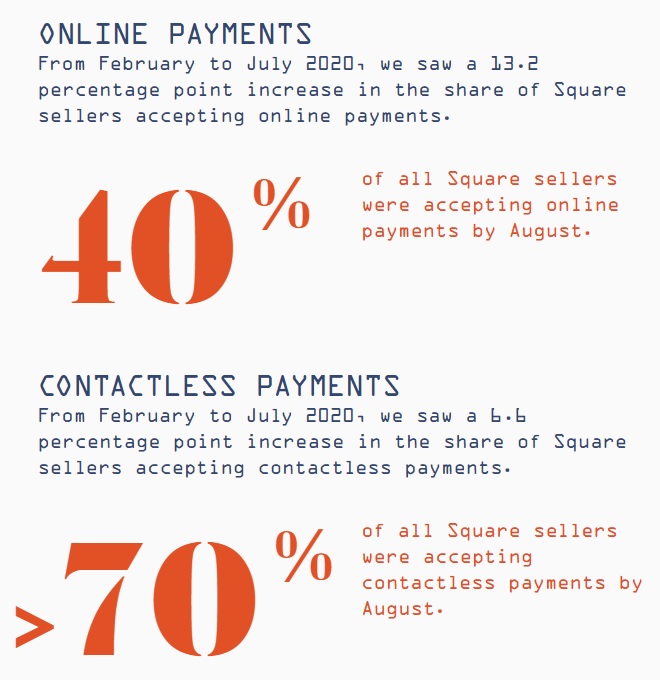

U.S. – Growth of Online and Contactless Payments Contributes to Cashless

Increasing availability and usage of online and contactless payments are also contributing to the decrease in cash usage over the last year:

From February through August 2020, there was a 13.2 percentage point increase in the share of Square sellers accepting online payments. By August, more than 40% of all Square sellers were accepting online payments.

From February through August 2020, there was a 6.6 percentage point increase in the share of Square sellers accepting contactless payments. By August, more than 7 in 10 Square sellers were accepting contactless payments.

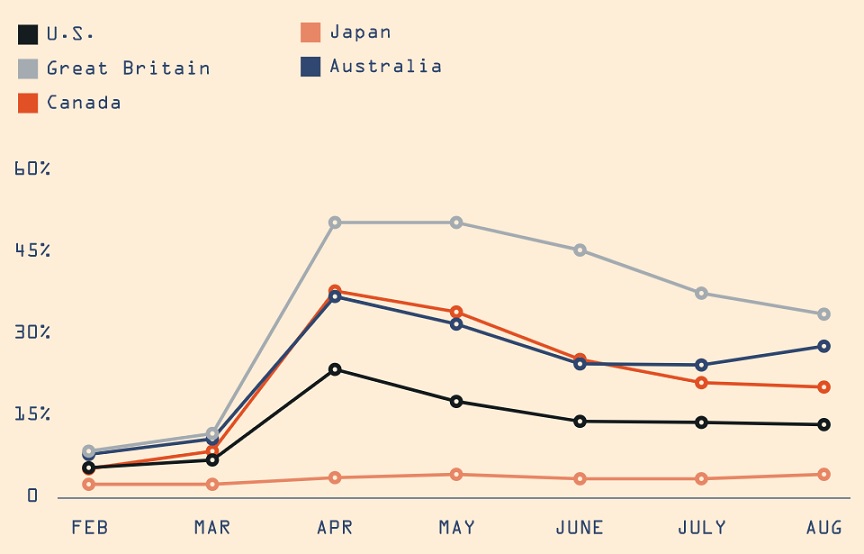

Share of Cashless Businesses Across International Markets

For a global perspective, we compared the monthly share of cashless businesses across each of Square’s international markets. From Japan to the UK, Square sellers are adopting cashless business models at noticeably different rates throughout the many phases of the pandemic.

*For the purposes of this report, Square qualifies any business accepting more than 95% of their sales via cashless means (in-person credit or debit card payments, online payments, contactless payments) as a cashless business.

###

Square, Inc. revolutionised payments in 2009 with Square Reader, making it possible for anyone to accept card payments using a smartphone or tablet.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: