Revolut becomes the first digital-only bank in Romania to launch eSIM, „a seamless way to avoid unexpected roaming charges”. Once installed, customers will be able to top up data wherever they go – without any need for a physical SIM.

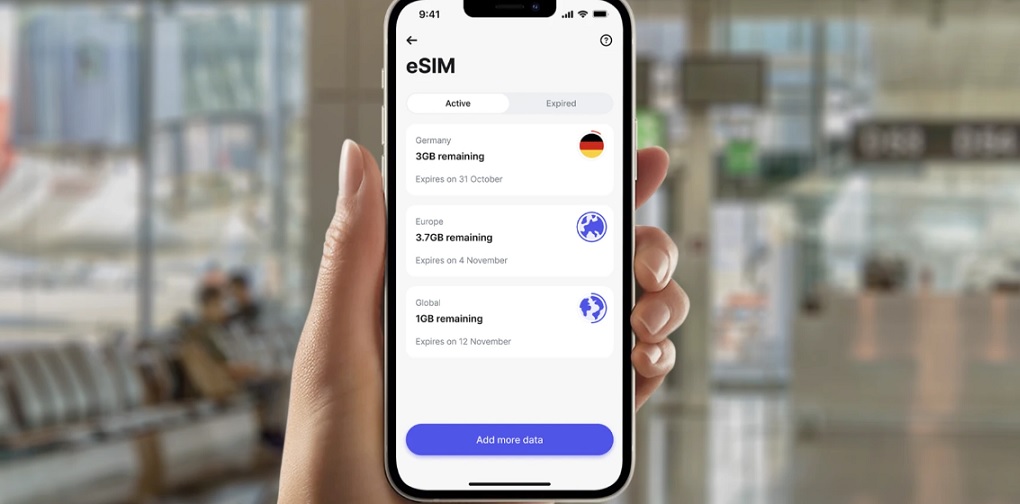

Revolut says it became one of the first digital-only banks in the Economic European Area (EEA) and the first in Romania to launch eSIM, offering a cost-effective way to access data plans without unexpected roaming charges in over 100 countries. From March 25th, 2024, 3.5+ million retail customers in Romania will be able to install a single eSIM fully digitally, which they can top up in just a few clicks in their Revolut app whenever they need. The eSIM can be used simultaneously while having a physical SIM, „allowing customers to switch easily between networks and never worry about roaming charges again„.

Revolut, the global financial app with over 40 million customers worldwide and 3.5+ million in Romania, becomes the first bank in the local market and one of the first digital banks in the EEA to offer eSIMs and global data plans to its customers. Revolut eSIM allows customers to get mobile data abroad, and stay connected without unexpected roaming charges and interruptions.

Available from March 25th, 2024, all Romanian Revolut customers on eSIM compatible devices will have access to the eSIM, regardless of their plan – Standard, Plus, Premium, Metal or Ultra. Once installed, customers will be able to top up data wherever they go – without any need for a physical SIM. Connecting the eSIM enables customers to use the Revolut app without using up their mobile data allowance – so if a Revolut customer lands in a country and doesn’t have data access, they can still access their Revolut app and use all the products and features, including topping up their data.

With the eSIM installed via the Revolut app, Ultra customers will gain access to a new benefit as part of their plan – 3GB of mobile data to use globally, with a rolling refresh every month.

The cost of using mobile data overseas has increased in recent years. Most EU mobile networks no longer allow their users to „roam like at home” in the UK, and data charges for the rest of the world are almost always outside the standard benefits.

Elyas Sadou – Product Owner of eSIM at Revolut, commented: “At Revolut, we harness technology to simplify our customers’ lives, and that’s precisely what our eSIM accomplishes. It offers seamless access to mobile data, eliminating the inconvenience of high prices or the need to buy and organise a physical SIM card.’

Whether you are in the US, Australia or Egypt, you can effortlessly secure a data plan with just a few taps on your phone, and then instantly share those breathtaking photos of your trip with friends and family. It’s a game-changer for people who love to travel.”

Hakan Koç – founder and CEO of 1GLOBAL said: ‘By joining forces, Revolut can leverage 1GLOBAL’s worldwide mobile network and market leading eSIM platform to enhance their own international technological infrastructure. 1GLOBAL provides quick and secure mobile network connectivity in over 160 countries worldwide. Our eSIM technology integrates seamlessly into the existing Revolut app and can be installed on any eSIM-compatible mobile device in less than a minute.’

The launch of eSIM ensures travellers are supported by Revolut from the very beginning of their trip through to the very end. From booking accommodation through Stays, to enjoying lounge access at 1,000+ airports, as well having peace of mind with emergency medical and dental cover for Premium, Metal and Ultra plans (Insurance T&Cs apply, Paid Plan terms and subscription fees apply). Customers can then take advantage of Experiences for tours and attractions, as well as spend like a local with currency exchange at competitive rates in 30+ currencies. Now with eSIM, customers no longer have to worry about extortionate roaming charges.

______________

eSIMs are compatible with the majority of 4G/5G Apple and Android smartphones, and are easy to install, with no need to download any additional apps or fiddle with a physical SIM.

The new product is available to all users on the latest version of the Revolut app version 10.14.

Prices per location for 1GB will start at RON5 with 100+ countries to choose from. There will be multiple data plans available to purchase which will range from 1GB up to 20GB, and customers will also have the option to choose from regional or global data plans to cover them across multiple countries with one plan.

______________

In 2015, Revolut launched in the UK offering money transfer and exchange. Today, more than 40 million

customers around the world use dozens of Revolut’s innovative products to make more than half a billion transactions a month.

Founded in 2022, 1GLOBAL is the new startup of Hakan Koç, co-founder and former Co-CEO of AUTO1 Group. 1GLOBAL acquired a group of telco assets operational since 2006, including an internationally-recognised, GSMA-accredited global mobile network. Headquartered in London, with an R&D hub in Lisbon, they have now grown to include over 400 employees across 12 countries and have been granted fully-regulated MVNO status in 9 of them.

As innovators in eSIM-based GSM mobile services, 1GLOBAL cater to both organisations and individuals with products including mobile call and SMS recording for businesses, remote SIM provisioning, IoT services, embedded telco services for tech companies, platforms and super- apps like Revolut and affordable roaming services for consumers.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: