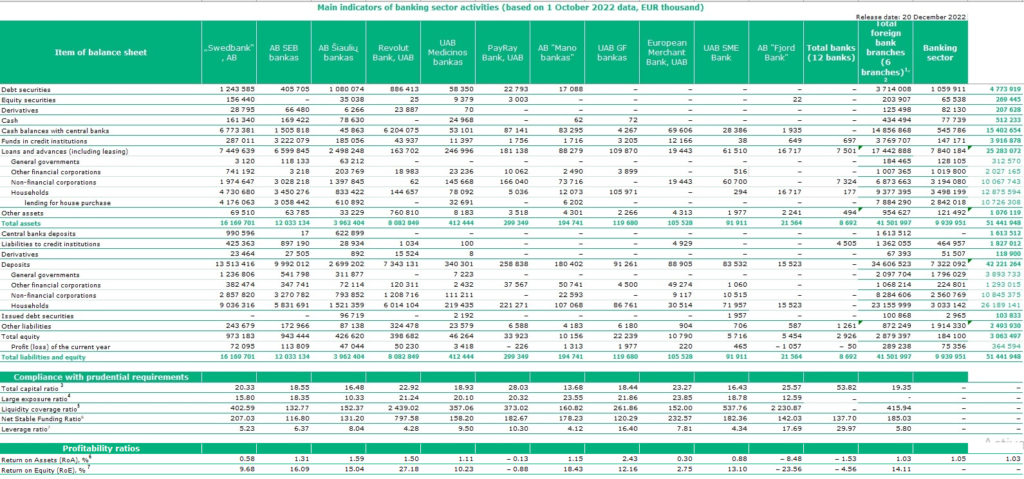

Revolut was recognised by the Board of the Bank of Lithuania as a „systemically important institution”

Revolut Bank – UAB reported EUR 8.1 billion in assets at the end of Q3 2022, ranking among the top 3 Lithuanian banks based on the value of total assets. Moreover, in terms of profitability ratios, Revolut Bank – UAB has a return on equity (RoE) of 27.18%, the highest level in the Lithuanian banking system, and the second level of return on assets (RoA) ratio with 1,50%.

For the first nine months of 2022, Revolut Bank – UAB reported a net profit of EUR 50 million, the third best performance on the market.

„The reorganisation of the Revolut Group and its consolidation into a bank had a significant impact on the banking sector’s performance (assets, deposits and other indicators)”, says Central Bank of Lithuania. At the end of December, it was recognised by the Board of the Bank of Lithuania as a systemically important institution.

13 banks in Lithuania currently hold a banking or a specialised bank licence, while six banks operate as a foreign bank branch.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: