Banco Santander announced the launch of PagoFX, a low-cost international money transfer service, in the UK. This new service, available via a mobile app, allows UK residents with a debit card issued by any UK bank or financial entity to seamlessly and quickly send money abroad from their smartphone with low costs, bank-level security and customer support via in-app chat, web and e-mail.

In light of the ongoing coronavirus pandemic, PagoFX will allow customers to use the service to transfer money abroad without any fees at all for the next two months.

PagoFX works as an autonomous fintech start-up with more than 50 people in Madrid, London and Brussels.

The launch is another milestone in Santander’s four-year (2019-2022), 20 billion-euro digital technology pledge. PagoFX is the open-market version of Santander’s existing international money transfer service One Pay FX, which offers transparent and quick international transfers to its bank customers in key countries in Europe and the Americas.

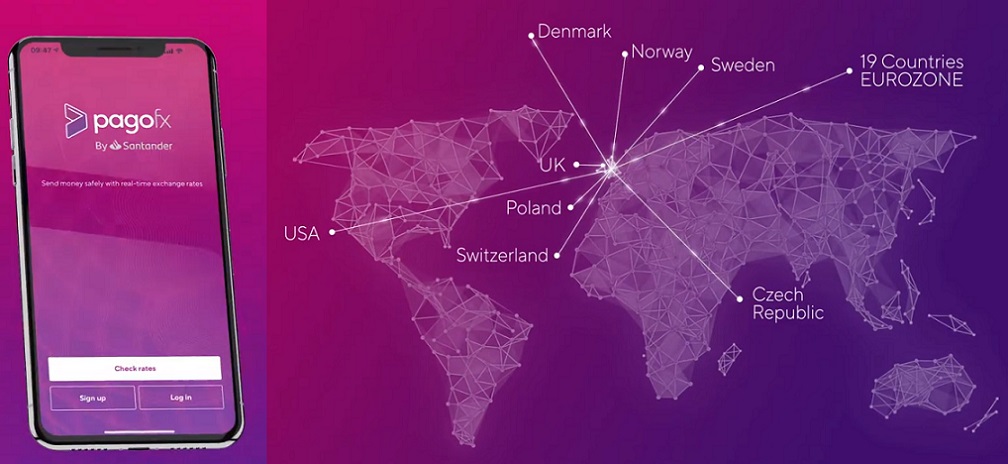

With the PagoFX service, international payments can currently be made in selected currencies from the UK to the US, the eurozone, Poland, Switzerland, Norway, Denmark, Sweden and the Czech Republic, with plans to introduce further currencies and payment options in the short term.

The service will be rolled-out to sole traders and small-and-medium-sized enterprises in the UK via the PagoFX website and mobile app in the near future. In addition, PagoFX will be launched in other European countries later this year and be present in around 20 markets in the next three to four years.

The no-fee programme, deployed due to the coronavirus pandemic, is available to all registered UK users of the PagoFX app on Android or iOS.

Until 16 June 2020, PagoFX shall waive international money transfer fees on transactions up to a limit of 3,000 GBP per user. This limit is cumulative – once you submit a single or multiple transactions above the 3,000 GBP limit, PagoFX’s standard fees shall apply on all amounts above the limit. Standard low-cost fee for transferring money to the eurozone, Switzerland, Norway, Sweden and the Czech Republic is 0.70% of the sent amount. For transfers to the US, Poland and Denmark, the fee is 0.80% of sent amount.

PagoFX shows all the information upfront and offers real-time foreign exchange rates.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: