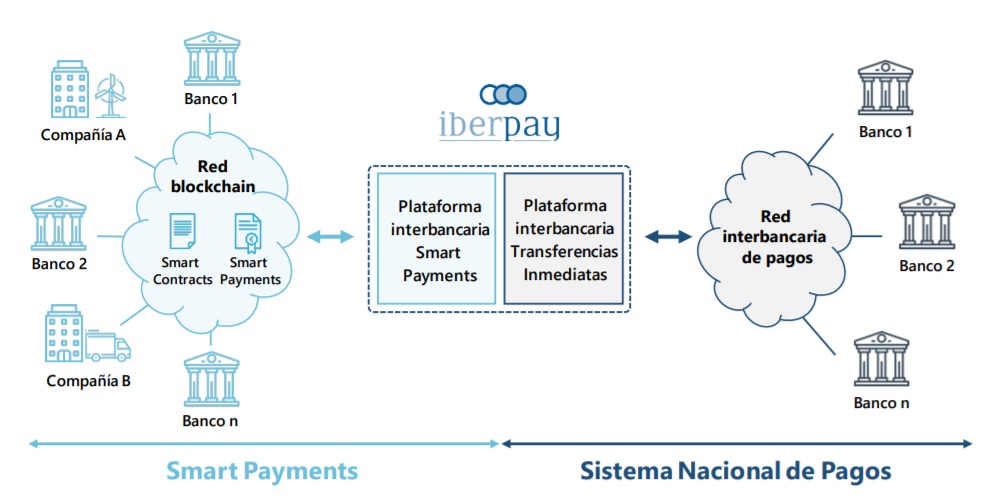

Banco Sabadell, Banco Santander, Bankia, BBVA and CaixaBank have initiated a proof-of-concept test to deploy an interbank Smart Payments Platform that would enable the execution of payments in blockchain networks.

The initiative, coordinated by Iberpay, the company that manages the Spanish Payment System (SNCE), aims to facilitate the initiation of instant credit transfers from smart contracts deployed in a blockchain network, according to the press release.

Iberpay says that any kind of business case developed with the technology could execute and programme automatic payments – from the signing of a contract to the delivery of goods.

The test includes a pilot based on a fictitious business case deployed in a blockchain network, which has already been implemented and has six distributed nodes managed by each participant.

The six-month trial of the concept is being conducted in association with Grant Thornton as a technology and legal advisor.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: