According to Revolut research done in January 2023, 58% of Europeans prefer to use an exclusive (32%) or complementary (26%) joint account to manage expenses with a partner. Joint Accounts is part of new 9.0 version of the app, which also features multiple UX upgrades like customisable home screen shortcuts and a group version of Revolut Chat.

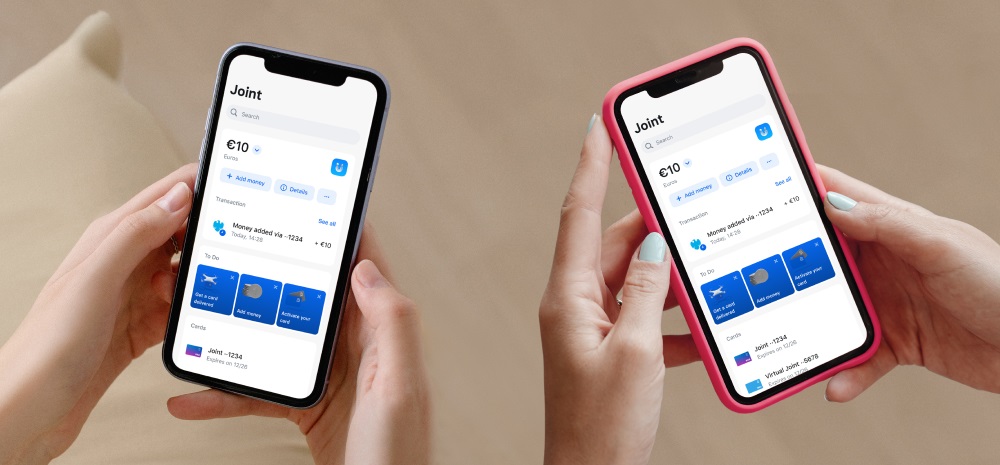

Revolut released today its new 9.0 version of the app including the new shared banking product Joint Accounts for the EEA. Joint Accounts allows customers to create an extra account within the Revolut app to be jointly owned by two people – whether they are partners, family members or friends. The 9.0 UX upgrade is available for both iOS and Android and also includes the group version of the instant messaging tool Revolut Chat. The new suite of products is available now across all EEA markets.

Sharing life with Joint Accounts

Revolut Joint Accounts is all about flexibility and inclusion, as it suits the needs of different types of people and relationships. In order to set up shared accounts, customers do not have to explain who and why, nor prove they live together. Joint Accounts along with Revolut <18 can become a centre of family finance, but they can equally be used by all types of duos, whether that be partners, siblings, roommates or friends.

According to a survey recently carried out by Revolut, 58% of Europeans were keen to use a joint account to manage their expenses with a partner. 32% of them preferred to use it exclusively, as their only account, while 26% as a complementary one to their private ones. The remaining 33% preferred to keep their accounts and budgets separate. Interestingly, 5% said they don’t even talk about money with each other, as they don’t want to mix finance and love. 4% didn’t have a clear opinion on the matter.

When asked how they split costs with their partner, the most popular answer was 50/50 (36%) – although 22% of respondents said that one person in the duo would pay more or less, depending on their income. 7% were more specific indicating one partner pays for the rent, while the other for bills and groceries. 4% opted for a set-up where one partner pays for all expenses, because they earn significantly more. 1% confirmed that the party who is covering expenses/rent are their parents. 24% said they don’t care or there is no rule. 6% didn’t know.

Chat, split, and settle bills with Group Chats

In November 2022, Revolut launched its instant messaging feature Chat, where Revolut customers globally can chat as well as share fun gifs and stickers whilst sending and requesting funds to and from other customers. With the latest 9.0 update, Revolut introduces Group Chats.

The new feature allows several people to discuss and clarify payment details within the app, rather than having to swap between different messaging apps to send or receive funds – staying true to the mission of offering a service that addresses all things money in one place.

Designed with a focus on security, all chat messages have end-to-end encryption. Customers are able to opt out of the chat function should they not want to use it, and they can either enable or disable it completely in the ‘Security & Privacy’ section.

What’s new in Rev 9.0?

Home screen shortcuts: customers now have the ability to customise their app experience with the introduction of new widgets that they can mix and match on their Home screen.

UX: 9.0 is addressing hundreds of UX and performance topics flagged by customers as potential friction and barriers to take desired actions. Revolut gathers feedback from customers on an ongoing basis, which later turn into numerous upgrades.

Group Chats: customers now have the ability to chat with other group bill participants to discuss and manage anything and everything specific to their shared expenses.

Joint Accounts: EEA customers now are able to open a joint account with whoever they want (as long as they have an account serviced by the same entity), whether it is a partner, friend or someone else, tailored to their own specific needs.

Dmitry Zlokazov, Head of Product at Revolut:

“The advanced customisation options and streamlined UX make it even easier for customers to navigate through favourite features and products. I’m also particularly glad to see that Revolut is becoming even more social and inclusive, suiting the needs of different people, relationships and budgets. Both Joint Accounts and Group Chats will help to easily sort out money matters with whomever we share our financial life – blending the best of existing social and banking features”.

Over the years, Revolut has become one of the biggest financial communities of the world, with multiple features specifically created to be used with other people and to make daily banking faster and easier – such as Group Bills, Revolut Chat, Revolut <18, Group Vaults and hassle-free p2p payments.

To open joint accounts both parties need to be Revolut customers and have the app updated to the version supporting the Joint Accounts feature. Also, both persons need to share the same country their personal accounts were registered in, the same Revolut entity or branch (personal accounts registration entity) and they cannot be a part of another Revolut Joint account (or have a pending invite for a Revolut Joint account from someone else). For more information about Joint Accounts, please check this dedicated page

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: