Seven Fin and Tech truisms we wish were myths

an article written by Chris Skinner, the most influential person in technology in the UK, international best selling author, top worldwide speaker on fintech banking. Chris will give a keynote speech at Banking 4.0 – international fintech conference.

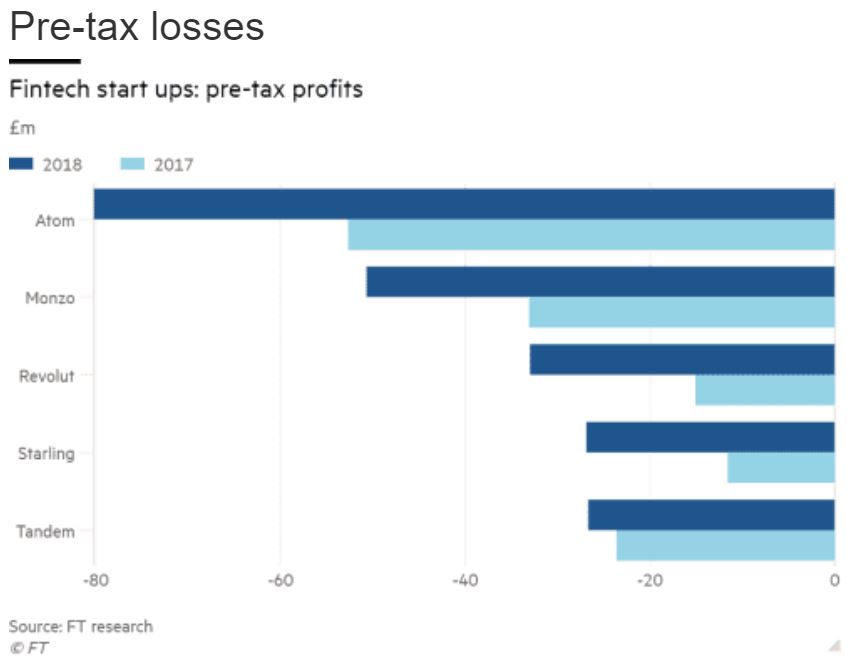

I attended the New Stateman’s FinTech Summit yesterday. I gave the opening speech and was followed by the indomitable Anne Boden, CEO and Founder of Starling Bank, who talked about the path to profitability. She asserts the bank will deliver profitability next year, but her presentation focused upon a number of what she sees as myths in the FinTech world.

Myth #1: FinTech start-ups are founded by young white men

She’s not really a young man, so Anne is proof you don’t have to be a young white man to found a FinTech. However, in general, over 70 percent of the UK workforce in FinTech is male, and only 17 percent of senior FinTech roles are held by women. In a Harvard Business Review study, young white men are always the most likely to win endorsement for their ideas. Women are 20 percent less likely, people of colour 24% and LGBTs 21% less likely to win endorsement. So yes, there is a tendency for young white men to get more backing than others in Europe and America. It is why The FinTech 50 has 118 men as founders versus just six women. And it is because men generally are more oriented towards technology and finance. Cryptocurrencies is a good example here. According to The Financial Times: “Uphold, a virtual currency wallet service that does background checks on its users, says 75 per cent are men, while Coin Dance, which tracks statistics on the bitcoin community, found 97 per cent of engagement was from men.” In other words, the geeks and nerds of the male dominated youth community are engaging in FinTech. Not a myth Anne.

Myth #2: Banks are run by old white guys

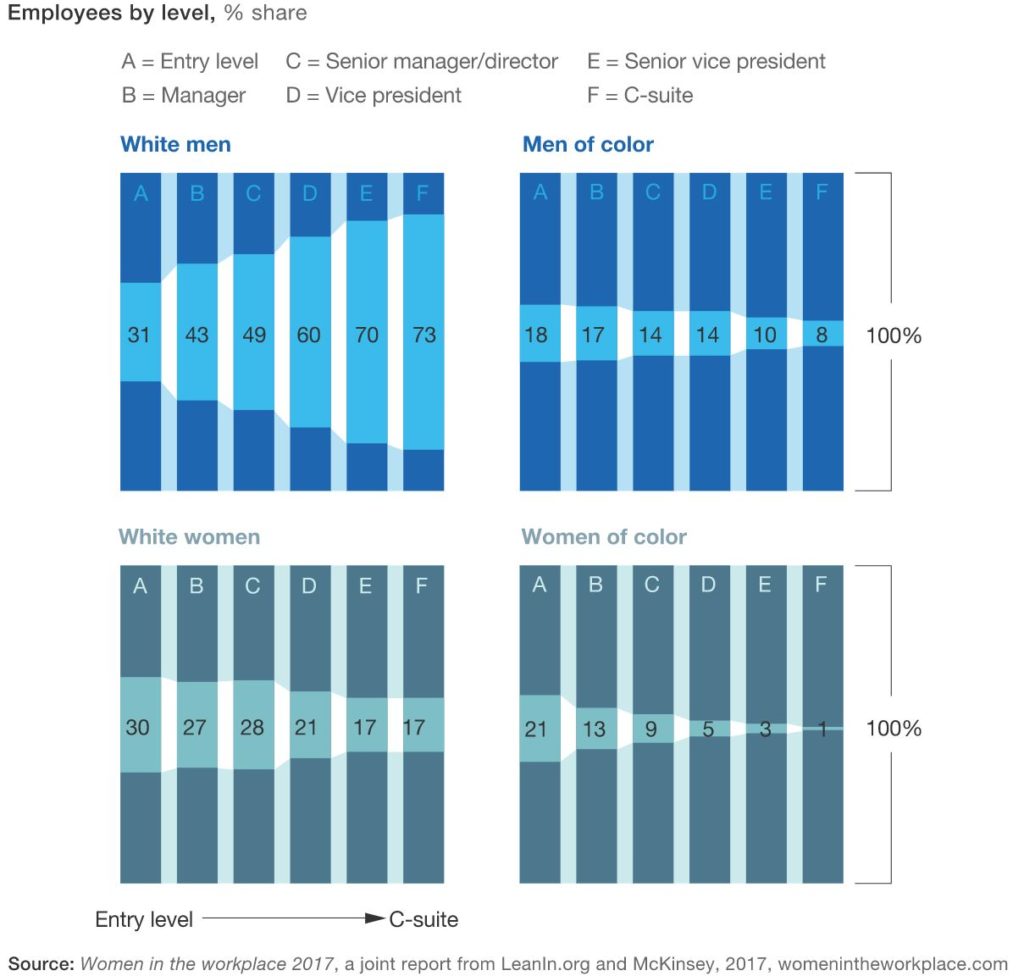

She’s not a man and she had a senior role in a bank, and there are others who are women succeeding in banking … but not so many. Again, the City and Wall Street are oriented towards men, and generally Caucasian white men. But McKinsey research of financial institutions found that the more senior you get in a bank, the more white male you are likely to be.

73 percent of the banks surveyed had white male C-suite members, compared to 17 percent with women and just 8 percent of men with colour. Oh dear. Meantime, the average age of a leadership team member is 54 and a CEO 58, so yes, they are relatively old as a rule. Not a myth Anne.

Myth #3: People don’t change their bank account

Well people are switching to Starling, Monzo, Revolut, TransferWise and others for financial service, but are they actually switching accounts? Anne claims they are. When looking at account switching data, the service offered by BACS for easy change of bank account, the numbers are rising year-on-year, but the top three banks making gains are Nationwide, HSBC and NatWest. So yes, people are moving accounts between traditional banks and yes, yes, yes, Monzo and Starling drop in at fourth and fifth places respectively, but the numbers are still low generally. Most people don’t change their bank account. Sure, 919,000 did last year … but that is a lot less than the 50 million who didn’t. Not a myth Anne.

Myth #4: New banks don’t do real banking

OK, I’m not sure where this one comes from apart from maybe the idea that some of the names like Monzo and Revolut started out as pure prepaid cards, without bank licenses. Every challenger bank that calls itself a bank has a banking license and does real banking. Not a myth Anne.

Myth #5: Small businesses need branches

Not necessarily, but equally they won’t all be purely digital clients. Many small businesses are shops, cafes and restaurants and if customers want to pay with cash, then they need somewhere to go with the money. A pure digital bank won’t credit your account with £1,000 when you send them a photo of fifty £20 notes. So what to do? It’s an issue raised regularly by the Federation of Small Businesses, as the rise in branch closures has seen half of Britain’s network wiped out in the last 25 years, and a further 50 percent predicted to disappear in the next ten years. I guess that’s why Lloyds, Barclays and RBS have partnered together to launch a joint venture to service small businesses through physical hubs across the country. Not a myth Anne.

Myth #6: Big banks will catch up

It’s true that it’s much harder to change a bank than launch a new one, which is why RBS has launched Bó to keep up, but I always contend they still need to change the old bank too. JPMorgan Chase with its $11.4 billion investment in technology this year, increased five percent over the previous year, is a good example of that. It’s also a good example of a big bank with big bucks making big investments to change for the future, in order to be the disruptor and not the disrupted. That’s a wee bit more than the $300 million Starling has raised in the last five years through six funding rounds. It’s also the size of budget being touted around by JPMC’s peers Bank of America and Citigroup. In fact, to put this figure in context, the IT budget of these three American banks is fifty percent more than the total amount invested in all European FinTech start-ups last year. Not a myth Anne.

Myth #7: Digital banks aren’t profitable

Not a myth Anne.

Nevertheless, I enjoyed the presentation Anne delivered and it is entertaining to raise questions about an industry that stubbornly refuses to change. It will. It will just take a long time to prove these truisms can become myths.

About the author

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal’s Financial News. To learn more click here…

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: