Revolut on the hunt for acquisitions. UK fintech plans to use recent $500m fundraising to buy rivals hit by coronavirus pandemic.

British fintech Revolut is looking to use some of the proceeds of its recent $500m fundraising to buy rival technology companies that have been hit by the coronavirus pandemic.

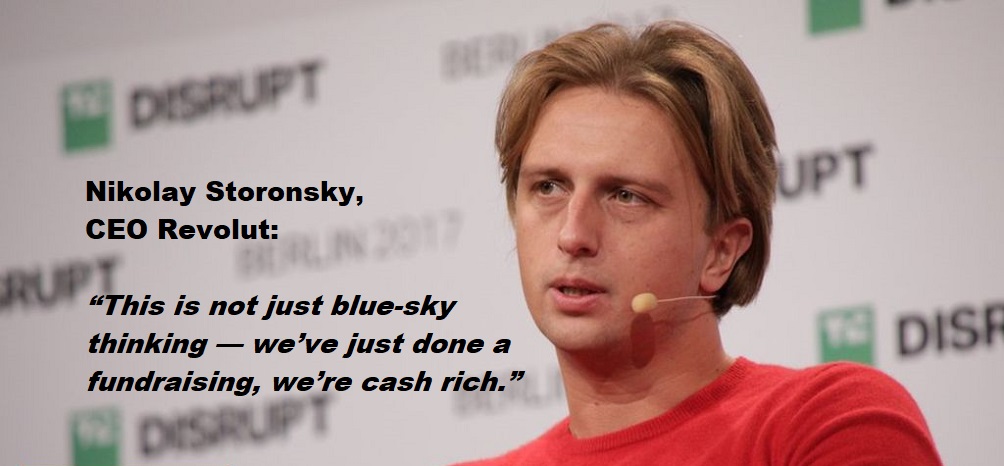

Nikolay Storonsky, chief executive, told the Financial Times that Revolut had “a real opportunity” to benefit from the crisis, despite suffering a substantial hit to its revenues as lockdowns around the world caused a drop-off in card transactions.

Revolut launched five years ago as a prepaid debit card that allowed customers to avoid foreign exchange fees while travelling. Since then it has expanded into areas ranging from cryptocurrency trading to business banking.

Mr Storonsky said he was now looking to build on Revolut’s roots as a card for travellers, by targeting deals in areas such as travel aggregation, which would allow customers to buy flights or rent cars through the Revolut app when travel restrictions are finally lifted.

“A lot of travel aggregators are in trouble at the moment — we could probably purchase one and sell flight tickets at cost and be 10 to 15 per cent cheaper than everyone else,” he said.

Revolut recently appointed Don Hoang, a former Uber executive, to lead its dealmaking efforts. Mr Storonsky added: “This is not just blue-sky thinking — we’ve just done a fundraising, we’re cash rich.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: