Social media platforms is preparing to move into the payments arena – Facebook tests ‘buy’ button

Facebook has begun testing a ‘buy’ button which lets users purchase products advertised on the social network. Meanwhile, Twitter is also stepping up its commerce game, acquiring payments outfit CardSpring. Only yesterday it emerged that a third social media giant, Snapchat, has filed trademarks which suggests that it too is preparing a move into the payments arena.

Facebook has begun testing a ‘buy’ button which lets users purchase products advertised on the social network. Meanwhile, Twitter is also stepping up its commerce game, acquiring payments outfit CardSpring. Only yesterday it emerged that a third social media giant, Snapchat, has filed trademarks which suggests that it too is preparing a move into the payments arena.

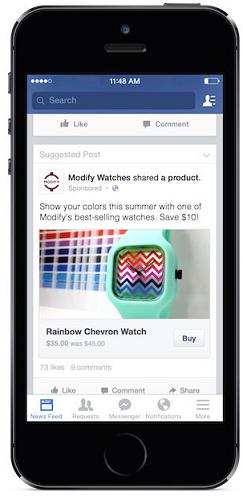

„Today we’re beginning to test a new feature to help businesses drive sales through Facebook in News Feed and on Pages. With this feature, people on desktop or mobile can click the “Buy” call-to-action button on ads and Page posts to purchase a product directly from a business, without leaving Facebook.”, according to Facebook announcement.

Users can pay with a card that Facebook already has on file or enter new details and save them for future use or have them forgotten. No payment details are shared with advertisers.

„None of the credit or debit card information people share with Facebook when completing a transaction will be shared with other advertisers, and people can select whether or not they’d like to save payment information for future purchases.”, according to Facebook press release.

So far, the system is only being tested with a few small and medium-sized businesses in the US.

Separately, Twitter is also looking to strengthen its commerce credentials, buying CardSpring for an undisclosed fee, according to finextra.com. CardSpring provides an API designed to make it easy for developers to link digital applications to payment cards.

It is expected that CardSpring’s technology will help merchants offer discounts in tweets, with customers entering their card details so that when they make a purchase at a later date, the saving is automatically applied.

Says Twitter’s head of commerce, Nathan Hubbard, in a blog post: „As we work on the future of commerce on Twitter, we’re confident the CardSpring team and the technology they’ve built are a great fit with our philosophy regarding the best ways to bring in-the-moment commerce experiences to our users.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: