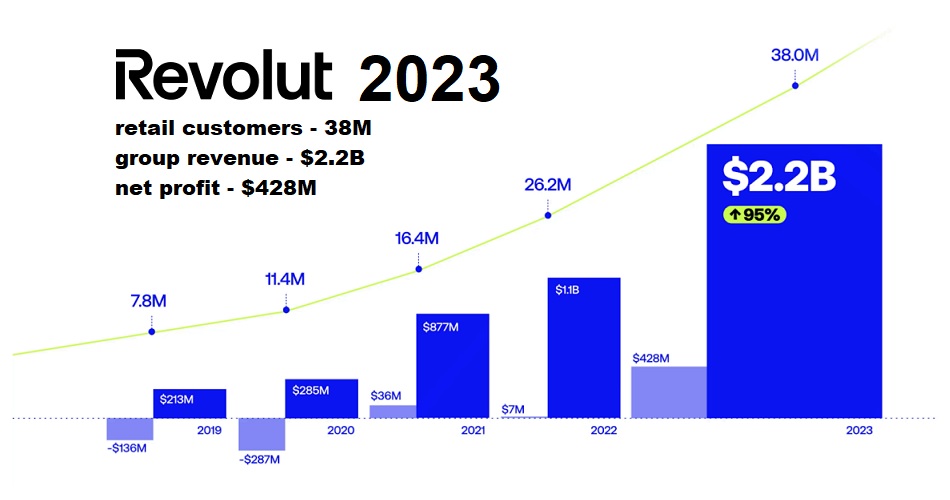

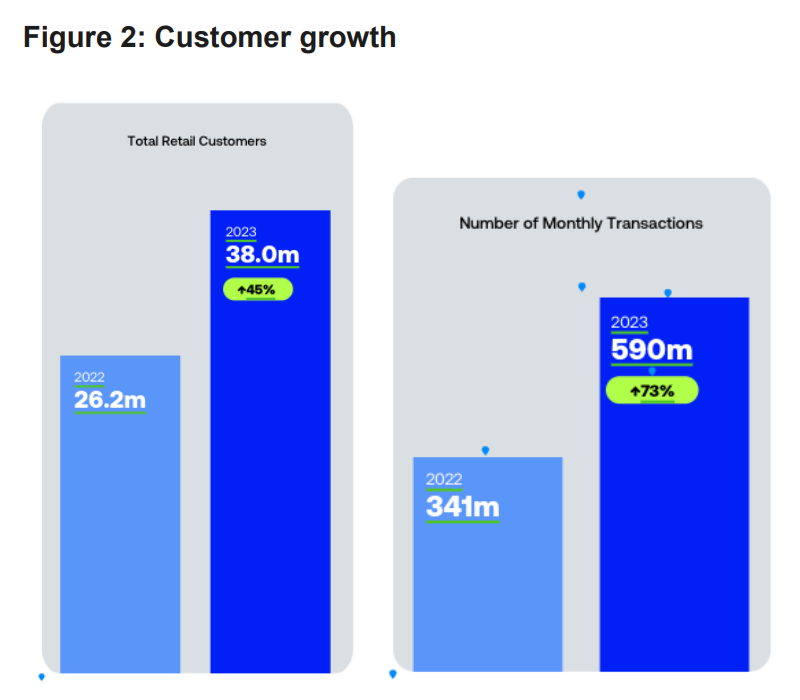

Revolut added 12m new customers globally last year, totalling 38m in 2023 and reaching 45m in June 2024. The company is on track to surpass 50m customers by the end of FY24. In the local market, the retail customer base increased by 38% in 2023 vs. 2022. 38% increase in customer balances to $23bn (£18.2bn) and 41% increase in paid subscriptions.

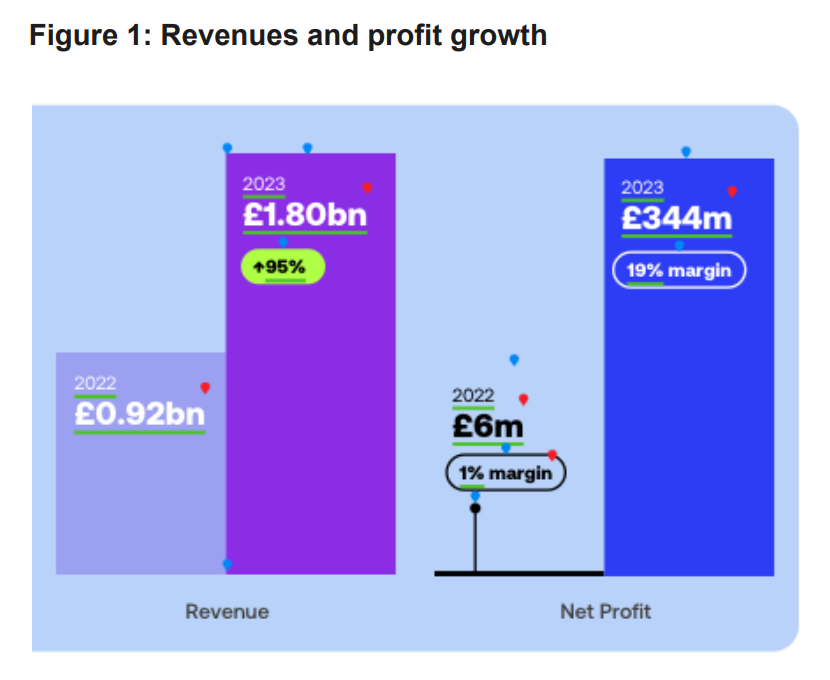

Today, Revolut released its Annual Report for the year ending 31 December 2023. Group revenue increased by 95% from $1.1bn (£0.92bn) in 2022 to $2.2bn (£1.80bn).

Revolut has now been net profitable for three years in a row: Profit before tax was $545m (£438m), and net profit grew to $428m (£344m), up from $7m (£6m) in 2022. Net profit margin for the year was 19%.

Nik Storonsky – CEO of Revolut said: “This year, we took our biggest steps yet on our mission to deliver the best product and the best customer experience at great value to customers, everywhere. Our customer base is expanding at impressive rates, and our diversified business model continues to fuel exceptional financial performance, delivering revenues of over $2.2bn in 2023 and a record profit before tax of $545m. With a net profit of $428m, 2023 was our third profitable year in a row.„

“We remain committed to our ongoing UK banking licence application in addition to bringing the Revolut app to new markets and customers around the world. Even as we surpass more than 45 million global retail customers six months into 2024, Revolut remains poised for exponential growth in 2024 and beyond, continuing to redefine the financial services landscape as we’ve known it.”

Revolut’s revenue diversification continued to drive sustainable growth with no single product stream or country accounting for more than 30% of total revenue in 2023.

Over the year, Revolut added almost 12m new customers globally, „the highest YoY increase in the company’s history”, bringing the total to 38m in 2023.

In Romania, Revolut had 3.39 million retail customers, as of December 31st, an increase by 38% compared to December 31st 2022. In 2023, the customer base for Revolut Business rose by 171%, in the local market.

70% of new customers joined organically or were referred by someone they know. Word of mouth growth complemented by further investment into marketing and sales functions, including for Revolut Business, which was onboarding 20,000 SMEs (small and medium enterprises) each month by the end of the year.

Romanian businesses and customers using Revolut as a primary bank account have deposited more than EUR 750 million in their accounts as of December 31st, 2023 (+41% in 2023 vs 2022).

This growth was consistent across all revenue streams of Revolut’s diversified business model, with more customers engaging in more of our products:

. Cards & Interchange: $605m (£486m), up 59% from $379m (£306m);

. FX & Wealth: $491m (£395m), up 46% from $334m (£270m);

. Subscriptions: $303m (£244m), up 53% from $196m (£159m);

Total customer balances increased from $16.4bn (£13.2bn) to $22.7bn (£18.2bn).

Due to expanded treasury capabilities, higher customer deposits, alongside the tailwind of increases in central bank rates, and acceleration in the credit portfolio, interest income grew to $621m (£500m) in 2023 compared to $102m (£83m) in 2022.

Customer usage accelerated with transaction volume increasing by 58%, reaching close to $870bn (£700bn). Monthly transactions as of Dec 2023 totalled 590m, up 73%.

An increasing number of customers have adopted Revolut’s services through paid subscriptions, with 41% growth in customers opting for a paid plan.

As of June 2024, Revolut is the most downloaded app in the Finance category in Europe, ranking first in 17 countries.

The company expanded into new markets, including Brazil and New Zealand, bringing its global footprint to 38 countries.

With a focus on core banking services in Europe, Revolut doubled down on reinvestment to support future growth, including product development and expansion into new markets.

$300m (£241m) was allocated to advertising and marketing to supplement our organic growth. We also scaled our B2B sales team to over 900 employees by the end of 2023, as we aim to better serve the needs of larger enterprises. Total headcount increased by 38% YoY to 8,152.

Revolut also developed new local features across key European markets:

. IBAN: The company expanded local IBAN offerings for retail customers in France, Ireland, Spain and Netherlands.

. Credit: Personal loans were launched in France, Germany, Spain as well as credit cards in Ireland and Spain.

. Savings & Funds: Money Market Funds was launched across 22 countries in the EEA with balances reaching nearly $1.9bn (£1.5bn) since launch

2024 outlook

Continued customer growth: As of June 2024, Revolut has reached 45m customers globally, representing an increase of 7m in the first 6 months of the year. The company is on track to surpass 50m customers by the end of FY24.

In Romania, the retail customer base increased by 13% in the first 6 months this year, compared to the similar period of 2023, and will soon surpass 4 million clients. The deposits held by retail and business customers have increased by 22%, since the beginning of the year.

Expanding products and features: In addition to launching its existing suite of products in more markets, in the first six months of 2024, Revolut has launched:

1) eSIMs: Allowing customers to buy phone data packages through the Revolut app, signifying our push into non-banking services (available in the UK and select EEA markets).

2) RevPoints: Revolut’s loyalty programme – available in select markets – which enables customers to earn points on everyday spend (available in select EEA markets).

3) Revolut Robo-Advisor: A semi-automated tool that uses algorithms to manage investment portfolios, allowing customers to invest in a diversified tailored portfolio without spending hours on research and continuously managing their portfolios available in the US and EEA).

4) Refinancing credit and in-house savings accounts: In Romania, Revolut launched, in global premiere, the personal loan refinancing facility. The company continued to work to expand its product portfolio with interest-bearing accounts and trading functionalities, with the end goal of becoming the primary account of choice for its users in the country.

New Global HQ: Revolut announced a deal to move its global HQ to the YY building in Canary Wharf. The move will help facilitate the future growth of Revolut’s UK and global operations.

The 2023 Annual Report can be viewed online or downloaded in pdf format here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: