Historically, efforts at payment infrastructure integration have been part of a broader regional economic strategy and benefited from strong support from the public sector. This has resulted in regional payment arrangements with an anchor in economic groupings.

Interlinking payment systems with new common platforms can support payment infrastructure integration across borders. These are not new concepts, but recent advancements in technology may increase the efficiency and decrease the cost of such arrangements.

Payment integration projects have different options in terms of the structure of and technical choices for cross-border arrangements, and the real world will be more complex than ideal-type models. Public and private actors can cooperate or develop competing systems. Ultimately, the level of fragmentation or integration will depend primarily on policy decisions rather than technology.

Over the past two decades, through a combination of digital innovations in payments and evolving end user needs and preferences, the regional integration of payment infrastructures has been expanding. This has enabled cross-border transactions for financial market participants or their customers, often between countries within a region. In some cases, this integration has spread across regions and even globally.

Payment infrastructure integration is not only the linking of payment systems from a technical standpoint. It is equally about defining a common operational framework for transacting, clearing and settling cross-border transactions, as well as a robust governance and oversight framework that upholds the high standards of safety and financial integrity. In view of this challenging task, not all payment integration projects have been (or will be) successful.

Several fast payment systems (FPS) that have become operational face some challenges in attracting participants and/or volumes even at a domestic level. Adoption of fast payments tends to be more widespread when the central bank owns the FPS. Publicly owned FPS may be designed to prioritise a public good perspective, aiming for open, inclusive and competitive payment markets.

A user-centric approach, addressing diverse needs such as domestic person-to-person (P2P) transactions, merchant payments and cross-border transactions is also important. The inclusion of non-bank providers may improve access for underserved customers. Cross-border functionalities can expand the utility of FPS beyond domestic transactions. Cheap and fast cross-border transactions can also broaden the access of firms to global markets. Keeping these features in mind may help build strong public infrastructures that are widely adopted and support policy goals.

Models of integration

Integrated payment systems can substitute for or operate alongside domestic payment systems and traditional back-end arrangements for cross-border payments such as correspondent banking4 and closed loop systems.

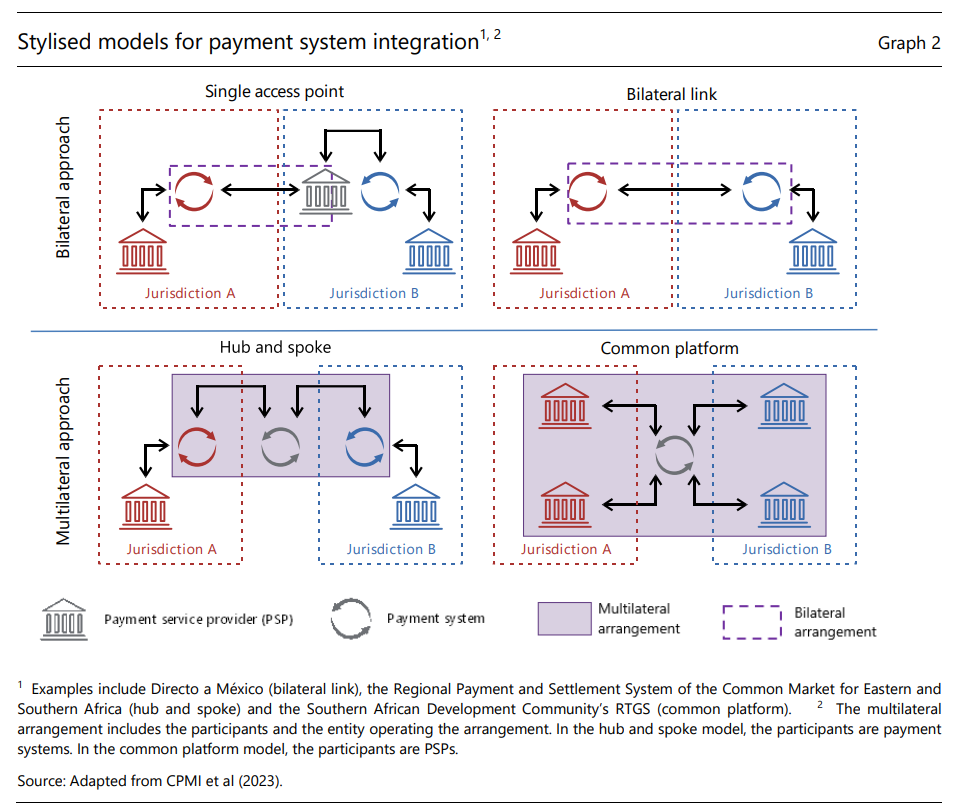

Generally, the processing of payments can be split into (i) the front end, in which end users interact with their payment service providers (PSPs) to initiate or receive payments, and (ii) the back end, in which the clearing and settlement of payments is supported by different arrangements. Payment system integration approaches can be classified into four stylised models (see Graph):

. In the single access point model, participants in one domestic payment system have access to a foreign system through a single entity that directly participates in the foreign system.

. In the bilateral link model, participants in the domestic system can directly reach all participants in the foreign system via the bilateral link instead of only through the single gateway entity.

. In the hub and spoke model, two or more payment systems (the spokes) link to a common intermediary (the hub).

. In the common platform model, participants can reach each other directly across borders on a single, integrated technical platform.

The hub and spoke and common platform models, referred to collectively as multilateral models, differ from each other in two notable ways. First, in the hub and spoke model, the domestic payment systems (the spokes) connected to the hub must adhere to the hub’s rulebook, but PSPs participating in the spokes may be bound by the hub’s rules only if they offer cross-border services.

Conversely, on a common platform, all PSPs must adhere to a common rulebook. Second, hub entities are most often built solely to enable cross-border payments, while common platforms can be built to enable domestic as well as cross-border payments (CPMI et al (2023)). Integrated payment systems can overlap in their geographic reach and/or co-exist with domestic payment systems.

More details here: CPMI Brief No 4 – Regional payment infrastructure integration: insights for interlinking fast payment systems (pdf report)

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: