Sign-in with Klarna enables consumers to choose which data Klarna shares with the merchant for a personalized shopping experience. For example, data regarding purchase history that enables personalized product recommendations based on interests as well as sizes, and style and color preferences for clothing.

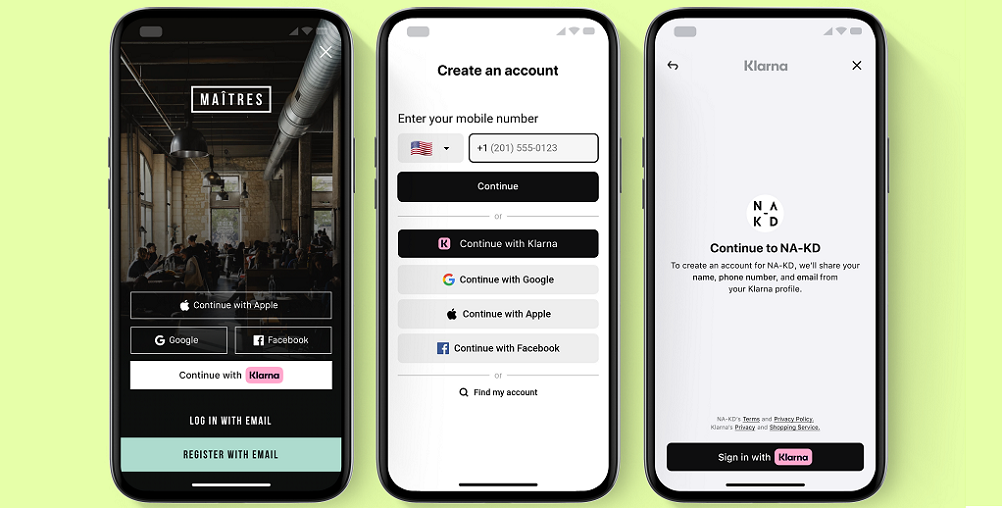

Klarna, the AI-driven global payment provider and shopping assistant, has launched „Sign in with Klarna” to offer consumers a smoother shopping experience with increased control over their own data. „The service saves time for consumers by fast-tracking the online purchase process and, if they consent to sharing their data, unlocks personalised offers from merchants.” according to the press release.

The service is now available in 23 countries: USA, UK, Ireland, Canada, Mexico, Australia, New Zealand, Sweden, Norway, Finland, Denmark, Germany, Austria, Belgium, Netherlands, France, Italy, Spain, Portugal, Greece, Poland, Czech Republic, and Romania.

Challenging American tech giants in the multi-billion industry

Apple and Google’s elimination of third-party cookies has made it harder for payment services to automatically fill in customer details to speed the online checkout.

„Sign-in with Klarna solves this for both consumers and merchants and presents a challenge to tech giants Apple, Facebook, and Google in the global verification industry – which is expected to almost double in size from 10.16 billion USD today to 18.12 billion USD by 2027.” the company explains.

Phenomenal Success in Sweden

The service has now launched globally after launching first with restaurant app Maitres and the marketplace Tradera during a test period. After just a few months, the service has become the second most popular login method on Tradera, with 20% of the total social logins demonstrating its usability and ease.

„We immediately get a complete profile with just a couple of clicks from the consumer, whereas similar services from Apple, Facebook, and Google create a profile that the customer needs to complete since it lacks information such as address and phone number. The vast majority of Swedes already use Klarna, and the new login service thus significantly simplifies registration for the majority of our customers,” says Stefan Öberg, CEO at Tradera.

Klarna already sees great interest among merchants wishing to implement the service. Since the turn of the year, the service has been implemented at Rusta, Casall, and NA-KD, who have rolled out the functionality in Norway, Finland, Denmark, Netherlands, Austria, and Germany.

„With our new login service, we add another dimension to improving the customer journey for consumers and our offering towards merchants. We give consumers control over their own data, making it easy for them to choose what to share with stores for a more personalized shopping experience. The product has enormous growth potential, and we believe that it will become as familiar a feature in global online retail as our payment solutions in the near future,” says Raji Behal, Head of Western and Southern Europe at Klarna.

How „Sign in with Klarna” works:

Consumers save time by logging in or registering with just a few taps for a quick and smooth checkout. On registration, the customer chooses what data they wish to share with the merchant, and sign-up to any membership or bonus programmes offered by the merchant. Merchants gain access to personal data with consent from the consumer and can use it for memberships and to give consumers personal recommendations based on their purchase history. The verification of the consumer’s data is entirely handled by Klarna, which means a cost saving for merchants who do not need to pay third-party services to confirm the customer’s identity via email or SMS.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: