SeedBlink is aiming for €3 million in Series A funding to expand into Europe. €500,000 of the round are to be raised through equity crowd investing – today.

The platform intends to list at least 150 startups and attract 30,000 individual investors by the end of 2022. The pre-money valuation of SeedBlink is 12 million euro.

SeedBlink, the fastest growing investment platform in technology start-ups in Europe, has announced that it aims to raise 3 million euro in a Series A round, of which 500,000 euro are to be raised through equity crowd investing. The listing will be on their own platform, on May 27th, 2021, starting at 10.00 AM. Investors will be able to participate with tickets starting at 2,500 euro.

The main investor is a major VC in the region, who will be joined by other institutional investors, as well as by the SeedBlink community. The name of the lead funder will be announced after the due diligence process is completed.

SeedBlink is a platform that democratizes the access to early stage investments for investors who do not have large amounts of money, nor the time needed to join exclusive clubs.

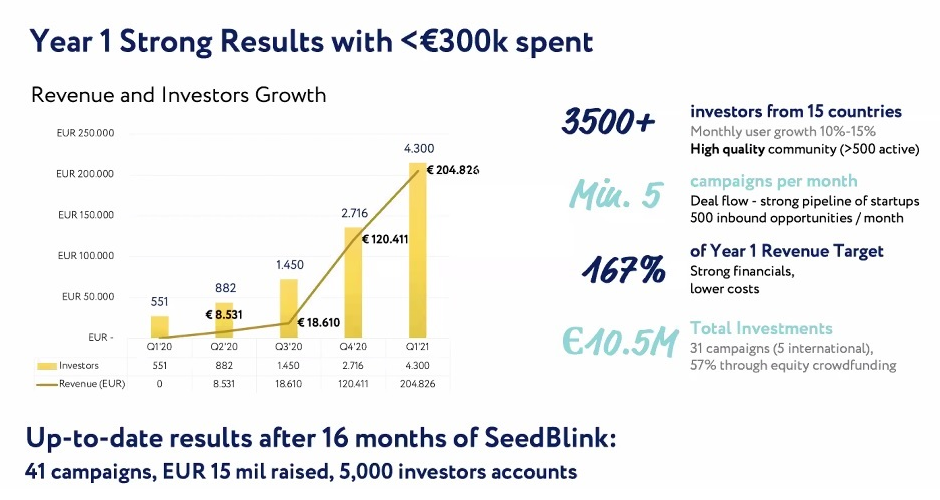

15 million euros obtained through SeedBlink since the platform was first established

The platform was launched in December 2019 by former bankers Andrei Dudoiu and Ionuț Pătrăhău. At the beginning of last year, Radu Georgescu and Carmen Sebe, two of the most famous technology specialists in Romania, joined as partners. The team participated in 45% of the financing rounds (Pre-Seed and Seed) of Romanian startups in 2020.

SeedBlink has launched 42 funding campaigns in the 18 months since its inception, thus helping startups raise a total of € 15 million from individual investors and VC funds (55% of the amount through equity crowdfunding). The success rate of the campaigns was 95%. The startups on the platform have attracted over 5,000 investors from 15 countries.

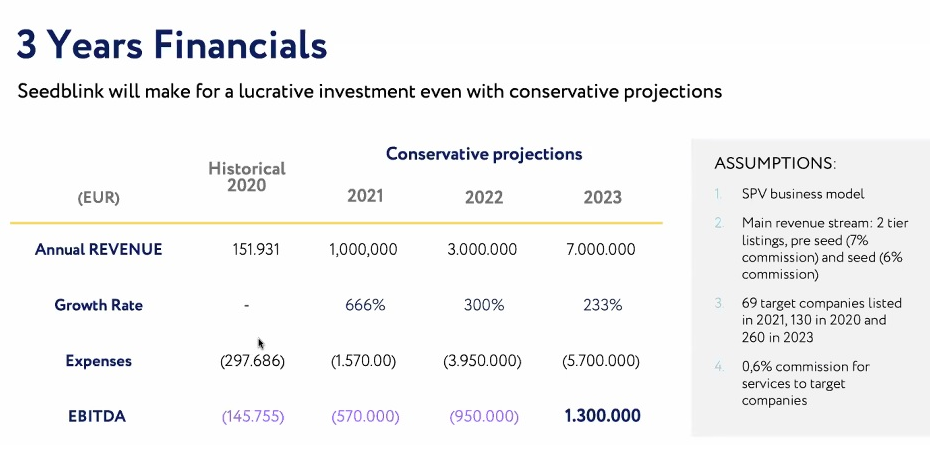

“By the end of next year, we want to list at least 150 technology startups and have 30,000 individual investors on the platform. Moreover, we aim for revenues exceeding three million euro in 2022,” states Andrei Dudoiu, co-founder and CEO of SeedBlink (photo – first from left).

For 2021, SeedBlink management is targeting revenues of over one million euro.

Expansion into the EU starting in Q4 2021

SeedBlink management plans to develop the platform internationally starting in the last quarter of this year by establishing partnerships with the main technology hubs in Europe.

SeedBlink’s intention is to shape Europe’s technological future by creating a platform that combines the visibility generated by crowdfunding, the flexibility of angel investors and the structuring provided by VCs. Furthermore, the management intends to set up an Advisory Board of senior specialists in the region within the next three months.

„Until recently, we had positioned ourselves as an equity crowdfunding platform for technology startups, but we have identified several other opportunities. We want individual investors in Europe to benefit from the possibility to fund technological startups together with business angel professionals and venture capital partners. And we want the founders to find resources and mentors in one place. We want to create an innovative investment platform for Europe„, says Andrei Dudoiu.

SeedBlink management also aims to provide products and services to a wider audience, by creating a secondary market, developing a network of experts, expanding the methods of interaction between the actors involved through technology, to name but a few.

_____________

SeedBlink is the fastest growing investment platform in technology startups in Europe in terms of the amounts traded and the number of investors. The company aims to democratize the investment process by combining, in one online platform, crowdfunding visibility, business angel flexibility and VC expertise. SeedBlink’s booming community is at the heart of the platform’s success, along with a selection of technology startups founded by passionate teams with innovative ideas, real social impact and potential for international scaling.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: