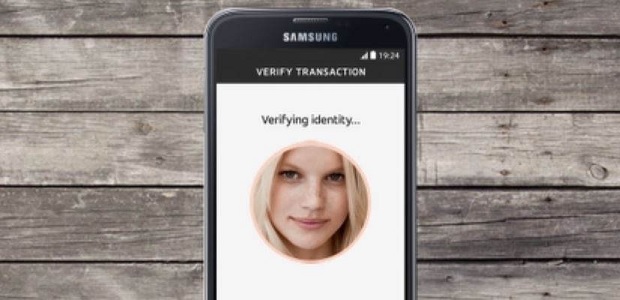

Societe Generale become the first bank in France that enables opening bank accounts using a selfie

One of France’s biggest banks has launched a biometric mobile enrollment system designed to let new customers open accounts with a selfie, according to mobileidworld.com.

In pursuing the technology Societe Generale says it has become the first bank in France to obtain regulatory approval for this kind of facial recognition technology from CNIL, the French data protection authority. But it’s far from alone in terms of global banking trends, with a growing number of financial services institutions embracing solutions like Jumio’s Netverify platform, which also uses facial recognition and document reading for remote customer enrollment.

Societe Generale may be unique, however, in appearing to have developed this technology in-house. Its announcement did not name a tech partner, and its system is somewhat unique in its use of what the bank calls a “dynamic selfie” – a series of selfie images from different angles. This dynamic selfie is used to match an end user to their official identity documents, allowing for reliable authentication.

It’s also a more in-depth process than what’s offered through other prominent white label apps. Even after the face matching process is completed, Societe Generale’s app requires that the user engage in a video call with one of its representatives, or to make an appointment to perform facial recognition a second time. But for many, this could still be more convenient than trekking to an actual bank branch to open an account.

In any case, the app’s launch is another example of the financial services sector’s intensifying interest in mobile biometric authentication, especially in Europe as the recently implemented GDPR and PSD2 privacy and payments regulations push banks to embrace more sophisticated security for their digital channels.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: