Quick Chip for EMV: a new Visa’s technology to optimise chip card transactions at POS

Visa introduces Quick Chip for EMV, a solution that speeds up checkout times on chip transactions at the point of sale and optimizes the consumer experience. The Quick Chip specification is available free-of-charge to payment processors, acquiring banks, and other payment networks to offer to merchants.

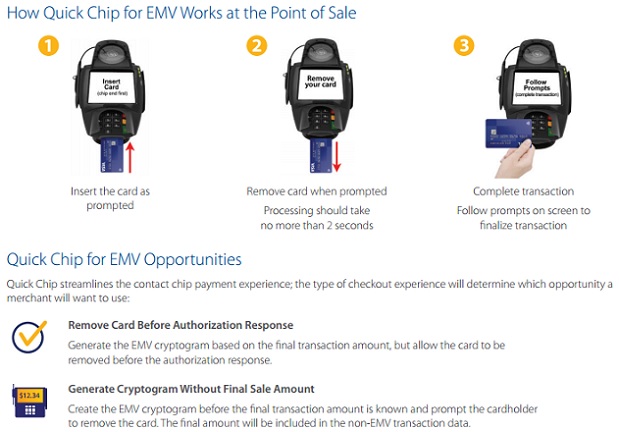

„The upgrade streamlines the processing of chip card transactions to enable customers to dip and remove their EMV chip card from the terminal, typically in two seconds or less, without waiting for the transaction to be finalized. The enhancement requires only a simple software update to the merchant’s card terminal or point of sale system.”, according to the press release.

“Visa is advancing a streamlined approach to chip transactions to make them faster and more efficient, while still providing a safe and secure experience,” said Mark Nelsen, senior vice president of Risk Products and Business Intelligence, Visa Inc. “Quick Chip for EMV helps make the checkout experience comparable to the ease and speed of magnetic stripe transactions.”

The updated process provides a number of key benefits, including:

Faster Checkouts: Quick Chip-enhanced terminals will prompt the cardholder to dip the chip card briefly in the reader and then remove it, reducing the card’s interaction with the terminal to about two seconds.

Streamlined Processing: Quick Chip-enhanced terminals can also allow the payment card to be inserted and removed while the shopping cart is still being rung up, further streamlining the acceptance process for the consumer.

Simple Implementation: Quick Chip requires a payment application software update that can be easily downloaded to the payment terminal. Once installed, the technology will work with all cardholder verification methods, including signature and PIN, and does not require the merchant to make any changes to its routing or transaction handling. Quick Chip does not require additional Visa or EMVCo testing if a merchant’s checkout system has already been certified as EMV chip compliant. No changes to chip cards are needed.

Encouraging EMV Chip Adoption

Quick Chip helps facilitate the payment industry’s transition to EMV chip technology in the U.S. So far, more than 265 million Visa credit and debit chip cards have been issued to cardholders, making the U.S. the largest chip card market in the world. In addition, more than one million merchants now have chip-enabled terminals, or roughly 20 percent of all merchant locations.

The specification has already garnered industry support with several merchant processors, terminals providers, and vendors planning to implement and offer Quick Chip in the coming months.

“We’re very excited to pilot this game-changing approach to EMV chip processing,” said Craig Ludwig, Group Executive of Product for TSYS’ Merchant Services segment. “Quick Chip improves the consumer experience, without impacting transaction processing or routing on the acquirer or issuer side.”

“Merchants want a fast, reliable, and secure checkout experience and hassle-free implementation,” said Richard Char, senior vice president of Business Development, Verifone. “Quick Chip will help Verifone deliver better service to our clients and a better payment experience to their customers.”

“Speed at checkout is paramount for our customers” said Robert Hayhow, vice president of North America Business Development, Equinox. “When Visa approached us about Quick Chip, we immediately saw the value of putting a solution into production.”

“Quick Chip is a solution that improves the consumer’s transaction experience with relatively minor changes to the checkout terminal,” said Allen Friedman, vice president of Payment Solutions, Ingenico. “Being able to make this update using existing EMV chip infrastructure and not requiring re-certification means retailers can integrate this enhancement into their solutions with minimal impact to the POS terminal application.”

“Quick Chip is fast and simple to implement at the middleware level,” said Bruce Murray, president of payment software and certification provider B2. “With no additional Visa or EMVCo certification required, merchants can be up and running on Quick Chip in no time at all.”

„What’s particularly appealing about Quick Chip for EMV is that it can be implemented quickly with no impact on Visa’s Level 3 certifications,” said Terrence Crowley, chief executive officer of TranSend, a provider of EMV software for point-of-sale systems. “On the acquiring side, we welcome secure methods that speed things at a merchant’s checkout, without slowing things down through additional certification requirements.”

Additional technical documentation is available at www.visachip.com.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: