Rapid growth of virtual banks puts new verve into old banking systems

a blog written by Moody’s

The accelerated global shift to digital banking during the Covid-19 pandemic has been largely positive for the new challenger banks. Their growth has been fueled by waves of customers who have embraced digital banking’s expanded product suite.

In 2017, there were about 100 digital challenger banks around the globe. They held nearly $161 billion in total global banking assets. By 2020, challengers’ total global banking assets quadrupled as the number of digital banks increased more than twofold.

Today, there are about 250 challenger banks. However, most technically aren’t banks since they don’t have a banking license. Moody’s analysis focuses on the 20 challenger banks that hold a banking license.

The 20 licensed virtual banks are among the largest, holding nearly half of all challenger banks’ assets in 2020. Japan’s Rakuten Bank, the largest licensed challenger, held $58.7 billion.

Digital banks, however, are still minnows compared with traditional banks. Challengers — licensed and unlicensed combined — hold only 0.4% of the world’s banking assets. While the 20 licensed challengers in our analysis represent an even smaller share.

What’s driving the growth?

Appetite for digital banking has accelerated in recent years. Virtual banks have surged ahead, increasing digital engagement with clients and simplifying the user experience, a phenomena boosted during the pandemic. Lockdowns amplified the need for easy online access to products, services and information. As we look ahead, financial services will become increasingly digital, likely benefitting digital natives.

The challenges ahead for digital banks

Despite fast-growing adoption of online banking across the globe, challenger banks struggle to achieve primary bank account status, particularly in developed countries. Most customers use challengers as a secondary bank account, while their salaries are paid into accounts at incumbent banks.

Moreover, traditional banks are catching up quickly in terms of new technologies, customer convenience, service and support. This keeps a large proportion of customers loyal to old, established names. Moody’s expects this gap to endure unless challengers offer an additional risk premium for deposits or provide access to a similar or wider range of financial products as incumbents do.

FOCUS ON PAYMENTS AND LENDING

Challenger banks follow broadly three main business models based on revenues coming largely from payments, lending, or both, with a multitude of other services playing a secondary role.

However, some key banking products, like mortgages, currently remain out of the challengers’ scope since their low yield and long tenor make mortgages less attractive than other business lines — few challenger banks have launched them or announced such plans. Lending to large corporates is also beyond their reach, for now, as it requires deeper credit expertise and long-established customer relationships.

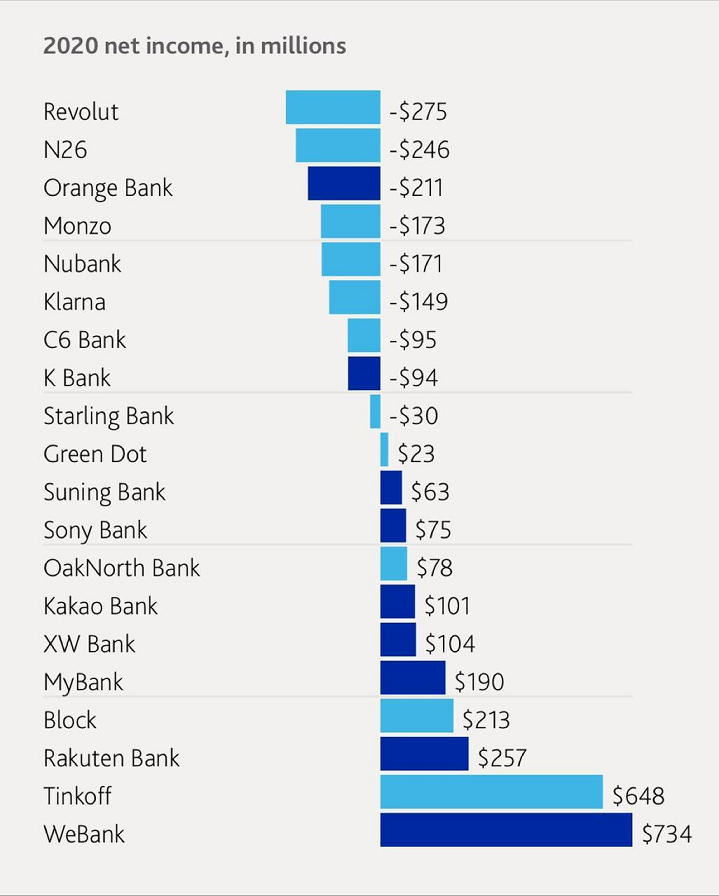

GLOBAL EXPANSION COMES AT A COST

Rapid growth requires additional investments and customer acquisition costs, which will weigh on their net financial results. Fast-growing challenger banks with cross-border expansion ambitions will likely keep posting net losses over the next few years for the sake of grabbing new markets and market share. Monetary tightening in many parts of the globe may also mean that venture capital becomes less abundant in the months to come.

Consequently, the market capitalization and private valuation of challengers could suffer for a while, but their growth trajectory will not change. Aggressive customer acquisition, continued innovation, consolidation and cross-border expansion, particularly into emerging markets, will ensure the challengers continue to grow in the years ahead, steadily increasing their competitive dynamic with incumbents.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: