Revolut is introducing Wealth Protection, a new biometric identification feature to protect customers from pickpockets and phone snatchers

Revolut’s Wealth Protection is launching this month ahead of a busy summer season for travel and festivals, where consumers are often at a higher risk of phone theft Revolut will be one of the first to implement this feature. More customers than ever before are using Revolut’s savings accounts and features. On average, customers hold 2.6x more money in their savings vs current account.

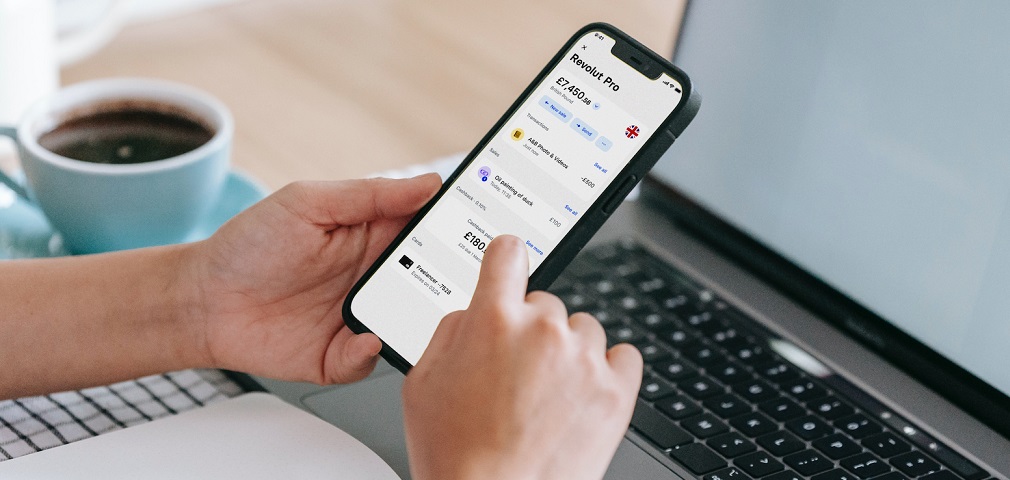

Revolut, the global fintech with over 3.5 million customers and 40 million globally, is introducing Wealth Protection, an extra layer of in-app identity verification, designed to prevent thieves from accessing customer savings within the Revolut app. Wealth Protection will help protect customers who have had their unlocked phone stolen, or password and face recognition compromised, and stops criminals from withdrawing customers’ hard earned savings out of their accounts.

Many banking apps rely on just one biometric authorisation (like facial or fingerprint recognition) built into mobile devices, usually when opening the app, which is then completely vulnerable if a pickpocket gains access to the device and changes the registered fingerprint or image to their own.

„Revolut is going one step further with its advanced facial technology. When turned on, Wealth Protection will verify the identity of the user against the selfie ID checks that the customer completed when first signing up to Revolut, helping to stop fraudsters transfering money out of their savings accounts, even if their phone security has been compromised. The feature, which requires customers to opt-in, can be turned on for Savings, Stocks, Commodities accounts (‘pockets’) and many more.” – the company explained.

Revolut will be one of the first to implement this feature and is doing so ahead of a busy summer travel and festival season, bringing with it greater risk for theft at large-scale events and crowded tourist hotspots. Physical theft was responsible for 38% of all unauthorised fraud losses and 69% of the total lost amount represented theft, in 2023. In London, for example, a phone is stolen every 6 minutes[1].

Customers are also at a heightened risk of ‘shoulder-surfing,’ where fraudsters first identify phone and banking-app passwords and then use this to bypass security measures, as well as having their phone taken whilst unlocked.

Woody Malouf – Head of Financial Crime at Revolut, commented: “We take fraud and the financial loss incredibly seriously. With phone thefts on the rise, Wealth Protection has been built to counteract theft by providing our customers with that extra layer of security when you’re out and about this summer. Our customers will be able to rest easy knowing that even if their phone is lost or stolen, their hard earned savings are more secure.”

In 2023, Revolut prevented over £475M of potential fraud against its customers and is consistently working on updating protections to stay one step ahead of fraudsters

[1] Evening Standard, 2024, https://www.standard.co.uk/news/crime/mobile-phone-thefts-robbery-london-police-crime-b1073286.html

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: