Revolut still the worst UK firm for fraud complaints, warns Which?

Revolut has once again recorded the highest number of fraud and scam complaints escalated to the Financial Ombudsman Service (FOS). Data exclusively obtained by Which? reveals that fraud complaints from customers of the e-money provider continue to outstrip all banks, as they did in 2023.

Authorised push payment (APP) fraud complaints

In the 2024 calendar year, Revolut customers referred a mammoth 3,242 APP fraud complaints to the FOS, while the rest of the top three was made up by Monzo (2,344 complaints received) and Barclays (1,704).

The data covering 2025 to date paints a very similar picture, although Monzo and Barclays have switched places.

To appreciate the difference in scale, you should know that, while digital rivals Monzo and Revolut have rapidly grown their UK customer bases to more than 13 million and 12 million respectively, Barclays still dwarfs both, with more than 20 million retail customers in the UK (a figure which combines its personal, business and Barclaycard customers).

Monzo has the highest uphold rate of 41% in 2025 – this is the percentage of complaints where the FOS found in favour of the customer – indicating its customers were the most likely to have been wrongly denied reimbursement.

The table shows the top 10 firms for APP fraud complaints referred to the FOS so far in 2025, along with their uphold rates.

Other fraud and scam complaints

In 2024, the FOS received 2,631 other fraud and scam complaints (not APP fraud) from Revolut customers. The rest of the top three was made up by Monzo (with 1,810 complaints) and Barclays (1,461).

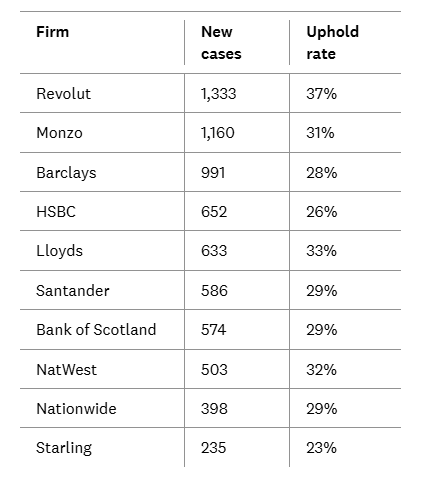

The same firms are set to be the worst in 2025, according to data covering the first eight months of the year. Revolut also has the highest uphold rate of 37% for non-APP scams and fraud.

The table shows the top 10 firms for non-APP fraud and scam complaints referred to the FOS in the first eight months of the year, alongside their uphold rates.

____________

APP fraud involves a customer being tricked into sending money to a scammer by bank transfer. In contrast, unauthorised fraud involves criminals stealing money by hacking into accounts, using stolen card details and committing identity fraud.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: