Revolut launches eSIM, „a seamless way to avoid unexpected roaming charges” – says the company

Revolut becomes the first financial institution in the UK to launch eSIM, offering a cost-effective way to access data plans without unexpected roaming charges in over 100 countries. Connecting the eSIM enables customers to use the Revolut app without using up their mobile data allowance. This means if customers run out of data on their eSIM, they can still access the app to top up.

Revolut, the global financial app with over 35 million customers worldwide and 8+ million in the UK, becomes the first financial institution in the UK to offer eSIMs and global data plans to its UK customers. „Revolut eSIM allows customers to roam like a local, and stay connected without unexpected roaming charges and interruptions.” acording to the press release.

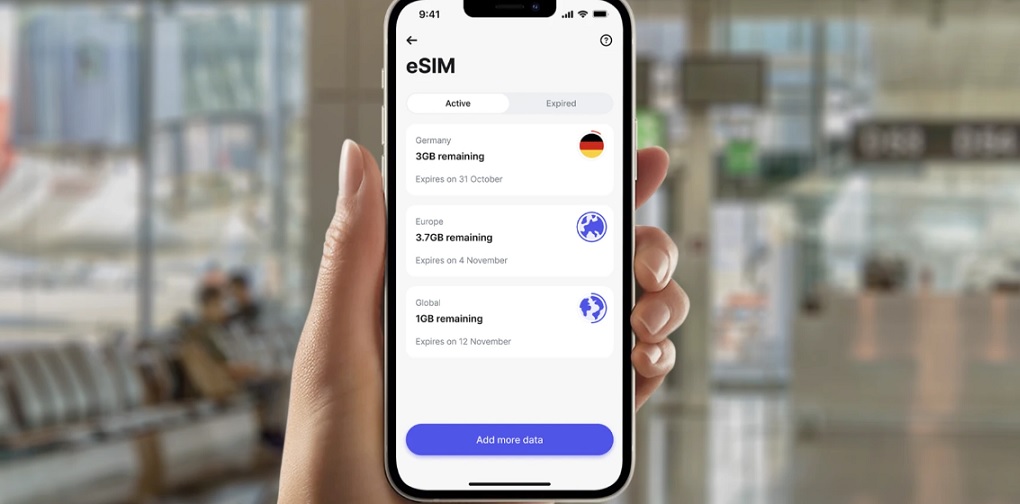

Available to UK customers later this week, Revolut customers on eSIM compatible devices will have access to the eSIM, regardless of their plan. „Once installed, customers will be able to top up data wherever they go – without any need for a physical SIM. Connecting the eSIM enables customers to use the Revolut app without using up their mobile data allowance – so if a Revolut customer lands in a country and doesn’t have data access, they can still access their Revolut app and use all the products and features, including topping up their data if they run out.” the company explains.

With the eSIM installed via the Revolut app, Ultra customers will gain access to a new benefit as part of their plan – 3GB of mobile data to use globally, with a rolling refresh every month. UK customers who install their new eSIM by 1 May 2024 will also be able to take advantage of an introductory offer of 100MB of global data at no cost (terms and conditions apply).

The cost of using mobile data overseas has increased in recent years. Most UK mobile networks no longer allow their users to „roam like at home” in the EU, and data charges for the rest of the world are almost always outside the standard benefits.

Elyas Sadou – Product Owner of eSIM at Revolut, commented: “At Revolut, we harness technology to simplify our customers’ lives, and that’s precisely what our eSIM accomplishes. It offers seamless access to mobile data, eliminating the inconvenience of high prices or the need to buy and organise a physical SIM card.’

Whether you are in the US, Australia or Egypt, you can effortlessly secure a data plan with just a few taps on your phone, and then instantly share those breathtaking photos of your trip with friends and family. It’s a game-changer for people who love to travel.”

The launch of eSIM ensures travellers are supported by Revolut from the very beginning of their trip through to the very end. From booking accommodation through Stays, to enjoying lounge access at 1,000+ airports, as well having peace of mind with emergency medical and dental cover for Premium, Metal and Ultra plans (Insurance T&Cs apply, Paid Plan terms and subscription fees apply). Customers can then take advantage of Experiences for tours and attractions, as well as spend like a local with currency exchange at competitive rates in 30+ currencies. „Now with eSIM, customers no longer have to worry about extortionate roaming charges.” – the company concludes.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: