Rambus token gateway for e-commerce solution is one of the first certified “Visa Ready” for tokenization program

For merchants, gateways and banks wanting to deploy EMV network tokenization to reduce (card-not-present) fraud and increase card approval rates, certification and integration to a wide array of scheme tokenization services is challenging. Rambus Token Gateway is a certified solution that acts as a single tokenization hub for token requestors to remove complexity and shorten time to market.

Rambus Inc. announced that its Token Gateway for e-commerce solution is one of the first to be qualified under the “Visa Ready” for Tokenization program. This certified solution enables token requestors like online merchants, payment service providers and acquirers globally to quickly and securely connect to the Visa Token Service to tokenize card-on-file e-commerce transactions.

Tokenization is a security technology that uses a unique digital identifier, or token, to protect sensitive information like cardholder account details. By replacing sensitive account information with a limited use token, including domain controls for device or channel, tokenization mitigates fraud risk and protects the underlying value of credentials.

The Rambus Token Gateway supports merchants in a number of ways:

. Customer convenience and confidence – Consumers no longer need to update card details following a card reissue, reducing frustration. Knowing that card details are not shared with merchants may also increase trust and the number of consumers willing to shop online safely and securely.

. Quick time to market – Merchants who integrate with Visa Token Service through Rambus do not need to wait for individual certification approval and can launch a token-on-file initiative more quickly.

. Reduced PCI compliancy – As merchants replace vulnerable cardholder payment data with secure tokens, their payment card industry (PCI) compliancy requirements may be reduced.

. Cost savings– The Rambus Token Gateway assures that merchants are constantly aligned with the latest Visa Token Service tokenization specifications, eliminating the need for manual integration work.

. Single interface – The Rambus Token Gateway provides a single interface to connect with all contracted token service providers, supporting a variety of messaging interfaces.

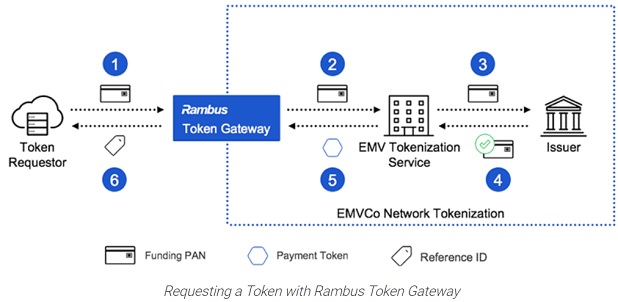

How the Rambus Token Gateway works

Token Gateway can integrate to EMV tokenization services that include Visa Token Service (VTS), Mastercard Digital Enablement Service (MDES), American Express Token Service, Discover Digital Exchange (DDX) as well as local debit scheme token service providers such as Interac (Canada) and eftpos (Australia).

(1) Token Gateway receives the card number from the token requestor

(2) Token Gateway routes it to the appropriate EMV tokenization service to request a network token

(3) The EMV tokenization service validates the card number with the card issuer

(4) The issuer approves the request and validates the token

(5) The EMV tokenization service returns a network token to Token Gateway

(6) Finally, Token Gateway shares a reference ID of the token with the token requestor (6).

451 Research Director, Jordan McKee notes, “The pace of digital change in financial services and retail is accelerating. We are witnessing a profound shift in consumers’ shopping preferences and habits, marked by a growing demand for omni-channel buying experiences. This is driving more transactions into digital channels and fraudsters are following the volume, eager to exploit vulnerabilities. Removing sensitive credentials from the transaction flow with a token is a critical defense that serves to safeguard consumers and revenues. Such steps ultimately improve the digital shopping experience and bring benefits to the entire ecosystem.”

“The success of the EMV® Chip Specifications in securing the physical point-of-sale means increasingly sophisticated criminals have shifted their attention towards more vulnerable e-commerce and m-commerce channels,” said Jerome Nadel, GM of Payments and CMO, Rambus. “Tokenization has been hugely successful in securing mobile payments and by using Token Gateway, we believe it can do the same job for online shopping. What’s more, increased customer confidence is likely to see higher conversion rates and reduce time spent chasing missed payments for merchants. As one of the first certified, we’re excited to support the retail community in managing customer data in faster and safer ways.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: