Romanian investors demonstrated a shared enthusiasm for Tesla (TSLA) shares, followed by the Chinese electric vehicles manufacturer NIO (NIO) and by the entertainment American company AMC (AMC). Among EU stocks, the Finnish Nordea Bank took the lead in capturing investors attention, followed by the Dutch bank ABN AMRO Group N.V. (ABN) and the German optic technology company Jenoptik AG (JEN).

Revolut, the global financial app with more than 35 million customers globally and over 3,4 million in Romania, unwraps some trends in how Romanians and the whole Europe invested in 2023.

In 2023, Revolut marked a record in Romania, where the number of the trading customers almost doubled (+95% as of December 31st, 2023 vs December 31st, 2022). Romanians were among the leading investors via the Revolut app across Europe, with average securities trading account size at the end of year reaching EUR 1,640, while the average invested amount across EEA was EUR 1,827. Largest investment accounts were accumulated by the customers in the 45-54 yo segment, reaching EUR 3,145.

Different gender dynamics also emerged. In Romania, men took the lead in the investment space, showcasing higher activity levels and investing more substantial sums. The average account size for men was 2x larger compared to women, EUR 1,980 and EUR 840 respectively.

Across the EEA, the most traded US stock in 2023 was the American automotive giant Tesla (TSLA), followed by the American spaceflight company Momentus (MNTS), and Chinese automotive NIO (NIO). Among EU stocks, Anheuser-Busch (1NBA) brewery took the lead in capturing investors attention, followed by the German automotive company Volkswagen (VOW3), and Dutch payment company Adyen (1N8).

Like most Europeans, Romanian investors demonstrated a shared enthusiasm for Tesla (TSLA) shares, followed by the Chinese electric vehicles manufacturer NIO (NIO) and by the entertainment American company AMC (AMC). Among EU stocks, the Finnish Nordea Bank took the lead in capturing investors attention, followed by the Dutch bank ABN AMRO Group N.V. (ABN) and the German optic technology company Jenoptik AG (JEN).

For those looking for diversified and cost-effective financial instruments, last year Revolut introduced Exchange-traded funds (ETFs), which offer exposure to a broad diversified portfolio of assets such as stocks and bonds, within the Revolut app.

„Investing in ETFs can make it easier to manage investment risks, and reduce the costs and time spent on investment research.” the company explains. To commit to investing regularly and reduce the impact of short-term price volatility Revolut recently added ‘Recurring buys’ feature allowing to buy stocks/ETFs at predefined time and frequency. The ETFs that secured top positions among the Romanian investors during 2023 were Vanguard S&P 500 (VUSA), Xtrackers Global Inflation-Linked Bond ETF and iShares Treasury Bond 7-10yr (Dist.) ETF.

Rolandas Juteika, Head of Wealth and Trading (EEA) said:

“As we reflect on 2023, the stock market’s impressive surge of over 24% by S&P 500 index and astonishing 54% by Nasdaq 100 index has been a testament to the resilience and adaptability of the financial landscape. Looking ahead to 2024, the prospect of interest rates potentially peaking at 4%-5% in the EEA introduces a nuanced dynamic. With potential interest rates decreasing, bond prices could rise, presenting new strategic opportunities for investors. We will soon allow our customers to access this space in just a few taps on a phone screen.

Moreover, the encouraging trend of decreasing inflation adds another layer of optimism, contributing to a more favourable environment for diverse investment strategies. As we enter 2024, a thoughtful and balanced approach, considering the evolving market conditions, will be key to capitalising on emerging opportunities.”

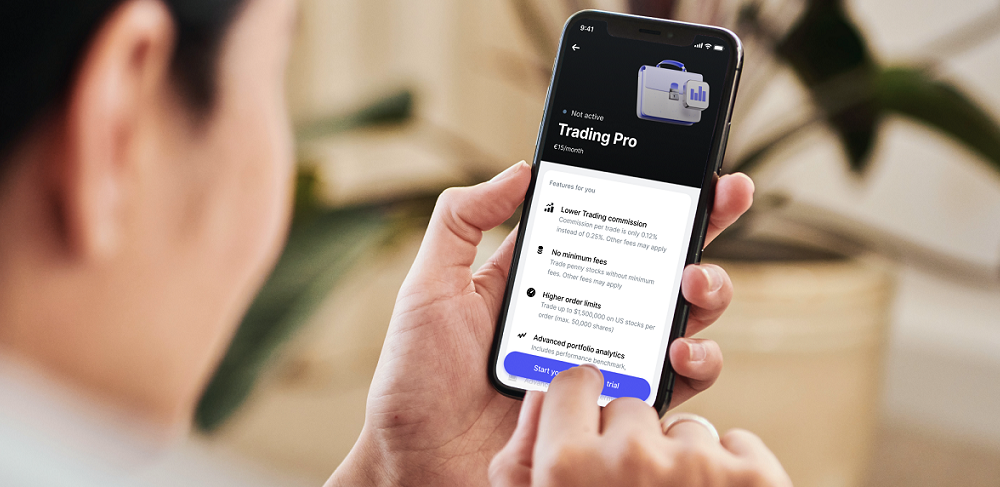

Revolut recently expanded its investment offering across the EEA with the shares of European-listed companies and introduced Trading Pro — a subscription for advanced traders with a discounted commission fee, higher order limits, advanced portfolio analytics, and a desktop Trading Terminal.

Revolut offers customers access to more than 2,200 US-listed securities, 140+ EU-listed securities and 200 Exchange-traded funds (ETFs) via the Revolut app. Investment services in the EEA are provided by Revolut Securities Europe UAB (Revolut), an investment firm authorised and regulated by the Bank of Lithuania.

___________

In 2015, Revolut launched in the UK, offering money transfer and exchange. Today, more than 35 million customers and hundreds of thousands of businesses around the world use dozens of Revolut’s products to make more than 500 million transactions a month.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: