Silvergate, one of the two main banks for crypto companies, is shutting operations and liquidating after market meltdown

Silvergate decision to shut down would be a fresh crisis in already fragile crypto ecosystem.

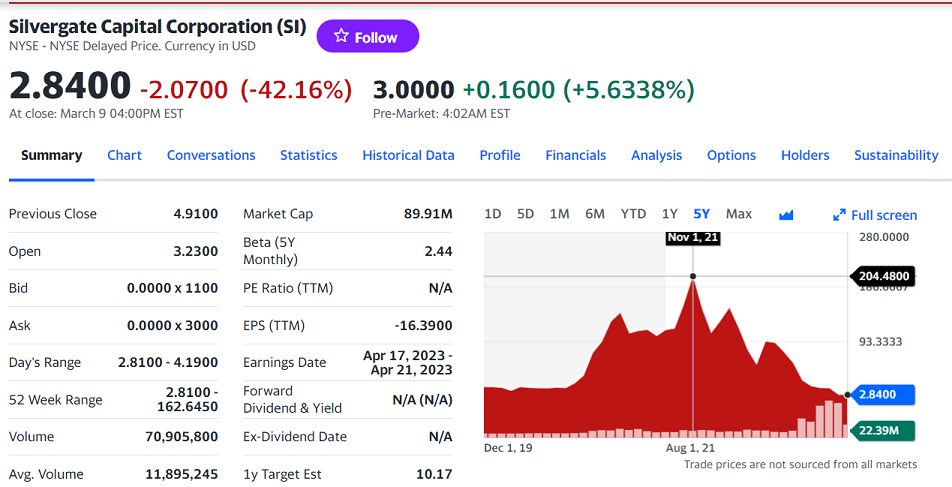

Silvergate Capital, a central lender to the crypto industry, said on Wednesday that it’s winding down operations and liquidating its bank. The stock plunged more than 36% in after-hours trading, according to CNBC.

Silvergate has served as one of the two main banks for crypto companies, along with New York-based Signature Bank. Silvergate has just over $11 billion in assets, compared with over $114 billion at Signature. Bankrupt crypto exchange FTX was a major Silvergate customer.

“In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward,” the company said in a statement.

All deposits will be fully repaid, according to a liquidation plan shared on Wednesday. The company didn’t say how it plans to resolve claims against its business.

The liquidation comes less than a week after Silvergate discontinued its payments platform known as the Silvergate Exchange Network, or SEN, which was considered to be one of its core offerings. As part of the liquidation announcement, Silvergate clarified that all other deposit-related services remain operational as the company winds down. Customers will be notified should there be any further changes.

The stock price fell to less than $3 right now, from nearly $205 in November 2021 (when bitcoin peaked at over $68,000).

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: