The approval rate of online loans granted by financial-banking institutions has doubled in the last four years, in Romania. Also, the financed value has increased more than four times, and the number of financed contracts is more than two times higher, according to an analysis by Qoobiss, the developer of the Qoobiss Identify solution, which offers a secure and digitized identity verification process at distance using video resources.

Online lending based on generative AI solutions is one of the trends analyzed by experts at the Banking 4.0 international conference.

The companies that have implemented Qoobiss Identify have been able to increase sales and improve their performance significantly. Thus, for example, with the help of the eKYC solution, one of the institutions, with its core business in offering loans, achieved a 2.5-fold increase in online credit applications this year compared to 2019. The amount financed increased by more than 4 times, and the number of financed contracts is almost 3 times higher.

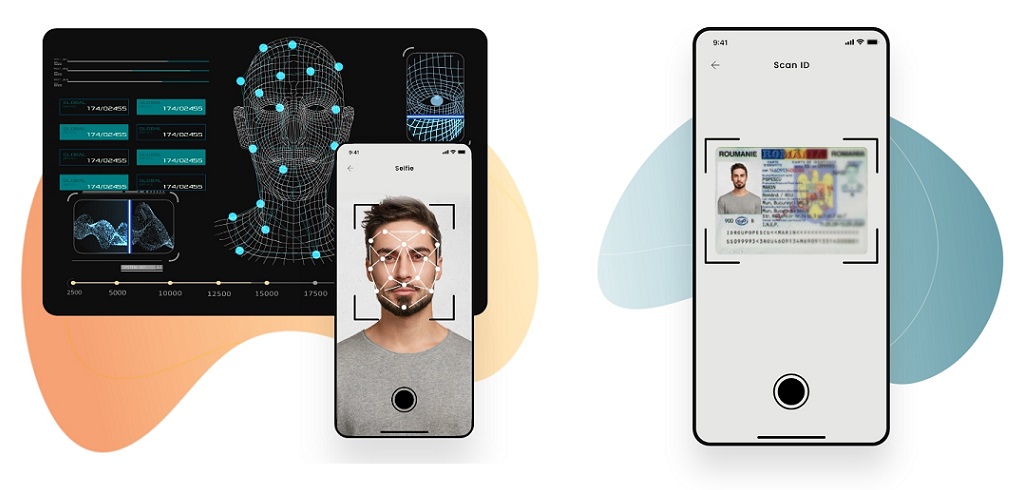

The migration of financial services to the digital environment has determined the search for innovative and technological solutions to meet the needs of customers. Users can apply to open an account or credit based on their ID card only, and thanks to eKYC solutions like Qoobiss Identify, they can remotely validate their identity in less than 1 minute. At the same time, the lending process is streamlined, with the implementation of an end-to-end onboarding service (Qbiz Management System).

„Currently, there is an orientation of financial institutions towards technology, manifested by the reduction of physical presence. The focus is especially on providing digital financial services, accessible wherever there is an internet connection. Adopting the most advanced technologies and optimizing the number of work points leads to an increase in sales and, implicitly, to a decrease in operational costs. With the help of the remote identification solution using video resources, Qoobiss Identify, and of a simplified end-to-end onboarding process, obtaining an online loan becomes a simple, easy and very advantageous process. To access online services, the customer who wants to access a financing solution, only needs the identity card and a smartphone with internet access„, says Ileana Comănescu – KYC Global Product Manager at Qoobiss.

Qoobiss is a provider accredited by the Authority for Digitization of Romania (ADR) for remote identity verification services, using video means. The Qoobiss Identify solution allows for the remote identification of any user and can also be adapted for the holders of the new electronic identity cards.

The process of remote identification of customers is carried out in an efficient way – the response speed is in seconds. Advanced facial and biometric recognition technology ensures the authenticity of each identification process, providing increased information security. At the same time, this process is fully automated, available 24 hours a day, 7 days a week.

The remote identification solution using video resources was designed to be easily scalable for a large number of users, easy to implement and 100% online.

„We use the latest biometric and Artificial Intelligence technologies, continuously improve the customer experience and comply with legal obligations regarding the remote identification process. The Qoobiss solution is easily customizable, being adapted for a variety of industries, such as financial-banking, medical, telecom, gambling, insurance, retail etc.”, says Ileana Comănescu.

Although the market faces several blockers in terms of online lending, such as the reluctance of financial institutions to integrate a KYC solution, the outdated technology used, bureaucracy and the poor security of IT systems, accessing online loans will accelerate in the coming years and simplify the activity of financial-banking institutions. The company estimates for this year an increase of more than 200% in the client portfolio compared to last year.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: