In Romania, 25,000 terminals were accepting card payments using SoftPOS technology, at the end of October, according to Visa. The figures were first mentioned at the Banking 4.0 international conference focused on digital banking.

When we are talking about cards acceptance at the merchants, the SoftPOS technology is changing the face to face environment from the hardware to software. Till today merchants encountered problems related to the hardware, very slow delivery, complicated deployment, low integration level, limited choice and very limited features. Thanks to SoftPOS the acceptance is available on any hardware, is faster and the deployment is instant, with a wide integration options and unlimited futures.

We interview Radovan Bryx, Head of Innovations & Changes at Global Payments, on SoftPOS technology’s future. He thinks that within 10 years, the common POS payment terminals will be history. The future is for terminals on mobile apps, like GP tom.

What is exactly GP tom (Global Payments – terminal on mobile)

It’s a mobile application which can transform in a payment terminal any android based device with an NFC reader. „Simply download the app, signed the contract with the acquirer – which is us, the Global Payments – and then you can immediately start accepting cards. You do not need any other device to accept the cards.”, explains Radovan.

Global Payments start thinking to a solution as an alternative to the ordinary POS payment terminals three years ago. The idea was to develop an app that can be downloaded by any merchant an use it immediately, with no costs, on any smart phone in the market.

„When we started three years ago, we decided that will develop completely in-house. One of the reason is that we strongly believe that will be a huge increase of usage of this technology. It was not an easy way because it was really new technology. In the payment industry it’s always difficult if you are going with the new technologies, like contactless in the past, because it needs time to design, prepare and adopt. But thanks to the contactless growth we knew that we are on the right way to deliver it.”

GP tom app was launched in 2021 on the Romanian market. It could happened sooner but the launch depends on the level of contactless acceptance in the market. The GP Payments expert believes that the right time to launch on any market, is when the level of contactless transactions is about 90% of all card payments transaction.

SoftPOS increases card adoption among merchants

SoftPOS democratizes card payment acceptance because merchants are no longer constrained to a limited number of terminals they can use.

„With the common payment terminals you have like three options devices and you can pick up one, but they are almost the same. With SoftPOS technology you can choose from 3000 mobile devices where you can put our solution GP tom and accept the cards.” explains Radovan Bryx.

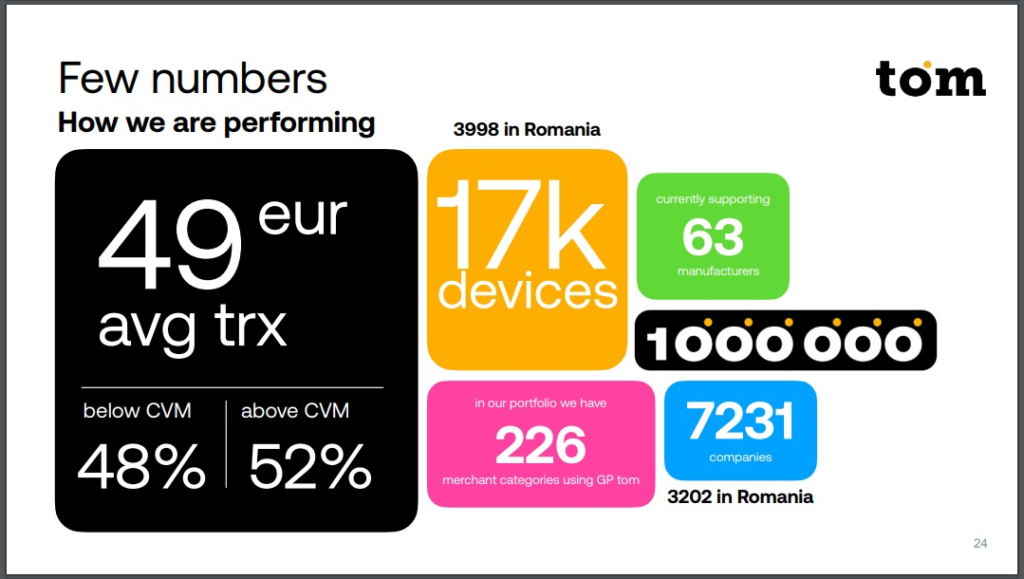

„It’s really interesting that the merchants are really picking any device so we have 600 device models which they use from over 60 manufactures.” he adds.

SoftPOS also democratizes the acceptance of card payments simply because any merchant can now afford to accept card payments as there is no need to buy or rent a POS terminal. This particularity increases the interest of many types of traders covering all types of segments.

„When we were thinking at SoftPOS we did not expect that we will cover all merchants. That was the dream but we were not pretty sure. So we were focusing on the delivery segments, season sale, micro merchants and so on. But now, we have over 220 merchant categories who are using SoftPOS.” says Radovan.

„In Romania, at the moment we have 4000 merchants. In total, in all countries (Czech Republic, Slovakia, Hungary, Austria, Germany and Romania), we have 8000 merchants and 17.000 devices which are up & running. (…) I think in the next 2-3 years we will double the numbers, at least. It will be a difficult time for the common POS devices to survive in the following years.”

Will regular POS terminals disappear?

The head of innovation and change at Global Payments answers the question using a quote attributed to Tesla CEO Elon Musk, who said: “When you are building a highway, sometimes you destroy the anthill. But it does not mean, that you have something against the ants.”

„So, are we killing the POSs as we know it today? We are not, for now. But we expect it will happened in some period of time. If I bet it will be sooner than 10 years.” says Radovan Bryx.

What’s next for GP tom

First of all, Radovan „strongly believe” that will be a „huge increase” of usage of this technology. „Because now, since you can choose any device, that will allow merchants to really use it everywhere.”

The Global Payments official also talked about the company’s plans to launch GP tom plus and the loyalty solution

„Very soon will present GP tom plus which includes the cash register inside, like the small cataloque where you can create the items, you can manage the orders. Then, we will launch the loyalty solution as well. Even if you are a micromerchant you can create the loyalty program, completely build in, easy to operate.

What is very important is that the loyalty program does not require loyalty cards.

„You don’t need to issue any loyalty cards. Customers only use the bank cards themselves,” explains Radovan.

Global Payments also plans to release the iOS version of GP Tom sometime in the second part of next year.

„We are now working on it and we believe that very soon we will be able to bring to the market the GP tom version running on IOS. (…) We would like to bring it during the summer. Latest to the end of the next year hopefully will be there.”

The full interview below

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: