Revolut CEO eyes expansion into mortgages, BNPL & crypto wallets

Digital banking platform Revolut is working on expanding into decentralized cryptocurrency wallets and is also looking at the mortgage sector.

Revolut, which currently offers payments services, crypto trading, savings accounts and stock trading, is focused in the short term on expanding its remittance offerings and launching a buy now, pay later product, according to Reuters.

But the financial technology company has more to do to become a one-stop shop fo financial services.

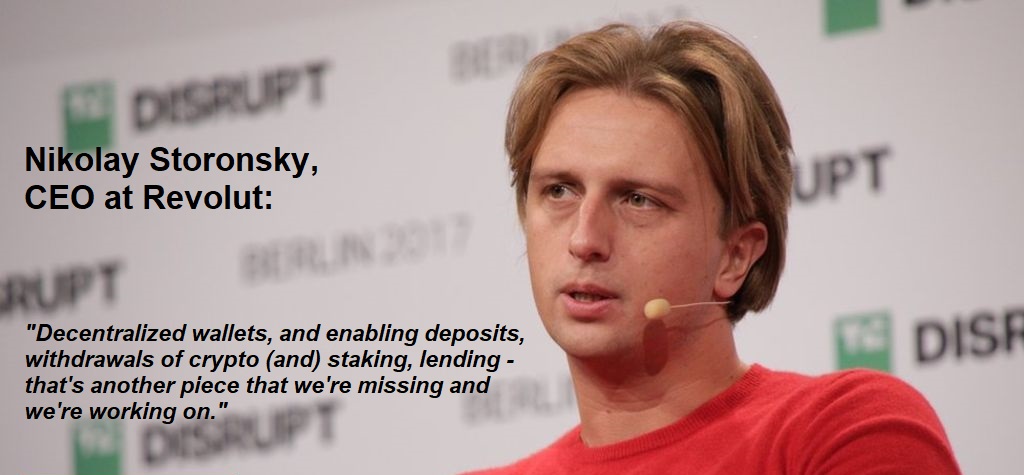

„For example … decentralized wallets, and enabling deposits, withdrawals of crypto (and) staking, lending – that’s another piece that we’re missing and we’re working on,” said CEO Nik Storonsky.

He added that it’s also important for the company to consider expanding into mortgages, since home loans „are quite an important part of consumer financial life”.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: