Seqr launches prepaid contactless payments app for teenagers and claims to be the first of its kind

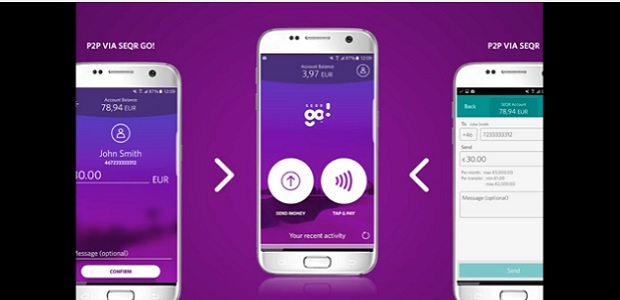

Seqr™ announces the launch of Seqr Go!™, the first of its kind prepaid mobile payment app designed mainly for teenagers.

„As we move gradually to a cashless society, introducing an accessible mobile payment solution for teenagers is both an innovative and logical next step. Thanks to Seqr Go!, there is no need for youths to carry cash or cards anymore: all they need is their smartphone, making it a safe and secure alternative for handling money.”, the company say.

„“Seqr Go! represents a major leap forward for Seqr and the mobile payment market in general. For the first time someone (Seqr) has provided a safe, smart, and youth friendly mobile payment technology.”, according to the press release.

„The youth segment is a large group of consumers that has effectively been shut out of this market and capabilities until now.”, says Peter Fredell, CEO of Seamless. “It replaces the need for a wallet or to carry pockets full of cash making it safer for teens when out and about. It also enables teenagers to send money to or receive money in real time from other Seqr users whether home or abroad, anywhere in the world, free of charge.”

The application is easy to manage and helps teenagers responsibly manage their finances. The in-app payments activity log gathers all purchases and receipts so Seqr Go! users (and their parents) can keep track of their spending in real time. The application provides a secure alternative to carrying cash and/or cards and is quick and easy to get up and running with the only thing being required is a name, date of birth, email address and telephone number – in comparison to the more complicated and often lengthy process of getting a bank account.

Seqr Go! also provides a smart way to help teens to manage their spending and learn more about budgets and finances. Money can be transferred instantly to a Seqr Go! account via person-to-person transfer by another Seqr user. Seqr Go! users don’t need to link a bank account because the funds are transferred to their prepaid Seqr Go! account. Thanks to the prepaid technology Seqr Go! users can only spend what is in their account, so there is no risk of teens being overdrawn.

As with the classic Seqr application, contactless is enabled for faster and more convenient payments. This is possible wherever contactless payments are accepted, currently around 30 million point-of-sales worldwide. The Seqr Go! user simply holds his or her phone up to the contactless card terminal in every shop where a contactless card terminal is installed. For low value transactions, there’s no need to enter a PIN code, making it a quick and easy alternative to cash and/or cards. The smart technology of Seqr uses encrypted payments so personal details are secure at all times.

Seqr Go! will be available to download in the Google Play Store on the 16th March 2017.

Developed by Seamless, Seqr is the safe, fast and easy way to pay by mobile. The only thing the user needs is the Seqr app to scan a QR code or tap on the NFC terminal. Seamless is one of the world’s largest suppliers of payment systems for mobile phones. Founded in 2001 and active in 35 countries (including Romania), Seamless handles more than 5.3 billion transactions annually through 675 000 active sales outlets. Seamless has three main business areas including the transaction switch, the technology provider for the distribution of e-products and the mobile payment platform.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: