Revolut has announced the launch of Open Banking for its more than one million customers in France, according to thepaypers.com.

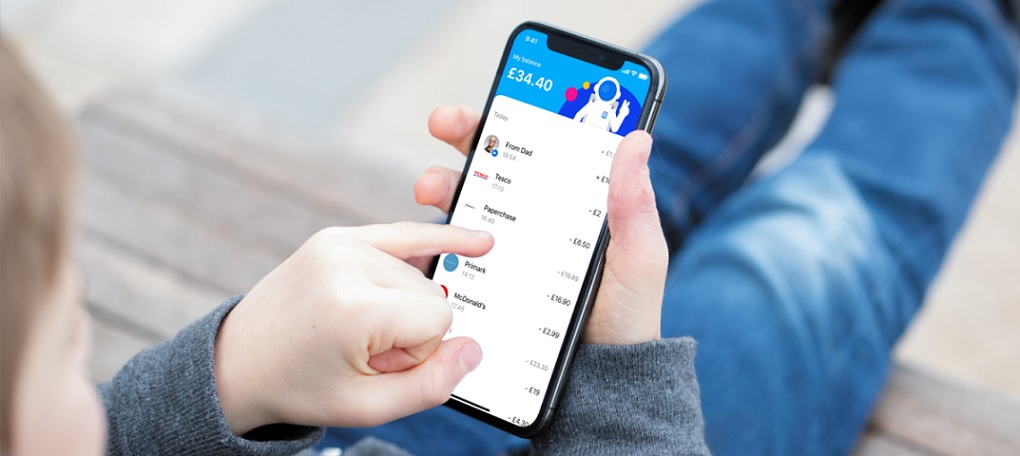

The new Open Banking feature allows Revolut’s retail customers to connect their Crédit Mutuel, Caisse d’Epargne, Banque Populaire, Crédit Agricole, Société Générale, BNP Paribas and Hello Bank! bank accounts to Revolut, allowing them to view all their balances and transactions in a single app.

Revolut allows customers to authorize the presentation of their transactions from a French bank account in the Revolut application via that bank’s secure Application Program Interface (API).

Once they have given their consent to Revolut, the fintech can request accounts information from the customers’ external banks and display it in the Revolut app.If Revolut’s clients have access to their French bank’s app, Revolut will communicate directly with the external bank’s app in order to retrieve balances, transactions and expenses.

If a customer does not have access to his bank’s app, he will be asked to connect to the bank’s online banking service. At no time during this process does Revolut have access to the customer’s login information on their external bank account, securing the entire interaction.

In the near future, Revolut also plans to allow French customers to top up their accounts directly from one of the linked external accounts.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: