Three weeks ago we launched our first AI agents. Finance teams at Notion, Webflow, and Quora have them working round the clock: reviewing, approving, and coding transactions, flagging fraud, and updating policies. We used to train people to think like software. Now it’s time for software to think like people: your sharpest controllers, procurement leaders, treasury experts.

an article written by Eric Glyman, co-founder and CEO of the fintech start-up Ramp

So, why are we raising another $500 million? (just 45 days after our last round)?

Because we’re at a unique moment in finance.

A new beginning. Fortunately, over the last six years we’ve assembled (what I think) are the best engineering and design teams in our industry.

Now, let me tell you how we think finance will change, and why you’re in the best hands.

The year is 2025: pick your poison

I talk to at least ten different finance teams a week. Some customers, some not. Nine out of ten conversations fall into one of two buckets.

First, the ‘manual’ crowd. Heads down. Working day to day. Who can blame them! The work is endless and there’s no time to change. It reminds me of Winnie the Pooh coming down the stairs. ‘Bump! Bump! Bump! ‘I’m sure there is a better way… If only I could stop bumping for a moment to think of it.’

Then there’s the ‘we’re doing something about what’s coming’ crowd. The CFO is asking for an AI plan. You’re testing different tools, there’s an urgency. Meetings are about automating away as much busywork as possible.

We’re noticing more and more companies across all industries (construction, healthcare, retail, etc.) hop from the first bucket to the second. And no one is going back. Once you’ve seen an agent automatically rebook your hotel if the price drops, the days of back and forth between you, your manager, and travel support feels impossible.

By 2026: agents take over the busywork

Picture the most routine transaction in your company: Jess from sales grabs a $5 latte on the way to a client meeting.

That’s 3 interruptions. 14 minutes. $20 in overhead for a single coffee. Scale that across 2,000 swipes a month and your finance team is trapped in an endless loop of micro-decisions.

With Ramp, all you have to do is give our agent your PDF policy and it immediately starts approving low-risk expenses, answering employee questions over SMS, and flagging true outliers for you to review.

If you joined our beta, here’s what you’re already seeing:

. The team? Doing 85% less manual reviews

. Our agents? Catching 15x more policy violations

. Your financials? 10,000 transactions reviewed without breaking sweat

This is the first of a suite of agents coming in the next year.

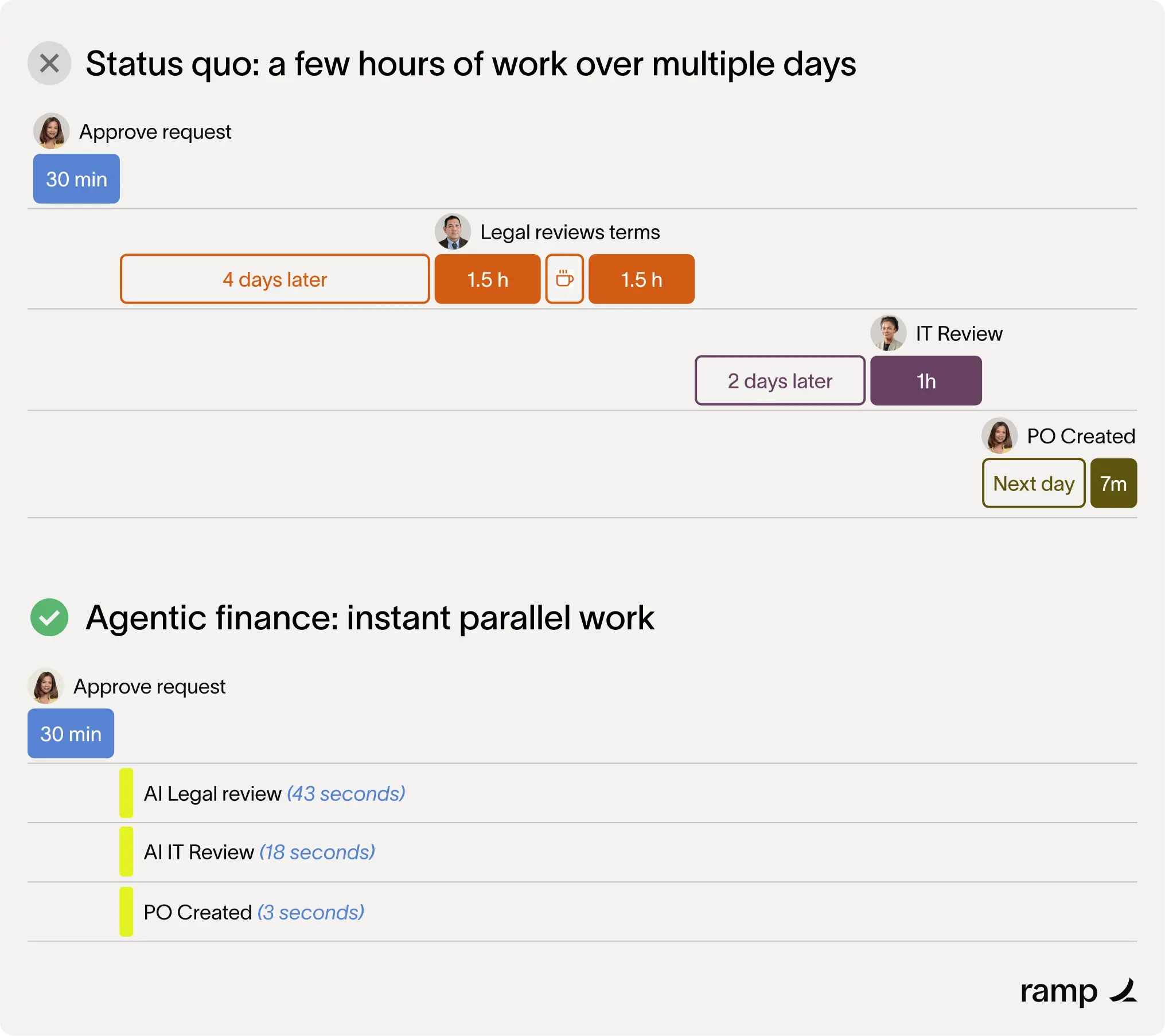

By 2027: finance starts running in parallel

Today, finance runs in ‘series’. You’re so used to it, you hardly notice.

Take something simple: a contract.

. If a vendor sends one, then procurement reviews it

. If procurement approves, then legal checks the terms

. If legal signs off, then finance drafts the purchase order

. If the PO is issued and an invoice is received, then accounts payable schedules the payment

It’s a relay. Nothing moves until the previous step is completed. For as long as humans are doing the work this makes sense. Finance isn’t going to waste time coding something until it’s approved.

But what if it’s not humans doing the work?

Why can’t legal, risk, and procurement copilots review the same request at once? Why can’t agents pre-negotiate, pre-approve, and pre-reconcile before anyone asks? Why do you need a ‘month-end close’ if the books are always live?

This future is starting to happen. The result? Faster decisions, fewer bottlenecks, shorter cycles.

Right now, Ramp users are getting 3× more done per minute compared to two years ago. By 2027 – as our agents start working in parallel – we’re aiming for 30×.

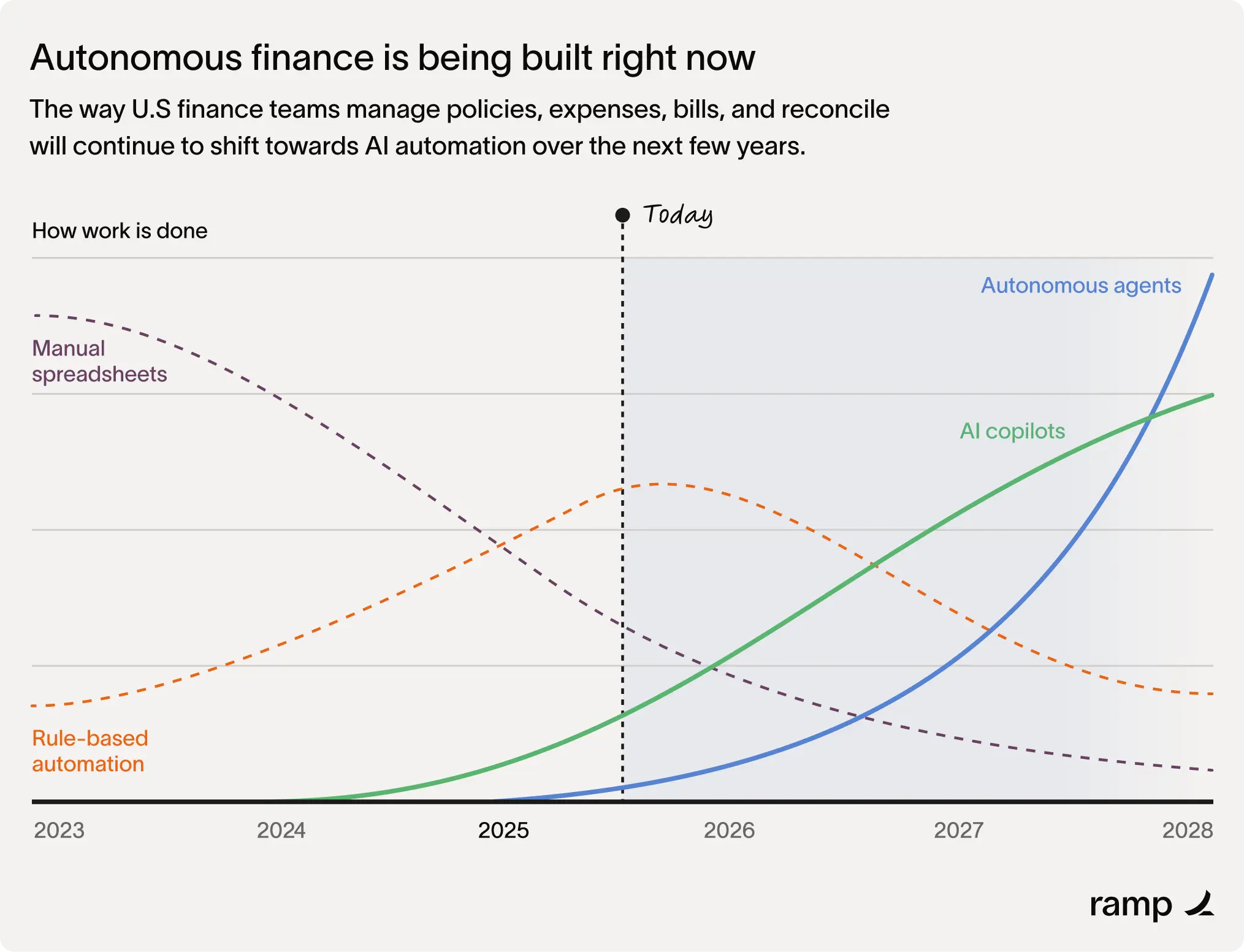

By 2028: autonomous AI with human oversight

Copilots now feel as natural as tapping to pay. Your team is ready for Autonomous Finance.

The difference? Auto = “self,” nomos = “rule”. Your finance software now thinks, acts, and improves by itself. A copilot flags idle funds not earning yield. Autonomous AI has already moved them; you don’t miss a penny of interest.

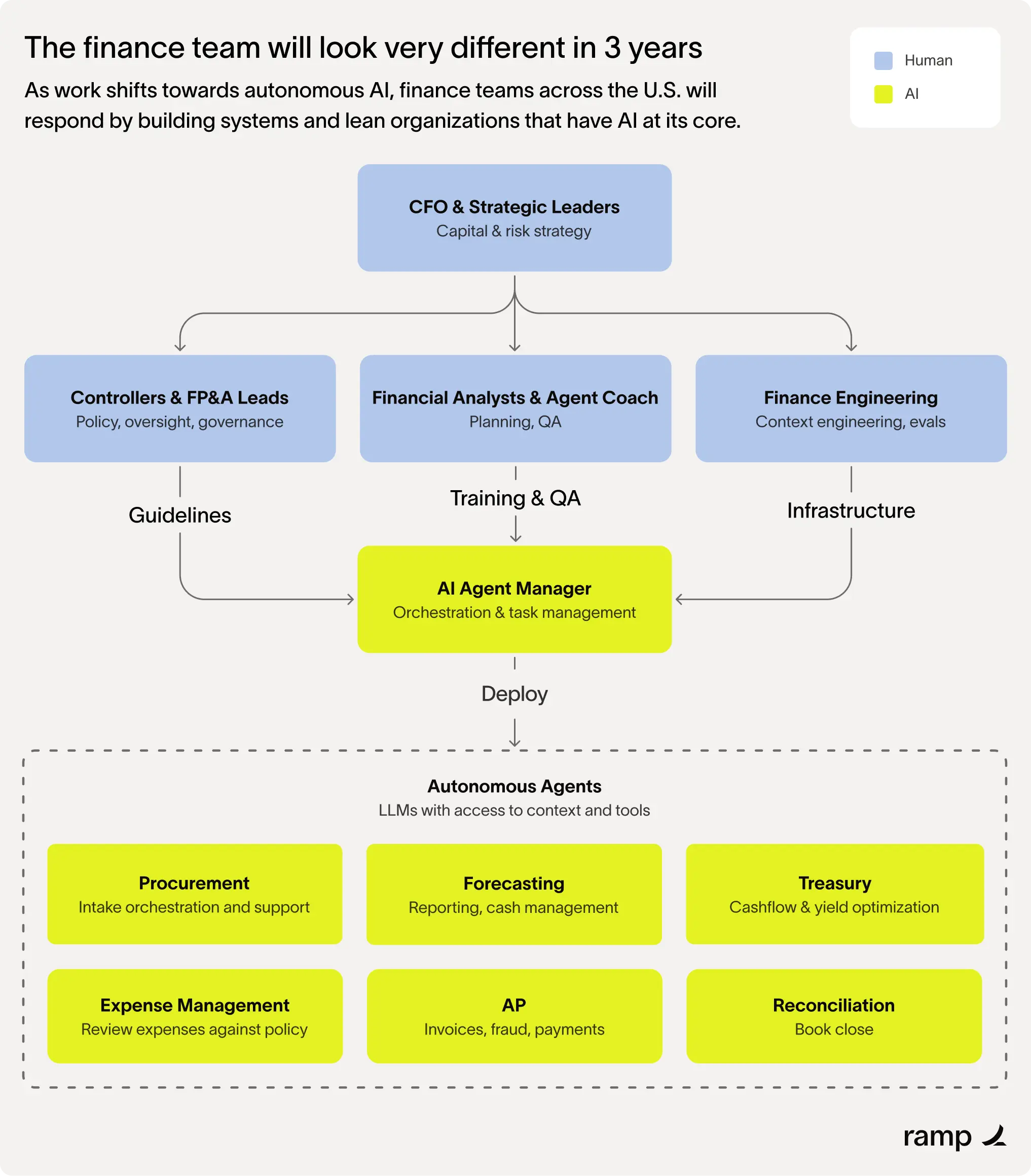

Picture a fleet for different tasks. Expense agents clearing 99%+ of transactions without human touch. Treasury agents optimizing cash positioning. FP&A agents running real-time forecasts.

This isn’t a story about replacing people. It’s about redeploying them – up the value chain, into the work only humans can do.

Your junior analysts become „agent coaches.’ Your senior leaders will make a smaller number of higher quality decisions. They’re all now strategists, not clerks!

Here’s roughly what we think the finance team of the future will look like.

45 days ago: I said “Let the robots chase receipts”

And we raised $200M to do just that.

Today, they’re not just chasing receipts. They’re filing your expenses, booking your travel, paying your invoices, and closing your books. And we’ve raised another $500M at a $22.5 billion valuation to pick up the pace.

If you’re reading this, you’re probably trusting us to run your finances – we’re saving millions of you billions of dollars and hours a year – and we’re deeply grateful for your trust.

But here’s the reality: we still serve just 1.5% of businesses in the US. 98.5% to go.

Fortunately, 45 days is now a long time in finance.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: