Revolut is Europe’s most popular digital banking app. JP Morgan’s Chase bank is currently the fastest-growing banking app in Europe.

Customer acquisition has been the holy grail for European banking apps. But who’s coming out on top?

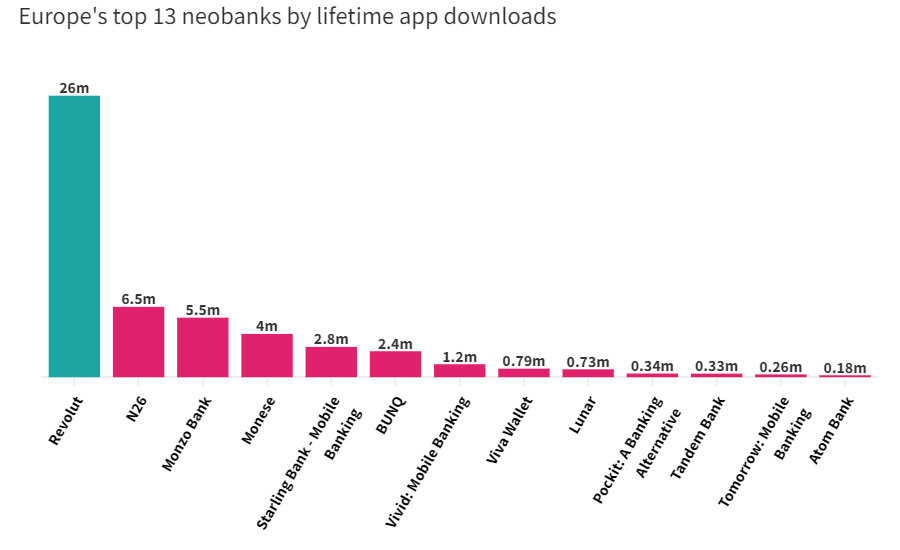

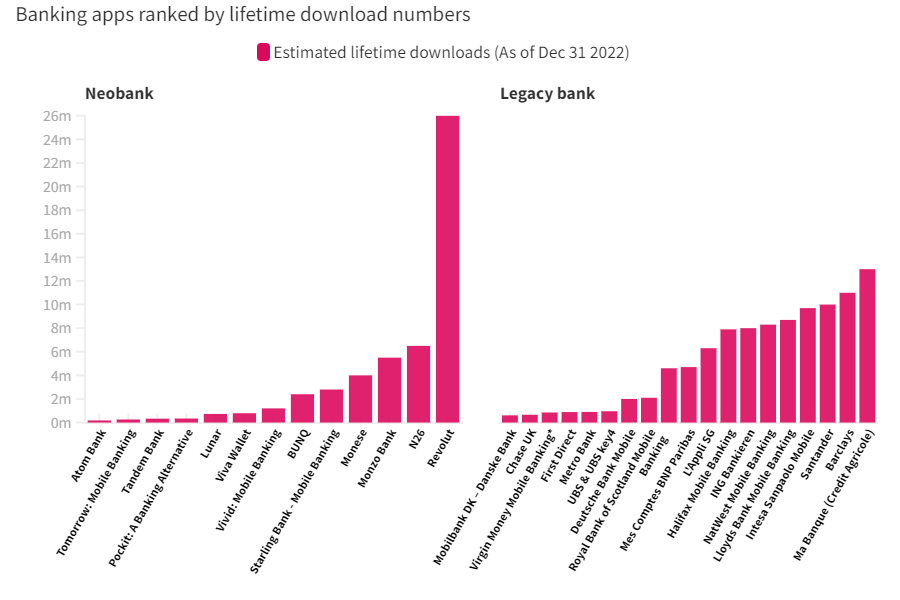

App Radar analysed how many downloads Europe’s top neobanks and legacy bank apps attracted between 2021 and the end of 2022 using data from the Google Play Store. Apple’s App Store data hasn’t been included.

Since launching in 2015, Revolut has recorded 26m app downloads, according to Sifted.eu. Revolut operates in more than 200 countries globally, and N26 operates in 21 countries across the Eurozone. This is a big contrast with Starling, which only allows UK residents to open accounts, and Monzo, which only launched in its second market, the US, in February last year.

Revolut still comes out on top for most downloads when you include legacy banking apps. But legacy banks’ apps have far more lifetime downloads than other neobank competitors. According to the data, Credit Agricole has clocked up 13m lifetime downloads, Barclays has 11m, Santander has 10m and Intesa Sanpaolo has 9.7m.

Data shows that legacy banks are beginning to close in on their digital-only peers when it comes to the rate of growth for the user base of their own digital offerings.

Although legacy banks have a larger general market share than neobanks this growth shows that they’ve not grown stale in customers’ eyes, says Silvio Peruci, managing director at App Radar.

“Legacy banks’ gains point to the fact that they are steadily adding new younger customers or converting existing customers to mobile banking,” he says.

“With the ongoing cost of living crisis, in 2023, both sides of the market will have to zero in on their user acquisition strategy, with innovative functionality and smart marketing techniques to attract and retain users.”

More details here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: