Revolut enters the travel insurance market with a global first pay-per-day geolocation service

Fintech startup Revolut is launching international medical and dental insurance. You can subscribe using the company’s app for £1 per day or more depending on the options. But the best part is that you can set it up and forget about it as Revolut uses your device’s location data to automatically turn insurance coverage on and off.

By default, insurance coverage costs £1 per day for medical and dental insurance. You can add an option for winter sports and you can also cover your friends and family. But if you’re always on the road and tend to spend weeks or even months abroad, Revolut is going to cap its travel insurance after a certain amount of time. You can also pay a fixed upfront price for an annual policy.

Revolut isn’t becoming an insurance company. Just like with its mobile device insurance product, the startup is working with third-party insurance companies. This time, Thomas Cook Money is in charge of the travel insurance product. It’s also worth noting that Revolut Premium includes travel insurance.

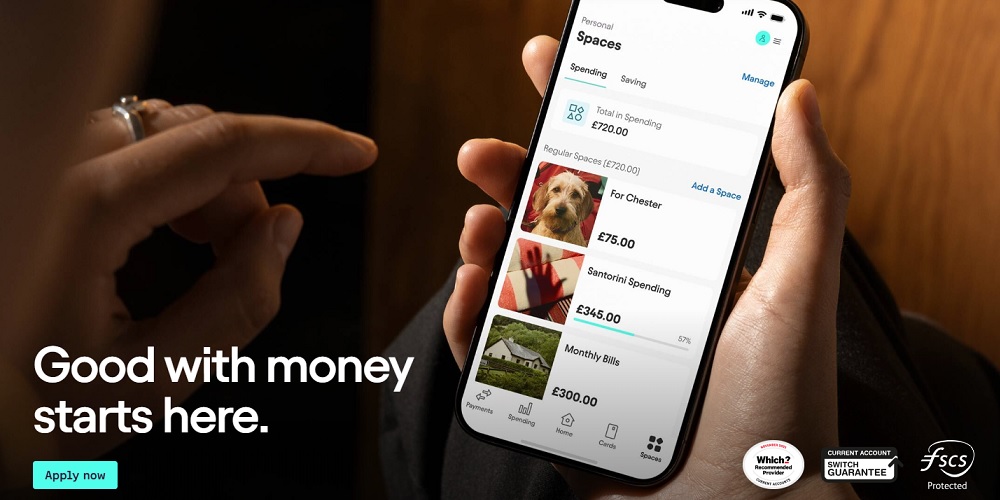

Revolut is slowly building an insurance hub to control all your insurance needs from the company’s app. And this is smart as Revolut just has to take a bit of money from your Revolut balance. It feels like you’re not spending any money because you don’t need to enter your card number.

Nikolay Storonsky, CEO and Founder of Revolut said: “This is a global first – Pay-per-Day travel insurance which leverages the power of your phone to save you money. We wanted to create a type of insurance that uses technology to help our customers and only cover you on the days you actually needed to be covered – all for the best price. Pay-per-Day travel insurance is a global first, and is another step in our journey to build a platform to offer a better kind of banking.”

Anth Mooney, CEO of Thomas Cook Money said: “Partnering with innovative fintech and traveltech companies is an important part of our strategy. We want to help more people have better holidays by making sure everything to do with their holiday money is looked after at every step – and improving the experience of buying travel insurance is an important part of that. You need strong alliances to start a revolution, and Revolut are making great strides in disrupting the traditional finance industry – we’re proud to be a partner and friend to Revolut, who share our simple vision of making things much better for customers.”

Revolut, launched two years ago, allows customers to set up a current account in 60 seconds, exchange currencies at the interbank exchange rate, transfer in 25 currencies to any bank in the world, and spend fee-free in 130 currencies with a contactless MasterCard.

The startup has been releasing new features at an impressive pace. The service is now much more than a simple prepaid MasterCard with a foreign exchange feature. You can now trade cryptocurrencies in the Revolut app, receive money on your own IBAN, ask for a credit line and more. It’s becoming a serious banking alternative.

Source: techcrunch.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: