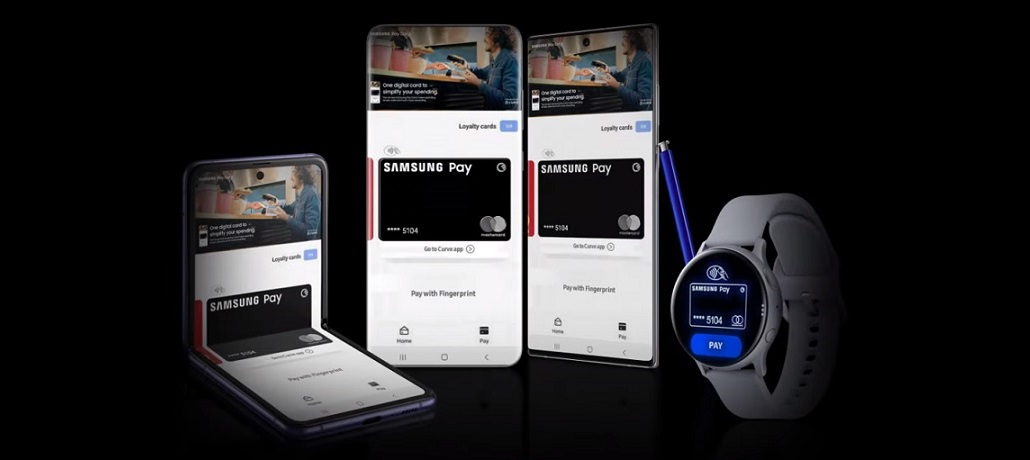

The new Consumer Device Cardholder Verification Method (CDCVM), which applies to purchases above $100 (or $200 with some merchants), allows customers to use their own devices to validate these purchases through PIN, iris, or fingerprint authentication, instead of having to physically enter their PIN on the point-of-sale terminal.

According to Mark Hodgson, Head of Services at Samsung Australia, CDCVM offers a faster and more hygienic way to verify high-value purchases.

“The launch of Samsung’s new CDCVM solution is the result of our ongoing investment in offering our Australian customers with the best possible digital wallet experience.

“CDCVM provides users with a payment experience which is both convenient and secure, and faster at the checkout.”

Axel Boye-Moller, Visa’s Head of Product for Australia, New Zealand and South Pacific, added that CDCVM makes for a “richer, more relevant consumer experience”.

“As more Australians tap their phones and watches to pay, Visa works to ensure these technologies not only meet, but exceed, expectations of security and convenience,” he said.

CDCVM is now available via Samsung Pay software update for Visa, MasterCard, and American Express cardholders, though users paying with a Mastercard and who loaded their card onto Samsung Pay before Tuesday 21 July will need to delete and re-load their cards in order to enable it; in addition, not all merchants currently support the technology.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: