Robinhood just dropped 𝙍𝙤𝙗𝙞𝙣𝙝𝙤𝙤𝙙 𝘽𝙖𝙣𝙠𝙞𝙣𝙜 along with three AI agents — and it’s a direct challenge to the traditional private banking model. No more private bankers, printed net worth reports, or back-and-forth texts. It’s mobile-first, AI-first, and built for the next generation of wealth management.

Robinhood has announced its next big thing. What started as a commission-free stock trading app, later branching into crypto and credit cards, is now moving deeper into financial services with Banking, Strategies, and Cortex.

Today, at Robinhood Presents: The Lost City of Gold, the company announced Robinhood Strategies, Robinhood Banking, and Robinhood Cortex, a suite of new features that will shape the future of wealth management. „With exclusive benefits for Robinhood Gold members, these products help you access financial services such as private wealth management and private banking, which were once thought out of reach to many.” – according to the press release.

“Our goal is for Robinhood to give you a world-class financial team in your pocket, with cutting-edge tools you can’t find elsewhere,” said Vlad Tenev, Chairman and CEO, Robinhood.

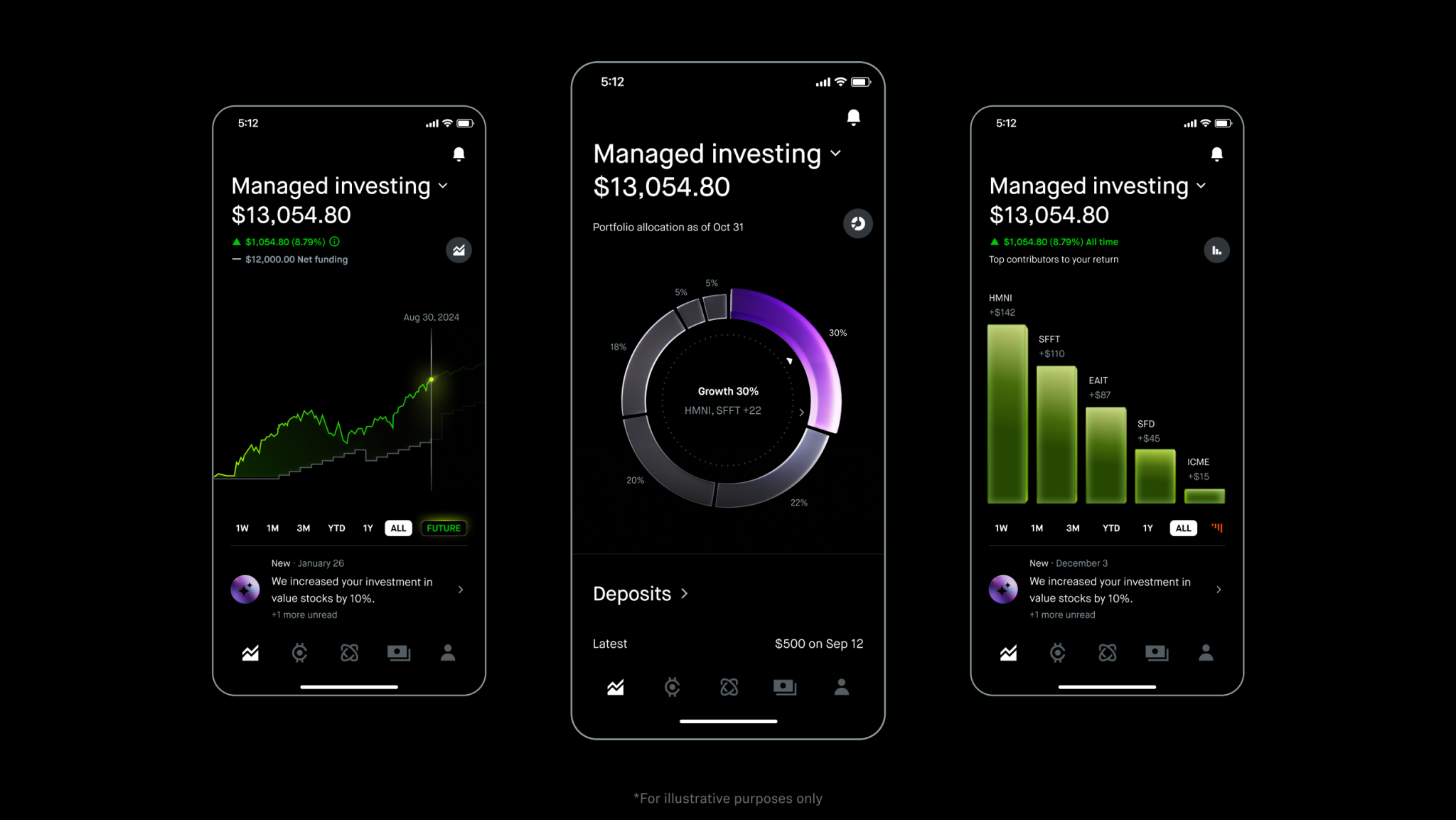

Robinhood Strategies

This is more than just another robo advisor. Robinhood Strategies aligns with your goals and delivers tailored, expert-managed portfolios directly in the app. „Our team will be there with you to deliver timely insights that help you understand how and why your money moves so you can invest with confidence. With zero management fees on every dollar over $100k for Robinhood Gold members–meaning you never pay more than $250 a year–you’re getting the benefits of a private wealth management approach, without paying more to invest more.” – the company explained.

“When building Robinhood Strategies we realized the existing digital advisory model was broken, with limited features and fees that grow as you do better,” said Steph Guild, President, Robinhood Asset Management & Senior Director of Investment Strategy, Robinhood Financial. “We designed Robinhood Strategies to give everyone incredible service and low fees with a cap, meaning you don’t have to pay more to invest more.”

The team behind Robinhood Strategies is guided by a collective 50+ years of Wall Street experience managing both institutional and high net worth clients. „Robinhood Strategies is a cutting edge wealth management service that gives you expert financial advice and the knowledge to effectively plan for your future.” – the company said.

Robinhood Banking

Robinhood Banking, a platform launching later this fall, will bring the private banking experience exclusively to Robinhood Gold members, providing access to traditional checking and savings accounts with luxury benefits. „You will be able to apply for an account right from your phone, send money across the world in 100+ currencies, and even get cash delivered directly to you.” – stated the press release.

“With Robinhood Banking, we’re trying to solve many of the challenges presented by legacy banks,” said Deepak Rao, GM and VP, Robinhood Money. “Robinhood Banking is thoughtfully designed to be as easy to use as possible, while still delivering cutting edge features historically reserved for the ultra-wealthy. We’re pushing the boundaries of what you should expect from your bank.”

Robinhood Cortex

The company is launching Robinhood Strategies and Robinhood Banking to give customers access to private wealth management and banking services historically reserved for the ultra-wealthy.

„Today, we’re also giving you a first look at the next big thing from Robinhood. Introducing Robinhood Cortex, an AI investment tool launching later this year that is designed to provide real-time analysis and insights that help you better navigate the markets, identify opportunities, and stay up to date on the latest market moving news.”

“High quality, premium investment and market analysis has historically been reserved for institutional investors and the rich,” said Abhishek Fatehpuria, VP of Brokerage Product at Robinhood. “Over time, Robinhood Cortex will completely transform the Robinhood experience as we strive to bridge that gap and put a premium research assistant right in your pocket.”

This is just the beginning of how we’ll use artificial intelligence to help power your investing experience at Robinhood. At launch, Robinhood Cortex is designed to up-level your trading and investing experience supporting:

Trade Builder: It’s a tool designed to simplify the trading process and help you learn about new strategies that align with your goals. For example, it makes the options trading experience more intuitive by helping you translate your beliefs about a stock into a specific options trade and strategy. We’ll use Robinhood Cortex to show you insights about price signals, technicals, market news, analyst reports, and more, and then Trade Builder will screen the market for trades to consider based on your inputs.

Stock Digests: This helps you answer the age-old question of, “Why is this stock going up or down today?” With Robinhood Cortex, simply go to the stock detail page, and we will quickly generate a short summary of what’s happening in the world to impact that ticker.

„Robinhood Cortex is not placing trades for you, but instead helps you gather analysis and insights to inform your market outlook. Over time, we expect Robinhood Cortex to enhance other parts of the Robinhood experience, and we’ll have more details to share when it starts rolling out to Robinhood Gold members later this year.” – the company explained.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: