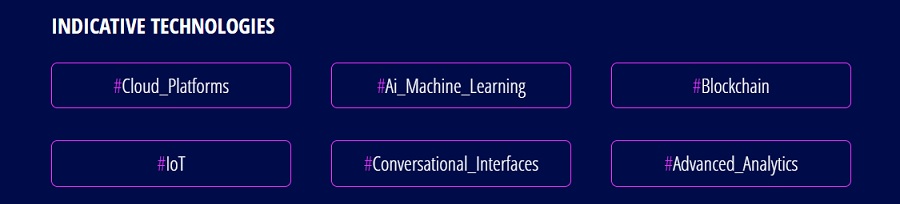

This year’s competition managed to attract the interest of more than 70 teams and individuals from 13 countries. „The variety of technologies brought forward (Cloud platforms, AI, IoT etc.) suggests that the opportunities to further transform our operation as well as the customer experience are abundant,” the bank said in a press release.

Seven fintechs were selected to the accelerator phase: Dobe (Letonia), Finloup (Greece), Finqware (open banking – Romania), Omnio (UK), Riskturn (US), SentiGeek (Greece), Wealthyhood (UK).

„As an aspiring leader in open banking in SEE region, we have Greek market on our radar for future business development. We are very proud to be selected in this fintech accelerator, the most prestigious in Greece. We are looking forward to understand and to have a footprint in the local market and hope to use at best this opportunity,” said Cosmin Cosma, CEO of Finqware.

For the Romanian fintech start-up, the selection into the Finquest accelerator program completes an excellent year, with other remarkable achievements in 2020. There will be other surprises by the end of this year, but the company prefers to keep it confidential for now.

„The year started with the Hungarian experience in spring at OTP Lab and Croatian project with OTP banka d.d., continued with acceleration sprint in Bucharest in InnovX by BCR program and these days we are already involved in Vienna Startup Package Program supported by Vienna Business Agency. Not to forget the major commercial launch of Open Banking in Romania with Banca Transilvania. Expect more from us!,” said Cosmin Cosma, CEO of Finqware.

About Finquest

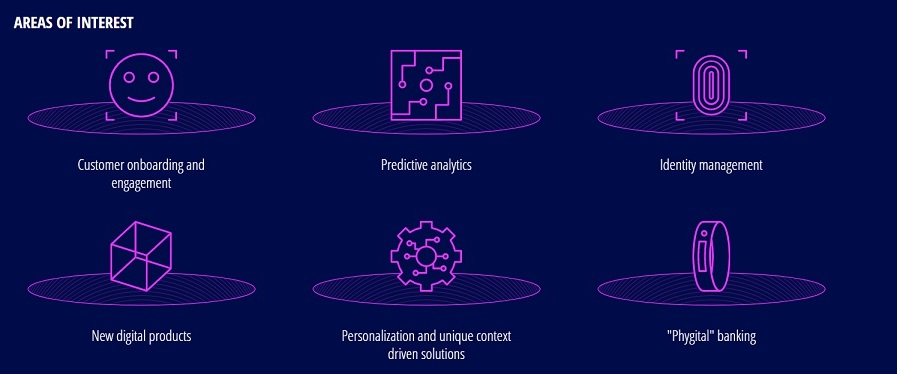

FinQuest by Alpha Bank 2020, which will run for a total of 4 months and will take place in three stages, will look for the most innovative ideas and proposals for the financial services of the digital era, taking advantage of the latest potential provided by technology.

The competition will present a real challenge in the financial services sector, to be tackled by individuals who will work in teams and will combine a wide range of skills and experiences, a combination that is considered particularly important for the successful operation of the new “ecosystem” of Fintech companies.

In the first stage of the competition, which starts in July, all interested parties, provided they over the age of 18, can apply to participate, by submitting their solution / software application to the FinQuest website. Individual entries will also be accepted; however, the competition encourages the participation of teams.

In the second stage of FinQuest by Alpha Bank, which have started in September, the best teams to emerge from the competition’s first stage will receive five weeks of mentoring from experienced Bank executives and technology experts, to further develop their ideas and make them applicable by the Bank itself.

In the third stage, which will start with a special event in November, the teams will present their final proposals to the Evaluation Committee, which will be composed of representatives from major academic institutions, Alpha Bank executives, executives from investment and advisory firms, and prominent start-up and fintech professionals.

The members of the Committee will evaluate the ideas and will award prizes to the top three, at a major event open to the public, whose guests will include key organizations and representatives of the academic, business and technology communities.

As was the case last year, the challenge of this year’s FinQuest by Alpha Bank is to create a new digital banking experience, using the innovative tools offered by digital technology, to create new, personalized services that focus on the Customers and respond directly and effectively to their evolving needs, in line with the priorities of Alpha Bank’s Digital Transformation strategy.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: