UK challenger bank Revolut has enabled instant transfers in Euros for business account holders to bolster customer payments to European bank accounts.

The bank will accelerate money transfers from Revolut business accounts to other bank accounts in Europe. This is applicable to the banks in Europe that support instant transfers.

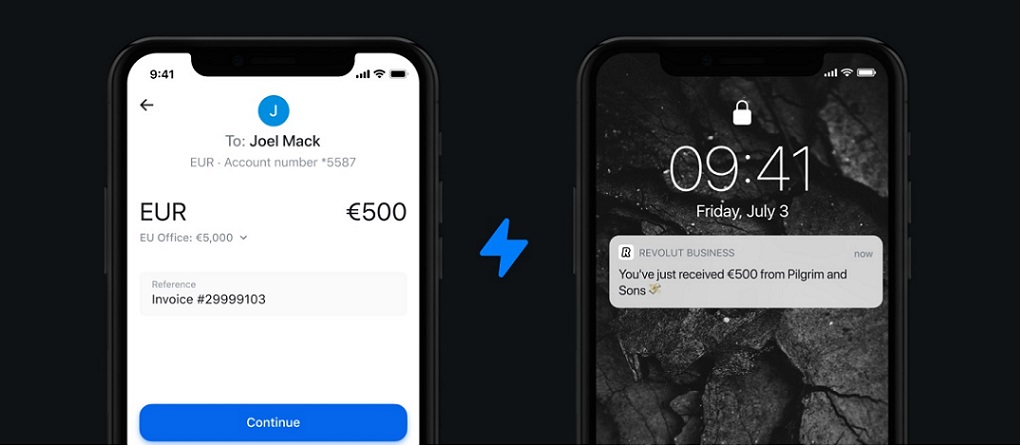

„Now, when you send or receive a EUR transfer from your Revolut Business account to another bank account in Europe, the money will arrive within seconds, as long as the other bank also supports Instant transfers,” Revolut said in a blog post.

Revolut said that customers can log into their accounts online and initiate transfers with a single click.

Account holders need to choose or create a beneficiary, enter the amount, confirm the payment details, and hit ‘send funds’ to complete the payment process.

While receiving the money in Euro currency, customers will need their International Bank Account Number (IBAN).

Context

Over the past decade, the Euro Retail Payments Board (ERPB) has made a number of important improvements to the way businesses and individuals can transact within the European Economic Area. One of these is the instant payments scheme, introduced in 2017 – it helps payments reach their destination more quickly via the Single European Payments Area (SEPA).

In layman’s terms, this system provides one, pan-European infrastructure for all payments to move through, which saves time. Typically, SEPA transfers take 1 to 2 business days to arrive. However, with SEPA Instant Transfers, that time is reduced to 10 seconds or less.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: