SEPA Cards Standardisation Volume, now Open to Public Consultation!

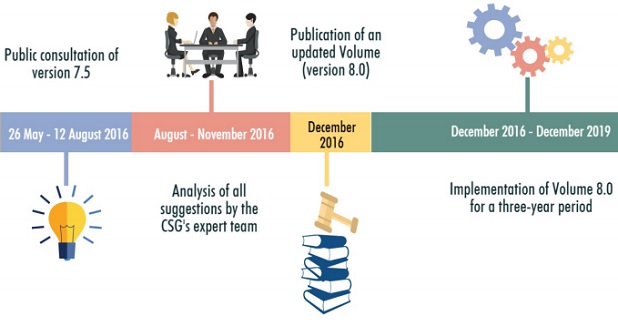

The European Payments Council (EPC) and the Cards Stakeholders Group (CSG – a multi-stakeholder body gathering retailers, vendors, processors, card schemes and the EPC) released version 7.5 of the SEPA Cards Standardisation Volume (the Volume) for a three-month public consultation.

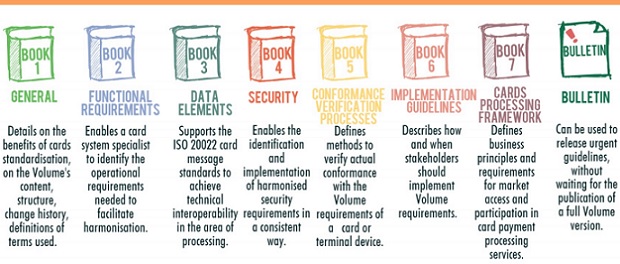

„The Volume is considered to be a key document for the card industry, aimed at achieving cards standardisation, interoperability, and security in Europe”, according to the press release.

The Volume version under public consultation includes guidelines facilitating compliance with the Card Interchange Fee Regulation (which final part will be in force on 9 June 2016), particularly in the fields of contactless payments and choice of application.

As it is an essential piece of the card industry self-regulation, the Volume should reflect market needs. Card schemes, PSPs, merchants’ representatives, consumer organisations and other stakeholders are invited to participate in the public consultation and send their comments by 12 August 2016. More information about the main changes included in the Volume 7.5 and the public consultation (such as the instructions to send comments) are available here.

The expert teams of the CSG will analyse all suggestions once the consultation closes. An updated version will be published in December 2016, to be implemented immediately for a three-year period.

This public consultation is part of the regular change management cycle of the Volume, in order to keep it up-to-date with card technology and regulation.

Life cycle of the volume

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: