QR codes now take 20% of all online scams

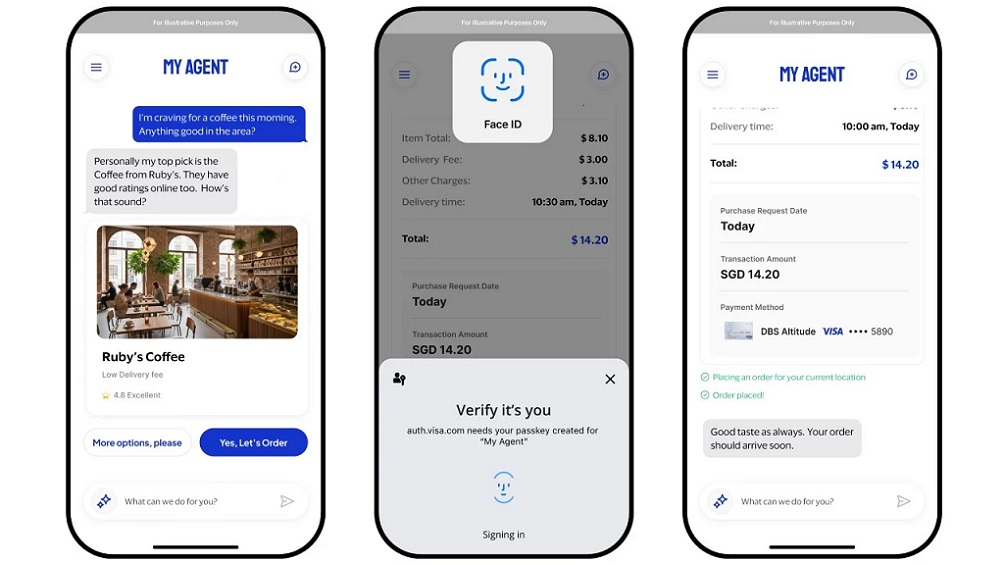

As digital scams continue to evolve, QR codes have emerged as a new gateway for cybercrime, often leading unsuspecting victims into dangerous traps. Known as “quishing,” these scams involve fraudsters tricking individuals into scanning fake QR codes, which then redirect them to fraudulent websites or malicious applications designed to steal sensitive information.

In an interview with PYMNTS, Greg Hancell, fraud expert at Lynx Tech, offered advice to consumers about this growing threat.

“QR code scams are different from other cybercrimes as they are harder to identify,” Hancell said. “QR codes cannot be read by humans, meaning victims cannot know the link destination until it is too late. Many individuals now have an awareness of how to identify phishing or smishing scams, however, as QR codes are relatively new — now accounting for more than 20% of all online scams — victims are more susceptible.”

According to the PYMNTS report, “Navigating Big Retail’s Digital Shift: The New Payments Strategy Evolution,” in collaboration with ACI Worldwide, 25% of merchants in the United States are adding or planning to offer QR payments in the next three years. The figure increases to about 28% of U.K.-based merchants. This trend, the report adds, reflects consumer demand for QR codes in omnichannel shopping experiences. More than 80% of retailers believe offering QR code scanning for product-level information is key to driving customer loyalty.

“I would urge organizations to reconsider relying solely on QR codes for payment processing due to the high level of risk involved,” Hancell said. “QR codes often lack adequate protection against tampering, making it difficult for businesses to monitor them consistently.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: