Revolut customers globally will be able to generate tax reports for any taxable events related to the crypto-assets held within the app as well as in other wallets and trading platforms

This third-party service, provided by Koinly, a global crypto tax service, „will enable Revolut customers to access our partner’s smart solution designed to simplify the tracking of information needed to generate tax reports from trading crypto and facilitate compliance with any tax obligations that may arise” – according to the press release.

The taxation of digital assets, including income from trading cryptocurrencies, will be a topic extensively analyzed at the Banking 4.0 – blockchain international conference. Reserve your place!

„The partnership between Revolut and Koinly makes tax reporting less stressful and time-consuming as well as more accurate compared to manual calculations. It is not only easy to use, but also enables a consolidated report that integrates the crypto assets and trading activities held with other platforms. The selected partner has the expertise to generate reports integrating transactions with 1,700+ tokens, 170+ supported blockchains, 100+ wallets and is available in 34 markets.” – Revolut explains.

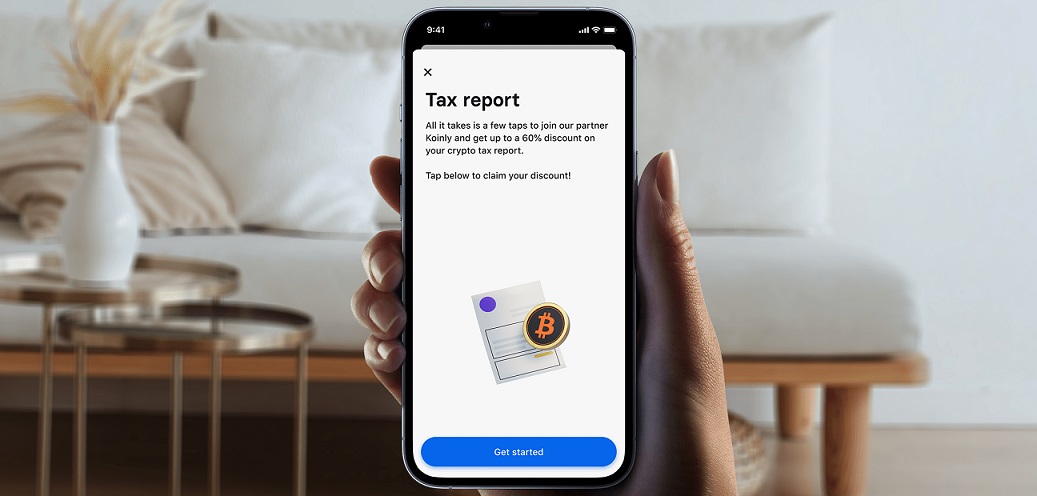

The feature is accessible in the Crypto section of the Revolut app. The customer must click on the link to Koinly’s platform and complete the sign-up process through SSO (Single Sign-On). After synchronising the transactions made through Revolut, the customer will have to review the reported transactions and, at check-out, will be informed of the cost of the service.

The final price paid by a customer will vary depending on the number of crypto transactions done with Revolut or other crypto platforms selected by the customer, including a discount of up to 60%. Once the report is paid for, and downloaded, the customer will be able to use it to complete their tax filings with the relevant tax authorities of their jurisdiction.

Revolut’s Global Business Head of Crypto, Mazen Eljundi, said: “Filing taxes for cryptocurrency and other digital assets is a challenge for many of our customers. We searched for a solution that would seamlessly track, consolidate, and generate a tax report in a matter of minutes, in order to meet our customers’ needs. We are confident that the crypto tax service offered through our partnership with Koinly will make this legally required activity easier, less stressful, and more accessible to all. (…) This is a significant step towards empowering Revolut customers to meet their tax obligations”.

Koinly’s Global Head of Partnerships, Jane McEvoy, said: „We are absolutely thrilled to join forces with Revolut, marking our collaboration with a leading global financial superapp. Revolut has made substantial strides in enhancing its cryptocurrency offerings, and we are proud to become their exclusive tax partner – a move that further bolsters their already robust value proposition. Revolut users can now effortlessly access Koinly directly through the Revolut app, streamlining the process of calculating their crypto taxes.”

___________

Currently, Revolut customers can buy and sell tokens from a portfolio of 100+ cryptocurrencies or they can test and trade 12+ Crypto Collections, moreover they can use the app to increase their knowledge of crypto, with Learn & Earn. The third-party tax reporting service will complement the diverse offer proposed by Revolut to millions of customers all over the world. (Note: availability of features and tokens varies by region).

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: