Spain’s BBVA turns hostile with $13 billion bid for Sabadell. BBVA aims to create a lender with more than 100 million customers globally and assets exceeding 1 trillion euros.

Following the closing of the deal, BBVA will be Spain’s second largest financial institution. The combined entity would overtake Caixabank as Spain’s biggest domestic lender.

Spanish bank BBVA launched a hostile 12.23 billion euro ($13.1 billion) all-share takeover bid for Sabadell on Thursday, in a surprise move that triggered immediate opposition from the government, according to Reuters.

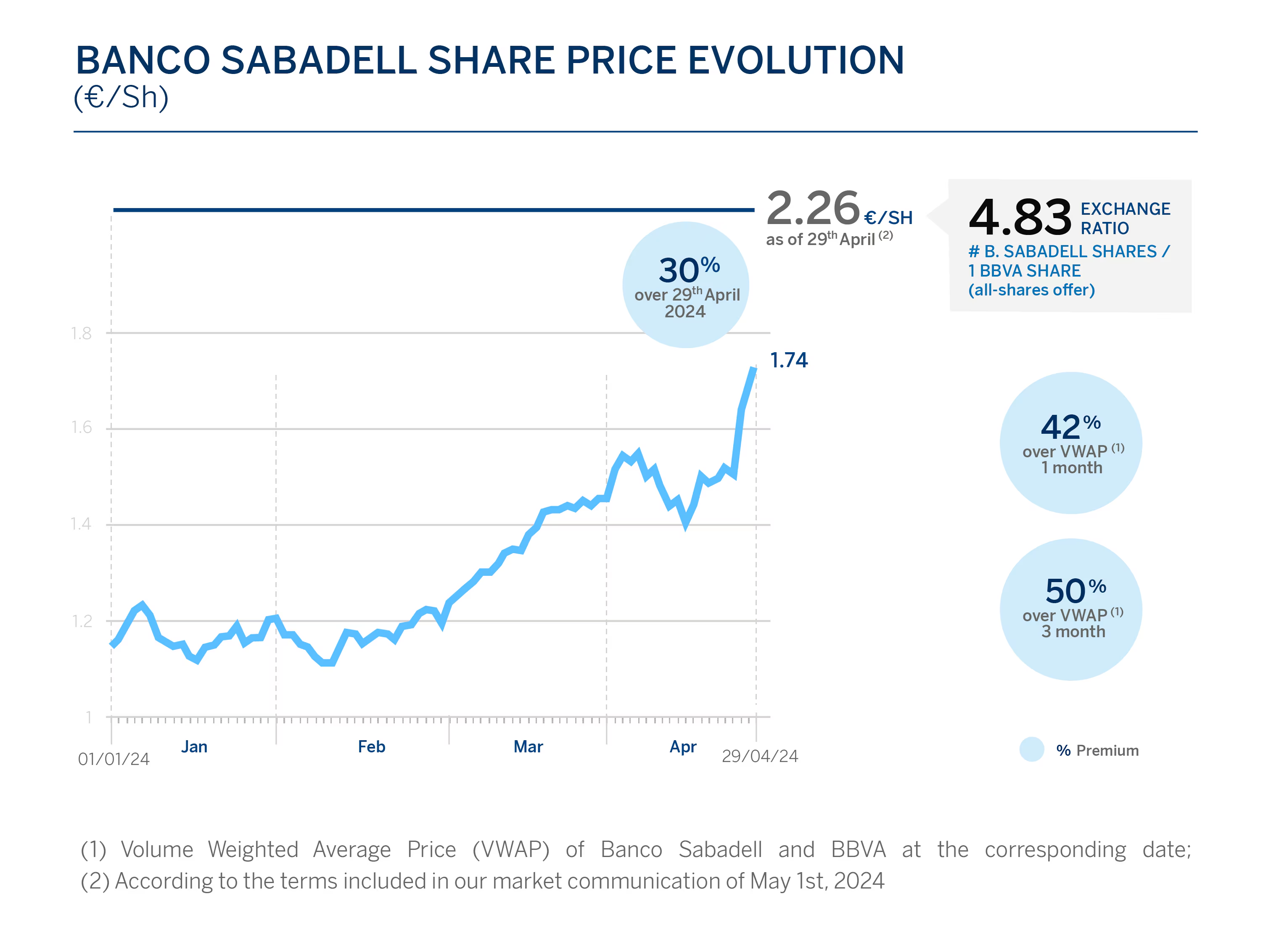

Taking the offer directly to Sabadell shareholders comes after Sabadell’s board rejected a bid on the same terms on Monday, a position the board reiterated on Thursday. BBVA offered an exchange ratio of 1 newly issued BBVA share for every 4.83 Sabadell shares, a premium of 30% over April 29 closing prices. That premium was around 8% on Thursday, valuing Sabadell at about 11 billion euros, according to Reuters calculations.

„The deal offers one BBVA share for every 4.83 of Sabadell, representing a 30 percent premium over the closing price of both banks on April 29th, and a 50 percent premium over the weighted average prices of the past three months. The transaction has very positive financial impacts thanks to relevant synergies and the complementarity and excellence of both banks. The operation will create one of the best banks in Europe, with a loan market share close to 22 percent in Spain.” – the bank said in a press release.

“We are presenting to Banco Sabadell’s shareholders an extraordinarily attractive offer to create a bank with greater scale in one of our most important markets,” said BBVA Chair Carlos Torres Vila. „Together we will have a greater positive impact in the geographies where we operate, with an additional €5 billion loan capacity per year in Spain.”

BBVA aims to create a lender with more than 100 million customers globally and assets exceeding 1 trillion euros – second only to BBVA’s long-time rival Santander among Spanish banks. By merging, BBVA seeks to rebalance its business towards Spain and reduce its reliance on Mexico, its main market.

The deal, which BBVA estimates could bring cost savings of 850 million euros before taxes, would give Sabadell shareholders a 16% stake in the combined lender. The combined entity would overtake Caixabank as Spain’s biggest domestic lender.

Hostile takeovers are rare in European banking and can end up embroiled in months of negotiations as politicians weigh in and regulators worry about potential instability. One recent example of a rare hostile bid for a European bank was Intesa’s successful takeover of UBI Banca in 2020.

It is the second attempt at a tie-up between BBVA and Sabadell. They called off merger talks in November 2020 after failing to agree on terms, including the price tag.

The latest move comes as Spanish banks have been looking for ways to increase revenue as a boost from high rates begins to fade. Spanish banking has gone through waves of consolidation, with the number of lenders down to 10 from 55 before the 2007/08 global financial crisis.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: