Revolut Junior change to Revolut <18 – accounts can only be created for children aged between 6 and 17. With over 1.6 million customers globally, Revolut Junior had over 350,000 customers in Britain alone, all of whom are now Revolut <18 customers.

Why did Revolut Junior change to Revolut <18?

Revolut says that „Teens asked for more of the main Revolut app and a different design, so we set to work on a fresh new look for Revolut Junior. Revolut <18 has all the features you know and love, plus some brand new ones like customizable cards and payments between friends on Revolut <18. Their app has a new cleaner screen that’s easier to navigate, and there’a a new customisable spending card available.„

What’s Revolut <18, and who can create an account?

Revolut <18 accounts are made for kids and teens, connected to their parent’s Revolut account, and can hold one currency only. It’ll be the base currency of your Revolut account when you created the Revolut <18 account and, at the moment, you can’t change it.

„We’ve created Revolut <18 because we want to help teens manage their money and we want them to create habits that’ll be helpful at any time of their lives,” the company says.

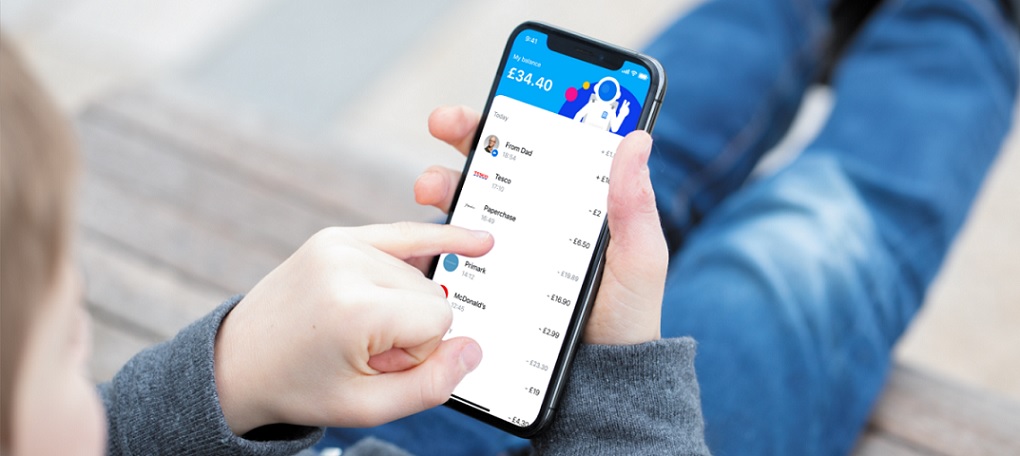

As a parent, you can set up a Revolut <18 account for your child and order a Revolut prepaid card for them, all within your Revolut app. Your child or teen can then spend the money you make available to them, and use the Revolut <18 app to check their balance and transactions. They can also access money management tools tailor-made to their age.

What’s the Revolut <18 app designed for?

The Revolut <18 app focuses on enabling your teen to learn money management skills. They’ll initially be able to view their balance and transactions, request money to the Lead Parent, and initiate Instant Payments to their Revolut <18 peers.

If they don’t have a phone or can’t use the app, they can ask you, as you’ll have access to their balance and transactions from your own Revolut app. You just have to use the „<18” tab of your Home screen.

Over time, we’ll be adding new features such as the ability to put money aside for special occasions or access to simple account analytics.

Parent control

As a parent, you have access to your kid’s balance and transactions. If you’ve enabled push notifications for your transactions, you’ll also receive instant notifications when your kid is spending money.

If something looks odd, open your child’s profile in your Revolut app, tap on their card and open the PIN & Security menu. You can then enable or disable swipe payments, contactless payments, online transactions and ATM withdrawals. You can also set a monthly spending limit: go on your child’s profile, tap on their card, select “Settings” and then “Spending limit”.

Your kid won’t be able to change these settings from the Revolut <18 app.

You’re always in control of the balance available to your child and they won’t be able to spend more than they have available on their card.

Revolut <18 accounts can only be created by a parent or legal guardian residing in Europe, Australia or the US. Revolut <18 will be rolled out to more countries very soon, so stay tuned!

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: