Scan & Pay – Competition between suppliers intensifies as mobile self-scanning takes off

Although leading retailers often develop ‘scan and go’ software in-house, many are collaborating with

specialist vendors or major technology players

Leading retailers work with specialist firms to develop self-scanning applications

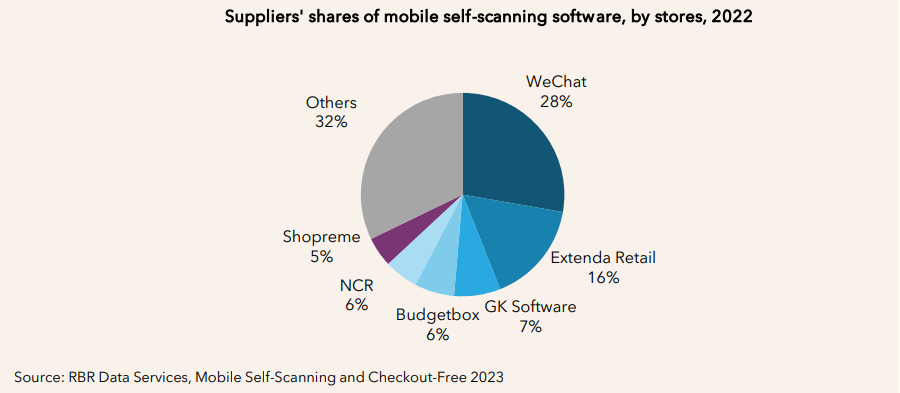

A brand-new study by RBR Data Services, a division of Datos Insights, shows that the mobile selfscanning market is increasingly competitive, with around 50 different software suppliers working closely with major retailers. According to Mobile Self-Scanning and Checkout-Free 2023, around 40% of the 57,000 stores globally to offer a ’scan and go’ experience are powered by third-party software.

The remainder run proprietary applications developed by the retailers themselves, albeit often in conjunction with barcode scanning specialists such as Scandit.

Chinese retailers use WeChat, while Extenda Retail and GK Software supply European firms

In China, apps like WeChat and Alipay are commonplace and can be used for a range of functions,

one of which is mobile self-scanning. WeChat has the largest market share, supplying ‘miniprogrammes’ which can be opened and used by customers to scan and pay.

Outside of China, the study shows that Extenda Retail is the largest provider of mobile self-scanning

software, thanks in part to its acquisition of Dutch firm Re-Vision, in 2022. Its customers include Tesco

in the UK and Coop in Sweden.

Many retailers run solutions from third-party ‘scan and go’ specialists such as France’s Budgetbox,

Austria’s Shopreme, UK firm Mishipay and US vendor Skip (now part of Standard AI). Others use selfscanning applications provided by their POS software supplier; GK Software, NCR, Toshiba and

Fujitsu all have a substantial market presence.

Zebra accounts for three out of four self-scanning devices provided by retailers

Over 12,000 stores globally provide handheld devices for customers to scan items as they walk around the shop, with more than 75% of these supplied by Zebra. Its devices are mainly used in Europe, but can also be found elsewhere, including in the USA, Canada, Thailand and New Zealand.

Italian firm Datalogic also has a major presence, with a large share of devices in its home market.

Retailers are also piloting smart cart solutions in increasing numbers. The carts either require customers to scan items as they put them in, or use computer vision to recognise products automatically. There are a wide variety of technology providers in this space, including Retail AI, Superhii and Veeve.

Alex Maple, who led RBR Data Services’ Mobile Self-Scanning and Checkout-Free 2023 research, commented: “Retailers rolling out ‘scan and go’ projects have a wide variety of software vendors and solutions to choose from. A more diverse range of retailers in an increasing number of geographies are introducing mobile self-scanning, so the demand for hardware and software to drive these projects is set to continue”.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: