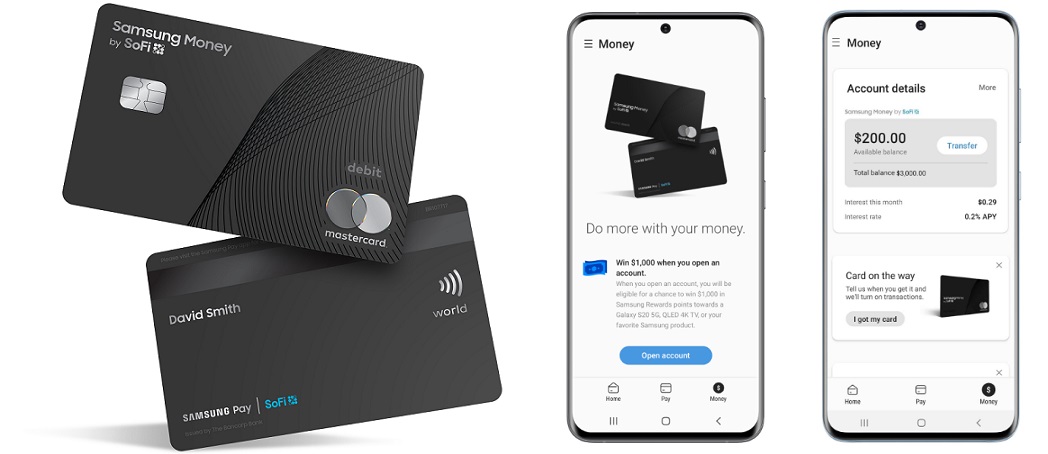

Samsung Electronics America, Inc., unveiled Samsung Money by SoFi, a new mobile-first money management experience that brings a cash management account and accompanying Mastercard debit card along with exclusive benefits to Samsung Pay, in partnership with fintech company SoFi. The Samsung Money by SoFi card is issued by The Bancorp Bank.

„The account is secure, with no account fees and rewards users for saving—earning higher interest relative to the national average of transactional accounts.1„, Samsung said. „At a time when people are turning to their technology to take care of essential tasks without leaving home, Samsung Money by SoFi makes it easier for them to manage more of their financial life in the Samsung Pay app.2„

“Samsung Money by SoFi is our biggest move yet to help users do more with their money. Samsung Pay is already the most rewarding shopping and payments experience driven by numerous innovations over the years. Now, users can access mobile-first financial services and earn exclusive Samsung benefits. We’re excited to help our users reach their financial dreams by allowing them to spend, save and grow their money and access it easily and securely.”, said Sang Ahn, Vice President and GM of Samsung Pay, North America Service Business, Samsung Electronics.

Now more than ever, people are counting on their technology to help them pay, shop, and manage their finances. At the same time, many people prefer payment methods that can earn interest instead of paying it. Samsung Money by SoFi offers the best of both: no account fees, higher-interest earning, money management experience that combines the convenience of mobile payments and the control of a debit card.

Samsung Money by SoFi puts Galaxy smartphone users in charge of their spending and saving. Users can choose between opening an individual or joint cash management account. What’s more, users enjoy in-network ATM fee reimbursement at more than 55,000 locations in the United States3.

„Setting up an account in the Samsung Pay app will take almost no time at all. The virtual card will appear instantly within Samsung Pay upon approval. And as soon as users receive their physical debit card in the mail, there’s no need to call a 1-800 number; the card is ready to use in a snap—just open Samsung Pay and activate the card with a tap.”, according to the press release.

With just a tap in the Samsung Pay app, users can check their balance, review past statements, and search transactions. They can flag suspicious activity, pause or restart spending, freeze or unfreeze their card, change their pin, and assign their trusted contact—all without ever having to leave home or call a representative.

To help users make their money go further, Samsung Money by SoFi offers exclusive benefits. Users can enroll in the Samsung Rewards program to earn points for every purchase they make using Samsung Pay. As an added bonus, loyal Samsung Pay users with 1,000 or more Samsung Rewards Points will be able to redeem their points for cash that will be deposited directly into their Samsung Money by SoFi account.4

A Samsung Money by SoFi account is FDIC insured for up to $1.5 million (six times that of a normal bank account)5. Samsung Money by SoFi account holders get the benefit of defense-grade security from Samsung Knox. The physical debit card will not display the card number, expiration date, or CVC. Should users need that information, they can easily find it within the “Money” tab of the Samsung Pay app, which is further protected by biometric or PIN authentication. Users assume zero liability should an unauthorized transaction occur.

“We are seeing a seismic shift across the world as consumers move to digital and expect safe and frictionless experiences.”, said Jorn Lambert, Executive Vice President, Digital Solutions, Mastercard. “Mastercard’s digital first solutions combined with Samsung Money by SoFi shows how our collective strengths and innovation can deliver this promise of safety, convenience and ubiquity.”

Samsung Money by SoFi will start to be available to U.S. consumers later this summer. To sign-up for the wait list and get the latest updates about Samsung Money by SoFi, simply go to http://www.samsung.com/us/money.

###

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: