Some challengers really are challenging … but not where you’re looking

an article written by Chris Skinner, the most influential person in technology in the UK, international best selling author, top worldwide speaker on fintech banking. Chris will give a keynote speech at Banking 4.0 – international fintech conference.

You’ve got to love all these challenger banks (née neobanks née digital banks née mobile banks née whatever banks) appearing. There’s lots of chat about the British ones led by Monzo and closely followed by Starling, Atom and Tandem, but there are many more. In the UK there’s Revolut, Zopa, Aldermore, Oaknorth, OneSavings and more, all circling the banking marketplace. It’s such a change from a decade ago. When Metro Bank launched, they proudly claimed to be the first new retail bank in Britain for over a century. Now, Fintech Futures lists over 100 new banks in Britain, growing by the day.

But Britain isn’t the only vibrant marketplace for new challengers. There’s banks appearing all across Europe from Bunq to N26, across Asia from Livi to Zhong An, and America from Chime to Emma.

In fact, globally, there’s been a phenomena of new bank services unseen ever before in history. Someone pulled me up on LinkedIn the other day and said yada yada yada we saw this twenty years ago with Egg, Smile and co … not really. Those were internet banks back in the day when you used a dial-up modem. Today, these new players are all starting with open banking in a connected marketplace of APIs and apps. It’s totally different in both business model, technology and funding terms.

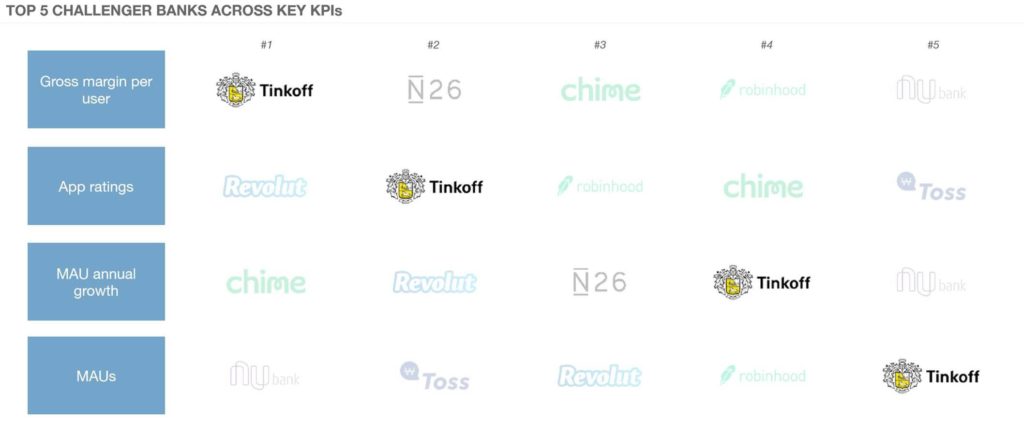

However, two of the most interesting new banks I’ve seen that get little analysis or coverage in the Western media are Tinkoff Bank in Russia and Nubank in Brazil.

I’ve bumped into Tinkoff Bank before – their founder Oleg Tinkov pulled me up in Sochi the other day and said I gave him a cold shoulder a few years ago. I didn’t mean to and, for everyone out there who find me a bit rude sometimes, I’m sorry … sometimes I’m just tired from travelling too much and sometimes suffering from being a bit too busy. Apologies.

Anyways, Tinkoff Bank are interesting. Established in 2006 and listed on the London Stock Exchange, they are profitable. This year the group will make around $600 million profit with a return on equity of over 60%. That’s a little bit better than Revolut. For example, the bank has over ten million customers and is valued at $3.5 billion. Revolut has eight million, but none of them full-service banking customers (yet), and is valued close to $10 billion.

Tinkoff Bank offers more than just banking. In fact, it’s a bit of a super-app offering ‘lifestyle’ services including travel, cinema, theatre, concerts, sport, taxi, restaurants, shopping, loyalty and other content. No wonder its mobile app gets good ratings.

Note: MAUs (monthly active users) are lower in Tinkoff as the law demands the user is met face-to-face for KYC in Russia

Equally, it is a real challenger, not just a notional one. For example, in the credit card space, it is second only to the dominant Russian state-owned player Sberbank, another bank that gets too little credit for its technology capabilities. Oliver Hughes, the CEO of Tinkoff Bank, nailed it in a recent interview when he said:

“In our head office we have 2,500 employees, 1,700 developers, designers, testers. In the future, if you’re going to survive as a financial-services provider, you have to become a tech company. You can’t be a balance-sheet company.”

In a similar style, Nubank is a company you may not have heard of, but is also nearing a $10 billion valuation.

Nubank is the most valuable start-up in Latin America, offering credit cards to the unbanked and challenging the financial system of one of the world’s biggest markets, Brazil. The bank has already achieved over fifteen million customers, making them one of the biggest new banks in the world, and growing fast. Between August and October, they’ve grown 25%, and the exponential growth continues. For example, a year ago, they had half this number of customers and are just six years old.

In conclusion and quite rightly, it was pointed out to me that we talk too much about some new banks – Marcus, Monzo, etc – and not enough about the rest – Tinkoff, Nubank … but add into that mix WeBank, MYBank, Kakaobank and more. All in all, there is a vibrant and dramatic rise of new banks with new bank models rising to challenge the old guard and their old bank models. It is very different to twenty years ago, and twenty years from now, I guarantee we will have seen a radical change to the banking system due to technology.

GUARANTEED.

About the author

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club.

He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal’s Financial News.

To learn more click here…

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: