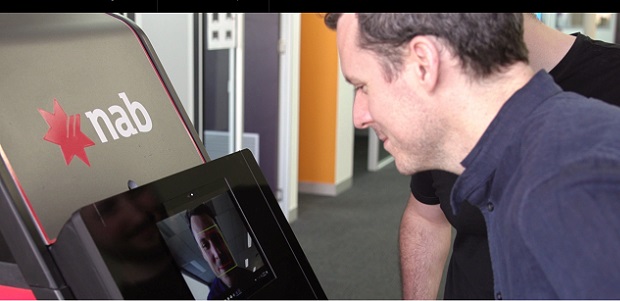

Sibos 2018: National Australia Bank and Microsoft test facial recognition for ATM withdrawals

National Australia Bank has teamed up with Microsoft on a proof-of-concept that taps AI to let customers make ATM withdrawals using facial recognition and a PIN. The cloud-based application, developed using Azure Cognitive Services, has been designed to improve the customer experience, removing the need for a card or even a phone. The system does not store images of customers’ faces, only the biometric data, which is held securely on Microsoft’s trusted cloud platform.

NAB and Microsoft have collaborated to design a proof of concept Automatic Teller Machine (ATM) using cloud and artificial intelligence (AI) technology.

„The cloud-based application, developed using Azure Cognitive Services, has been designed to improve the customer experience by removing the need for physical cards or devices to access cash from ATMs. Instead, through the concept, a customer who opted into the service would be able to withdraw cash from an ATM using facial recognition technology and a PIN.”, according to the press release.

Both Microsoft and NAB have a strong presence at this year’s SIBOS conference being held in Sydney, where the proof of concept ATM is on display.

A key theme for SIBOS 2018, which brings together 8,000 of the world’s leading financial services innovators, is to explore how data, AI and robotics are driving service innovation and business model renewal for financial service firms worldwide.

The likely impact of data and AI resonates with NAB Chief Technology and Operations Officer Patrick Wright who met with thought leaders, including senior Microsoft executives, during a tour to the US earlier this year.

“It just reinforced to me the need for banks to be simpler and faster for our customers; we want to deliver great connected customer experiences.

“Cloud technology allows us to take advantage of features and capabilities that are world-leading and enable us to deliver at pace for our customers.

“Working with companies like Microsoft allows us to develop concepts like this. It’s a look into what the future might hold for the way our customers access banking products and services.”

Steven Worrall, Managing Director of Microsoft Australia, said: “Cloud computing and artificial intelligence present the opportunity for a new generation of secure, streamlined financial services to be developed and rapidly deployed at scale. NAB’s innovation focus is concentrated on meeting the changing needs of the customer; this concept ATM that NAB and Microsoft are working on together provides an important glimpse into the future.

“We believe AI will profoundly impact financial services and the sorts of solutions that banks will be able to deliver in the future.

“For a consumer facing application such as the AI-powered ATM we’ve developed with NAB, this sort of continuous AI innovation is important. With its cloud-led approach to information systems, NAB is also guaranteed access to every Microsoft cloud-based cognitive service advance as it becomes available.”

Cloud first, innovate fast

Cloud computing plays a key role in the bank’s enterprise-wide transformation initiative, with its cloud approach supporting NAB’s commitment to continuous improvement and innovation.

Two recent important cloud-based initiatives see:

. NAB become the first major Australian bank to begin to transition key workloads to Microsoft’s recently opened Azure Central region which has been designed specifically to handle national critical computing; and

. To ensure that it has the internal skills for cloud success, NAB has also extended its Cloud Guild development program and is working with Microsoft to boost the cloud computing skills of its people, having already trained more than 3,000 NAB employees since the program launched in April.

About the proof of concept

The concept has been designed purely to test the customer experience of using such technology. The ATM system, using Azure Cognitive Services, does not store images, only the biometric data, and the data is held securely on Microsoft’s trusted cloud platform; it will be erased following the experiment. The information will be used only for the purpose of authenticating the customer and for no other purpose. Participants in the concept will not have any of their banking information connected to the system. The concept was developed in approximately two months by a small agile team from NAB’s in-house innovation lab, NAB Labs, and technology division.

You can find out more about working in technology at NAB here.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: