Digital commerce transactions to exceed 1.1 trillion by 2024, driven by emerging markets. Transaction Volume Growth of 73% over Next 5 Years.

A new study from Juniper Research found that global transaction volumes from digital commerce will exceed 1.1 trillion by 2024, up from 641 billion in 2019.

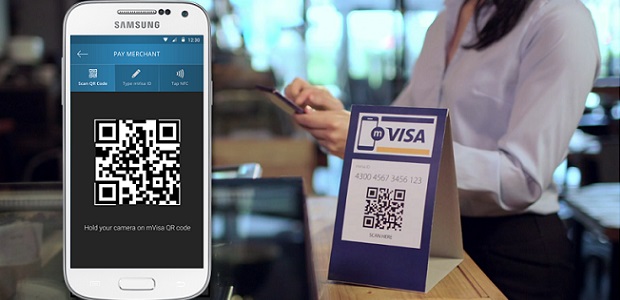

The new research, Digital Commerce Regional Analysis: Key Trends, Segment Analysis & Regional Forecasts 2020-2024, found that emerging markets, rather than developed markets, will be the driving force behind increased digital commerce. It also found that markets outside North America and West Europe will account for 77% of total digital commerce transaction volume in 2024, driven by QR code payment system rollouts and the displacement of the cash in emerging economies.

The research recommended that established fintechs seek local partnerships with key stakeholders as early as possible in order to facilitate service rollouts, or risk being outmanoeuvred by local fintechs.

For more insights, download the free whitepaper: Key Regional Strategies for Digital Commerce.

QR Code Payments Expanding Beyond China

The new research found that QR code payments will be the most used digital commerce mechanism in terms of volume throughout the next 5 years, accounting for 27% of all digital commerce transactions in 2024. The research also found that QR payments outside China will rise in popularity, accounting for just over a quarter of global QR payments in 2024.

Research author Nick Maynard explained: “QR payments will gain popularity as they are fundamentally suited to use in emerging economies. Its low infrastructure requirements make QR the best fit for digitising previously cash-based economies, making QR approaches vital to established financial players seeking new markets”.

Africa & Middle East is a Highly Important Digital Commerce Battleground

The research also found that digital commerce in Africa & Middle East is becoming increasingly important, with services rapidly diversifying beyond money transfer. The research identified the Africa & Middle East market as a $1 trillion digital commerce opportunity, making it the crucial next battleground. Juniper Research identified the mobile channel as essential for market development, meaning that partnerships with mobile network operators can be highly beneficial over the next 5 years.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: