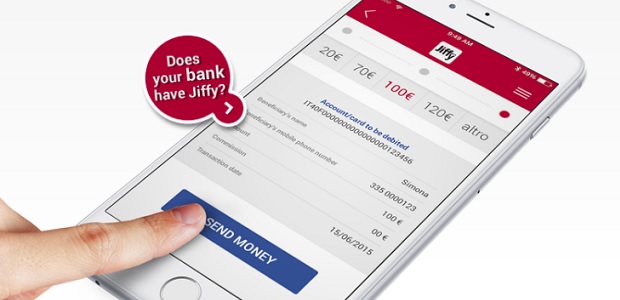

With the Jiffy service, made available by SIA and Intesa Sanpaolo, users just point at the QR Code generated at the cash desk to complete the transaction.

Starting today, customers at Carrefour Italia iper, market and express stores can pay for their groceries via smartphone in a simple, fast and secure way directly from their current account thanks to Jiffy.

The service, made available by SIA and Intesa Sanpaolo, lets customers do their shopping at stores in the Carrefour Italia chain in cashless mode in just a few clicks. After opening the Intesa Sanpaolo Mobile app, they need only point at the QR code generated at the cash desk with their smartphone and the transaction is completed.

„The innovative digital payment experience introduced with Jiffy offers immediate advantages both for the end customer and for the retail trade sector. Indeed, in just a few simple steps, from the XME Pay digital wallet via Jiffy, consumers can pay at self-service or manned cash desks using their fingerprint or facial recognition to confirm the transaction. On its part, Carrefour Italia has at its disposal an advanced payment management and collection system.”, according to the press release.

The Jiffy service, already active at more than 130 Italian banks, also enables money transfer between private individuals simply by using the contacts present in their smartphone as well as payments in stores and online. A further strength of the partnership is the recent integration of Jiffy with BANCOMAT Pay. The digital evolution of the domestic circuit will extend the usability of the services to a potential pool of 37 million PagoBANCOMAT® cardholders and over 440 banks.

“Thanks to the innovative solution Jiffy and to exceptional partners like SIA and Gruppo Intesa Sanpaolo, Carrefour Italia further enriches the range of services it offers to its customers, improving the shopping experience at its stores and strengthening even more the relationship of trust with the brand”, commented Tiziano Depaoli, Director of Financial Services at Carrefour Italia. “Embracing the digital transformation and its potentials is a necessary path we have been on for some time to respond in a simple, immediate and secure manner to the needs of our final consumers, offering them high added value and increasingly personalized services”.

“Intesa Sanpaolo Group is one of the leading banks in Europe for its positioning in instant payments and in digitalization of payment processes. We want to be among the major players in the technological challenge underway and that is why we are studying and developing new payment methods that make everyday life better”, said Stefano Favale, Head of Global Transaction Banking at Intesa Sanpaolo. “With the introduction of this solution, Intesa Sanpaolo customers can pay at Carrefour with XME Pay, the wallet available in the Intesa Sanpaolo Mobile app that today counts 50 million logins every month, by 3 million customers.”

“With the launch at all Carrefour stores, Jiffy reinforces its position as an innovative payment service able to make the purchase experience via smartphone convenient, fast and totally secure”, commented Marco Polissi, Head of the Jiffy service at SIA. “Following on from stores, airport parking and renewal of local public transport passes, now the retail trade channel also turns to our digital service to offer its customers cashless payment methods in tune with the times”.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: