PwC Switzerland: „If blockchain technology can be deployed on a large scale for payments, it would provide significant benefits for banks”

Blockchain: Applications in payments

Blockchain: Applications in payments

An article by Aniket Kulkarni, PwC

Aniket Kulkarni leads PwC’s Treasury and trading technology practice in Switzerland. Prior to joining PwC, he worked as a global product manager for treasury and commodity risk management in SAP. Aniket has a team of experts, helping corporates and trading companies in implementing treasury, Fintech and commodity trading systems and processes. He holds an engineering degree and a post graduate diploma in finance, and is certified treasury manager CTM.

Background of blockchain technology

In recent years, blockchain technology has significantly gained popularity because it has the potential to process financial transactions in ‘real time’ without compromising security.

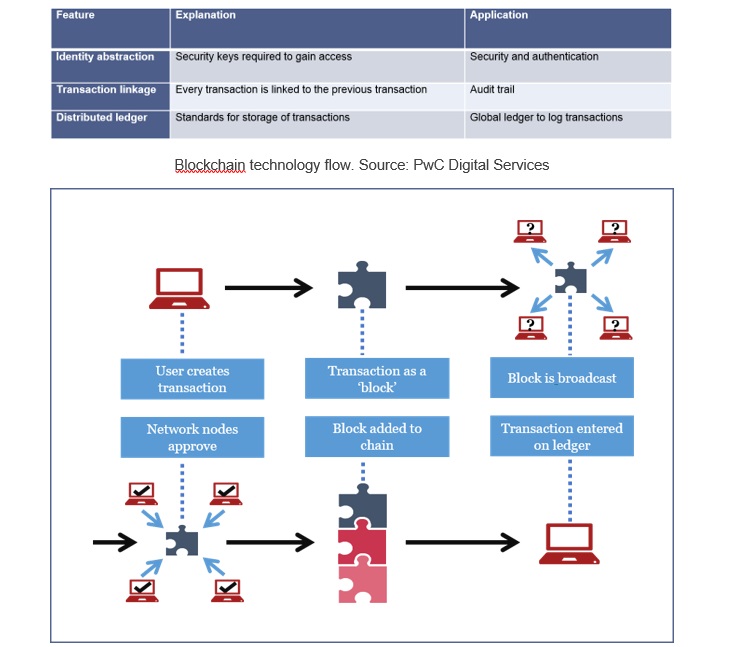

Blockchain is the technological backbone for ‘Bitcoins’ and was introduced in 2009 as a secure, fast and connected technology to enable their exchange. Blockchain technology has the following main features:

In blockchain, every user transaction creates a block, which is added to a chain of transactions. This creates a trail of blocks linked to each other. Every block is broadcast and added to the ledger.

As the user transactions are linked as a block to other blocks in the chain, it is extremely difficult to change their data, so this is a very secure way to exchange financial data.

Current challenges in payment infrastructure

The current payment infrastructure is mostly message based and relies on file exchange between multiple parties. A typical cross-border non-euro payment lifecycle involves several steps and parties to process the payments, which takes days to complete. Due to this delay, for example, a company initiating a payment is required to monitor its bank account or bank account statement to know exactly when the payment has cleared.

Application of blockchain technology in payments

Blockchain’s features match the requirements for a payment infrastructure: security, processing speed, traceability, global registry (ledger). The distributed ledger makes it possible to connect all the parties in a financial trade in real time for faster processing of a payment – all while maintaining an audit trail.

Because processing is distributed over the network, it is almost impossible to alter or manipulate the data, hence preventing fraud or a security breach.

This file-based transmission could potentially be replaced by Application Programming Interface (API) technology to enable the creation of blocks of transactions.

If this usage becomes a reality, payments processing would be in real time, and companies would no longer need to depend on bank statements to reconcile their accounting ledgers.

Current initiatives

Currently most of the big players in financial transaction chains have started initiatives to explore this technology and assess its application in the payments area. Some prominent examples include:

SWIFT: This global payment innovation initiative, launched in January 2017, explores whether distributed ledger technology (DLT) can be used by banks to improve the reconciliation of their Nostro databases in real time.

Banks: 22 banks around the world including Deutsche Bank, BBVA, Commerzbank, ANZ Banking Group, BNP Paribas, BNY Mellon, DBS Bank, RBC Royal Bank and others have joined SWIFT in this initiative. Citi Bank has also announced a similar partnership with NASDAQ to explore blockchain technology for payments.

Corporates and not-for-profit organisations: A number of companies and not-for-profit organisations are exploring private blockchain use for settlement of internal payments to reduce the settlement delay.

Challenges of blockchain technology

Although blockchain technology is promising, there are several challenges in using it for payments on a large scale. Here are a few of those issues:

Scalability: For example, the global payment network SWIFT processes as many as 30 million messages in a day. This processing volume requires a significant amount of computing power and infrastructure, whereas the current volume of Bitcoin transactions is relatively low (a few hundred thousand per day), and the technology has not been tested for high volumes of data.

Open network: Unlike current payment networks, blockchain is an open network (public blockchain), and hence would pose challenges for deployment of payment infrastructure. There is a possibility of using private blockchain networks, but the feasibility of such networks needs to be evaluated for the global scale.

Legal: Whereas blockchain technology has rapidly evolved, the underlying legal framework is still developing and uncertain, and lacks harmonisation across national jurisdictions.

Conclusion

If blockchain technology can be deployed on a large scale for payments, it would provide significant benefits for both banks and companies. Banks will no longer require heavy clearing and settlement systems, while companies can have a real-time accounting ledger in their enterprise resource planning (ERP) or treasury management systems. This would also improve payment security significantly.

The road to using blockchain on a global scale is, however, full of obstacles, both from a technology deployment perspective as well as from a legal perspective. The feasibility of using blockchain technology for a high volume of payment transactions still remains the biggest question.

Current initiatives, especially those concerning international instant payments, where companies can settle international payments in real time, have been successfully prototyped by many banks (e.g. BBVA, Deutsche Bank). Instant payments will significantly strengthen the global e-commerce/digital business initiatives adopted by many firms. This will not only impact big businesses, but also help small businesses to improve short-term liquidity. The visibility of cash flows in the short term is one of the big challenges facing corporate treasuries, but by using blockchain technology for faster international payments, treasurers can manage liquidity far more effectively.

Source: European Payments Council

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: