SIA expands its money transfer service from P2P to P2B – enabling instant payments at store

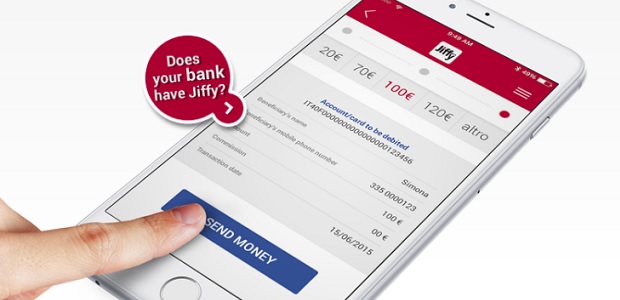

Jiffy, the service developed by SIA to send and receive money in real time from one’s smartphone using the mobile number, arrives in retail outlets.

„Indeed, following on from Person to Person (P2P) payments, the Person to Business (P2B) phase has begun in the cities of Milan, Rome and Turin, enabling users to pay via app instantly and in total security at over 150 outlets that have signed up with Intesa Sanpaolo.”, according to the press release.

The payment is made at the store by scanning the QR Code created by the merchant at the time of purchase.

More specifically, the merchant enters the amount of the sale on its app and a QR Code is generated in real time which the customer simply scans with his or her smartphone. The customer can then view the details of the payment on the app and authorizes the transaction by fingerprint or PIN. Both the merchant and the customer receive notification in real time of the outcome of the transaction and the funds are immediately credited on the merchant’s current account.

JIFFY for P2P

At present, Jiffy can count on over 4.2 million users and more than 120 Italian subscribing banks, making it the leading Person to Person (P2P) digital payment service in the Eurozone.

Jiffy is available to current account holders of Banca Mediolanum, BNL, Banca Nuova (Gruppo BPVI), Banca Popolare di Milano, Banca Popolare di Sondrio, Banca Popolare di Vicenza, Cassa Centrale Banca, Che Banca!, Cariparma, Carispezia, Friuladria, Gruppo Carige, Gruppo Veneto Banca, Hello bank!, Inbank, Intesa Sanpaolo, Monte dei Paschi di Siena, Raiffeisen, Sparkasse, UBI Banca, UniCredit, Webank and Widiba. Soon, Jiffy will also be available to Volksbank Banca Popolare and other Groups.

Once all banks are on board, the service will therefore by available to more than 32 million Italian current accounts, equal to over 80% of the total.

How JIFFY works

Jiffy can be used via smartphones with Android, iOS and Windows Phone operating systems and is marked out by its speed and user-friendliness. A user must be the holder of a current account at a participating bank.

To activate the service, the user needs to register on his or her bank’s site and download the app provided by the bank itself.

To transfer cash via smartphone, the user simply selects the receiver from the personal contacts list available on the bank app, enters the amount, a message if desired and with a click the money is immediately sent and can instantly be used by the beneficiary.

If the beneficiary is the holder of a current account at a bank subscribing to Jiffy, the debit and credit of funds will be immediate. Otherwise, the payment will be put on hold, but through the app it will be possible to send a message to report its presence and the steps necessary to collect it.

JIFFY is already set up to send and receive money in Europe

Based on SEPA money transfer, Jiffy is a service open to all banks operating in the Single Euro Payments Area, potentially usable by over 400 million European current account holders.

Compliant with the standards of the European Retail Payment Board (ERPB), it is already set up to be integrated with the pan-European instant payments infrastructure RT1, which will be completed by EBA Clearing by November 2017.

SIA’s Jiffy service was developed in collaboration with GFT, global provider of information technology solutions for financial services.

About SIA

SIA is European leader in the design, creation and management of technology infrastructures and services for Financial Institutions, Central Banks, Corporates and Public Administration bodies, in the areas of payments, cards, network services and capital markets. SIA Group provides its services in 46 countries, and also operates through its subsidiaries in Austria, Germany, Romania, Hungary and South Africa. The company also has branches in Belgium and the Netherlands, and representation offices in the UK and Poland.

In 2016, SIA managed 12.2 billion clearing transactions, 4.3 billion card transactions, 2.8 billion payments, 47.4 billion financial transactions and carried 654.3 terabytes of data on the network. The Group is made up of eight companies: the parent SIA, the Italian companies Emmecom (innovative network applications), P4cards (card processing), Pi4Pay (advanced collection and payment services), and Ubiq (innovative technology solutions for marketing), Perago in South Africa, PforCards in Austria and SIA Central Europe in Hungary. The Group, which currently has over 2,000 employees, closed 2016 with revenues of €468.2 million.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: