This time of the year is very special for the European Payments Council (EPC): the Single Euro Payments Area (SEPA) Instant credit transfer (SCT Inst) scheme is celebrating its fifth anniversary! To mark this occasion, EPC outlines the scheme’s most significant achievements, its opportunities, challenges, and future goals.

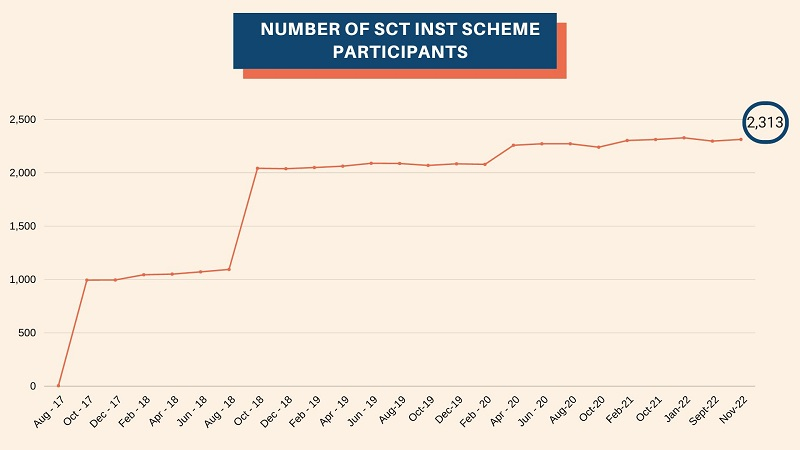

The SCT Inst scheme was successfully launched in November 2017. Since then, the SCT Inst scheme has just kept growing although at a slower pace since 2021. According to the latest data published in November 2022, the scheme now includes 2,313 PSPs from 29 European countries (the readiness date for the Croatian PSPs is 1 July 2023). They represent over sixty percent of European PSPs and more than seventy-one percent of PSPs in the euro area.

Moreover, a very large majority of payment accounts are reachable for SCT Inst in 15 countries: Portugal, Spain, France, Belgium, Netherlands, Germany, Austria, Slovenia, Italy, Greece, Slovakia, Lithuania, Latvia, Estonia, Finland.

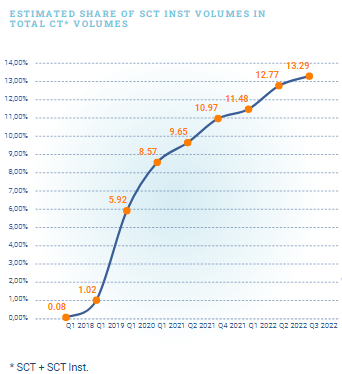

Over thirteen percent of all euro credit transfers in the third quarter of 2022 were SCT Inst transactions, compared to about ten percent in the third quarter of 2021. This growth is expected to continue in the coming quarters.

Instant payments have the potential to develop in the person-to-person and person-to-business segments in situations where cash (and in some countries cheques) are currently still widely used. This would reduce the cost of managing cash and cheques, which are the most expensive means of payment at the level of the entire economy.

Follow the link to see further details related to SEPA Request to Pay scheme, SEPA Proxy Lookup (SPL) scheme and the SEPA Payment Account Access (SPAA) scheme.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: