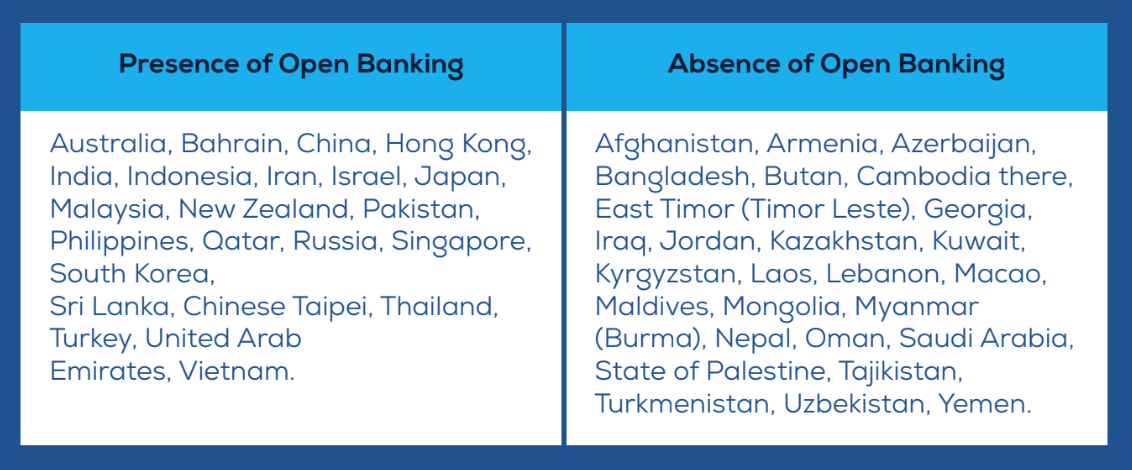

Amongst 51 markets in APAC, only 27 markets are involved in open banking somehow while the remaining 24 countries while the rest of 24 countries have not taken any action so far, according to a new report by the Emerging Payments Association Asia (EPAA), an pan-Asian payments association.

Unlike the regulator-led approach in the European Union (EU), the approaches to open banking in Asia-Pacific (APAC) have been more diverse with development and adoption varying greatly between countries across the region, according to the report.

Strategies vary across countries and there will need to be interoperability in order for the industry to take full advantage of open banking.

The report cites the case of India, Thailand and Australia, which have adopted a prescriptive approach where governments and central banks are playing a highly active role in defining the open banking ecosystem. Often times, in these jurisdictions, banks are required to share customer-permissioned data and third parties that want to access such data are required to register with particular regulatory or supervisory authorities to do so, it says.

Other markets such as Japan and Hong Kong, have adopted a facilitative approach where an industry standard-setter or government agency issues guidance and recommended standards and/or releases open API standards and technical specifications. Banks and third parties are not obliged to comply but may do so if they choose.

Meanwhile, China, Singapore and South Korea have taken more market-driven approaches where there are no explicit industry-wide rules or guidance that require or prohibit the sharing of customer-permissioned data by banks with third parties. In this approach, banks may choose to release their own APIs.

The report delves into the case of Singapore, which it says has been an early adopter and leader of open banking and APIs in the region.

In Singapore, development of open banking has been facilitated by regulators, and in particular, the Monetary Authority of Singapore (MAS), which has, among other initiatives, provided open banking/APIs guidelines, set out a framework, and which currently operates the Financial Industry API Register, which tracks APIs by functional category as they are launched.

In Australia, open banking has been monitored through the implementation of the Consumer Data Right (CDR) and the country’s four biggest banks are required to comply by releasing data APIs for the first set of account types by July 1, 2020.

Meanwhile, Hong Kong launched the Open API Framework in July 2018 which sets out a four phase process for open banking adoption, and Indian authorities have endorsed a two-phase development of open banking.

Open Banking development and adoption across APAC, Open Banking APAC, The Emerging Payments Association Asia (EPAA), February 2020

The disparate strategies across the region are posing difficulties in establishing an open banking regulatory infrastructure that will allow for interoperability across APAC, the report says.

In order for open banking to rapidly scale financial inclusion and enable a new wave of financial innovation, governments in the region must progress regulatory initiatives to allow open banking to be interoperable, both domestically and cross-border, it advises.

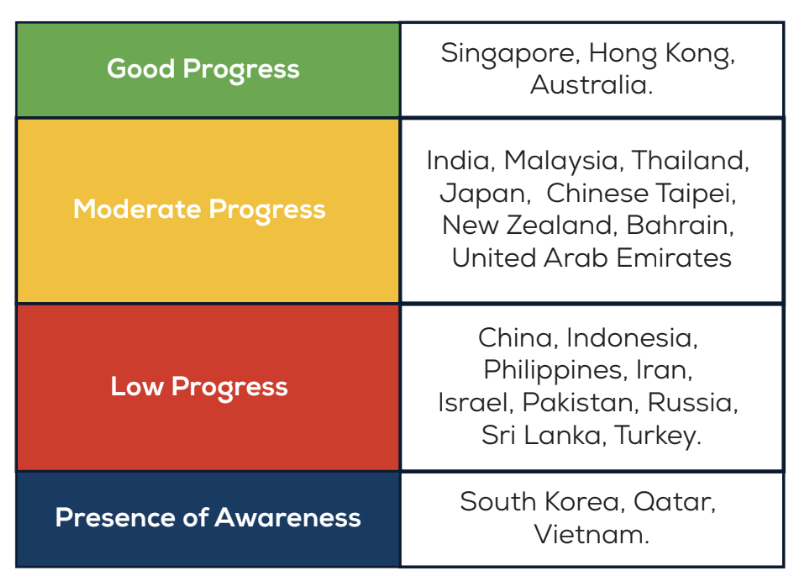

According to the study, amongst 51 markets in APAC, only 27 markets are involved in open banking somehow while the remaining 24 countries have adopted different approaches.

Open Banking across APAC, Open Banking APAC, The Emerging Payments Association Asia (EPAA), February 2020

The EPAA, which conducted a survey in 2019 of over 100 industry experts and professionals, found that industry participants believe that open bank will bring value to the payments industry (75%), and that in order to realize the full potential of open banking, interoperability is needed.

Over half (53%) of survey respondents indicated that interoperability in open banking in the same country is very important, and a similar portion (45%) considers interoperability in open banking across borders to be very important.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: