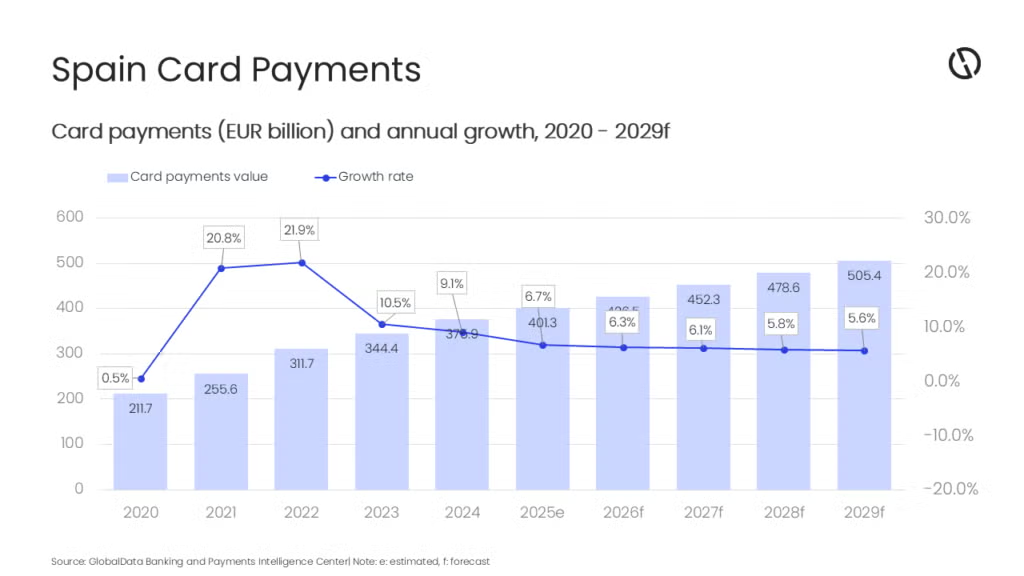

The Spain card payments market is set to increase at a 5.9% compound annual growth rate (CAGR) to reach EUR505.4 billion ($550.6 billion) in 2029, supported by near-universal bank access, extensive merchant acceptance, and rising use of contactless cards, forecasts GlobalData.

GlobalData’s Payment Cards Analytics reveals that the card payment value in Spain increased robustly in 2025, registering growth of 6.7% year-on-year to reach EUR401.3 billion ($437.2 billion), driven by increased consumer spending, expansion of e-commerce, and wider acceptance of contactless payments.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Despite, electronic payments gaining traction in the Spanish payment landscape, cash remains the preferred method of payment with card being a major beneficiary. Rising financial awareness, growth in card acceptance infrastructure, and the availability of digital-only bank account services are the key factors driving increased usage. The growing acceptance of payment cards by retailers and the advent of contactless technology are set to reduce the share of cash within the economy.”

Debit cards accounted for 60.7% of the total card payments in 2025. Rising awareness of payment cards, coupled with banks offering cards targeted at various consumer segments have supported the growth. The proliferation of digital-only banks is complementing traditional banks; further pushing banking and debit card adoption in the country.

On the other hand, credit and charge cards represented 39.3% of the market in 2025. This is supported by consumer preference for value-added features such as rewards, cashback and instalment facilities; these benefits have contributed to the faster growth of credit card volumes and values versus debit.

To capitalize on this growth, both banks and financial institutions are launching payment cards with multiple functions, enabling consumers to use their payment card as a debit, credit or charge card. In September 2025, BNPL platform Klarna launched a Visa-branded debit card throughout Europe, including Spain. This debit card provides flexible repayment options; allowing customers to convert their purchases into Pay in 3, Pay Later or longer-term financing for larger purchases. Card holders can also track their budgets and receive spending reminders through the Klarna app.

Spain’s payment infrastructure is undergoing significant transformation; driven by the modernization of payment terminals and the increasing inclination toward card payments among both customers and merchants.

For example, in March 2025, Revolut launched POS terminal for retail and hospitality sectors, supporting accepting payments via card or digital wallets. On a similar note, the payment service provider Adyen offers Apple’s Tap to Pay on iPhone in Spain allowing partner merchants to accept contactless payments via cards and mobile wallets.

Sharma concludes: “Spain’s card payments market will continue to benefit from well-developed payment infrastructure, the growing use of contactless cards and expansion of merchant acceptance. However, the ongoing geopolitical uncertainties, the economic slowdown in Europe, and increasing trade tensions represent key challenges that the market will have to cope with.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: